Form 4720 can be used by organizations and individuals, such as private foundations, donors, and organization managers, to report and pay taxes on transactions like self-dealing, excess lobbying, and excess …

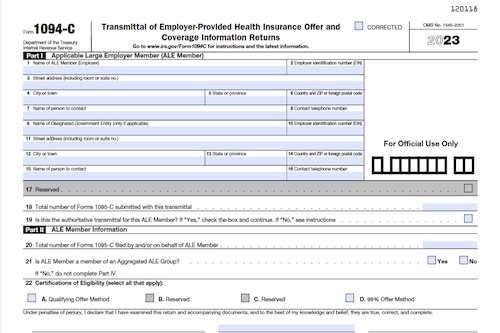

Form 1094-C: Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns

ALE Members with 50 or more full-time employees and members of an Aggregated ALE Group must file Forms 1094-C and 1095-C to report the information required under sections 6055 and …

Form 5754: Statement by Person(s) Receiving Gambling Winnings

Gamblers should be aware of the filing and withholding requirements for reportable gambling winnings, which includes wages of $600 or more in winnings, “identical wagers,” and wagers in “single parimutuel …

Form W-2C: Corrected Wage and Tax Statements

Employers and employees must be aware of certain rules and regulations governing the filing and distribution of Form W-2c. This article explains the requirements for the format and content of …

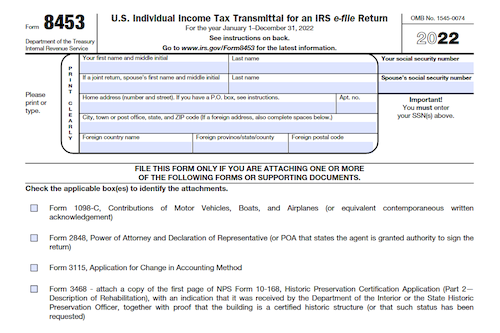

Form 8453: U.S. Individual Income Tax Transmittal for an IRS e-file Return

Submitting your tax return electronically can save you time, but there are times when you must also submit paper documents to the IRS. To do so, you’ll need to utilize …

Form 1040-NR-EZ: U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents

U.S. residents who are meeting certain qualifications can use Form 1040-NR-EZ to submit their tax return. Eligibility includes income from only wages, salaries, tips, and refunds of state and local …

How to Update Business Address for Quarterly Payroll Taxes with the IRS

If your business has changed locations, and you pay quarterly payroll taxes to the IRS, it is important to update your address with the IRS to ensure that all tax …

Form 8453-EX: Excise Tax Declaration for an IRS e-file Return

Form 8453-EX provides taxpayers with an easy way to authenticate and authorize electronic excise tax returns and requests for refund. It also gives taxpayers the option to authorize an electronic …

Form 8611: Recapture of Low-Income Housing Credit

Use Form 8611 to calculate and report the recapture of the low-income housing credit in certain situations such as when the qualified basis decreases, a building is disposed of, or …

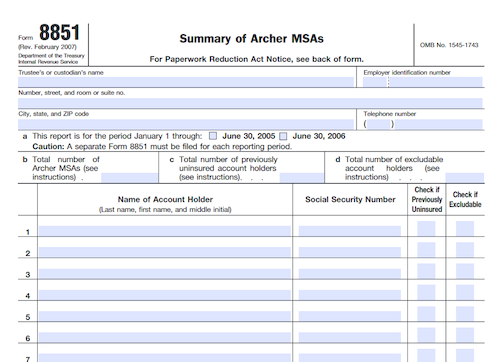

Form 8851: Summary of Archer MSAs

Trustees and custodians of Archer MSAs must file Form 8851 with the IRS to report their individual retirement arrangement. Approved by the IRS, the required form can be filed electronically …

Form 8849: Claim for Refund of Excise Taxes

Navigating Form 8849, a form used for claiming an excise tax refund, can be complicated. This article explains which IRS addresses to submit the form to, how to file an …

Correcting Tax Mistakes from a Previous Year

Discovering mistakes on your previous year’s tax return can be stressful, but it’s important to know that you have the opportunity to correct them. By following the proper procedures outlined …

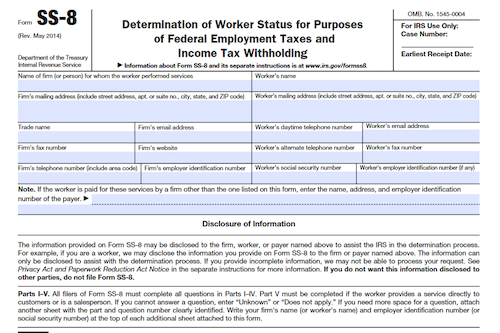

Form SS-8: Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding

This article covers the Form SS-8, a form used to request a determination of a worker’s employment status for federal tax purposes. The article goes over how to fill out …

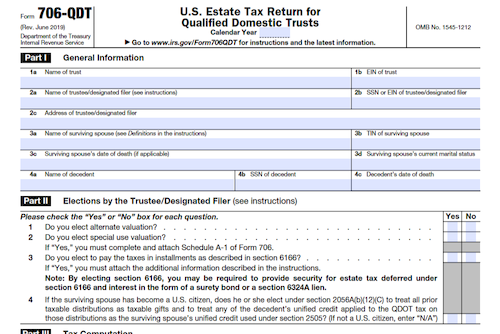

Form 706-QDT: U.S. Estate Tax Return for Qualified Domestic Trusts

For those with a surviving spouse who is not a US citizen, Form 706-QDT is used to figure and report the estate tax due on QDOT distributions, remaining the value …

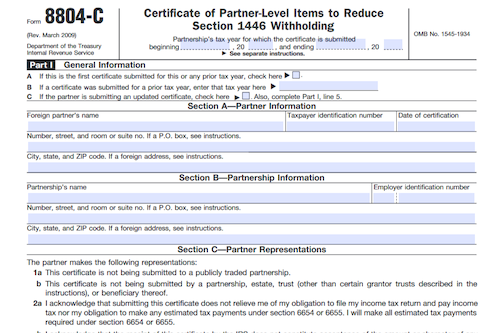

Form 8804-C: Certificate of Partner-Level Items to Reduce Section 1446 Withholding

Form 8804-C is used by a foreign partner to provide a certification to a partnership under Regulations section 1.1446-6 to reduce or eliminate the 1446 tax obligation on the partner’s …

Form 8804-W: Installment Payments of Section 1446 Tax for Partnerships

Partnerships that have taxable income allocable to foreign partners are mandated to make estimated section 1446 tax payments of $500 or more, due by specific dates throughout the year. Penalties …

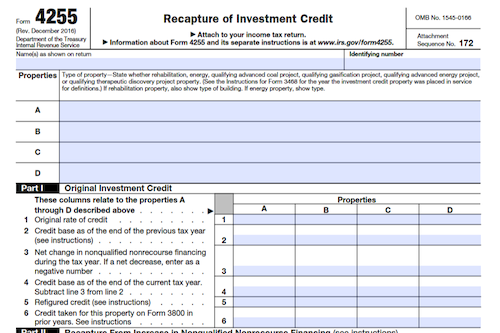

Form 4255: Recapture of Investment Credit

Form 4255 is used to calculate the tax increase for investment credit and a qualifying therapeutic discovery project grant when certain conditions apply. Learn about exceptions, adjustments, and regulations to …

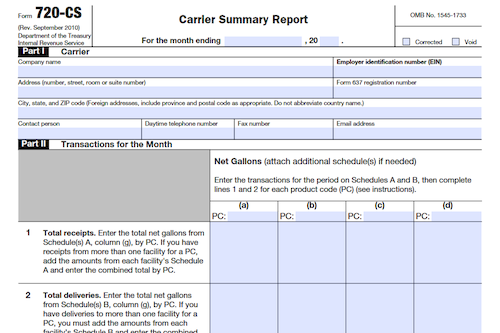

Form 720-CS: Carrier Summary Report

Bulk transport carriers must file Form 720-CS with the IRS to report monthly receipts and disbursements of liquid products at a designated storage location. Filing rules and requirements are outlined …

Form 8869: Qualified Subchapter S Subsidiary Election

Parent S corporations use Form 8869 to elect to treat eligible subsidiaries as a qualified subchapter S subsidiary (QSub), resulting in a deemed liquidation of the subsidiary into the parent. …

Form 8867: Paid Preparer’s Due Diligence Checklist

Form 8867 must be filed with the taxpayer’s return or amended return claiming the EIC, the CTC/ACTC/ODC, the AOTC, and/or HOH filing status. As a paid tax return preparer, you …