Managing rental properties requires a keen understanding of financial responsibilities, especially when it comes to reporting rental income to the IRS. This comprehensive guide is centered on the IRS Form 1040 Schedule E, a crucial tax form for declaring income from rental properties. Whether you’re a seasoned landlord or stepping into the realm of rental real estate for the first time, grasping the nuances of Schedule E is imperative. By delving into the specifics of Schedule E, property owners can sidestep common pitfalls, stay aligned with IRS requirements, and potentially enhance their financial outcomes.

What is Schedule E Tax Form and Its Purpose

Schedule E serves as a pivotal IRS tax form designed for reporting both income and losses from rental properties, alongside other supplemental income sources. It’s more than just a tax form; it’s a detailed ledger that captures the financial essence of property management. For property owners, understanding the pivotal role of Schedule E in their tax filings is indispensable. This form doesn’t just list rental income; it’s a reflection of the financial health of rental activities. In this section, we’ll delve into the specifics of Schedule E, outlining its purpose, the nuances of its sections, and its significance in the broader context of personal income tax. We aim to demystify this form, making it a less daunting part of your tax preparation process.

Determining If You Need to File a Schedule E

Not every property owner is mandated to file Schedule E. The decision hinges on several factors, including the nature of rental activities and specific income thresholds. This section offers a deep dive into these criteria, providing clear guidelines to help you determine whether Schedule E is a requisite in your tax situation. We’ll explore various scenarios, from occasional rentals to full-fledged property leasing businesses, and delineate the circumstances under which Schedule E becomes applicable. This isn’t just about compliance; it’s about understanding your obligations and rights within the tax framework.

Understanding Rental Income and Losses and How to Report It

Rental income isn’t just the monthly checks you receive from tenants. It encompasses various forms, including:

- Advance rent,

- Security deposits,

- Barter arrangements.

This part of the guide will break down these different components of rental income, offering insights into their nature and implications for tax reporting. We’ll guide you through the process of documenting these income streams on Schedule E, ensuring that you capture the full spectrum of your rental revenue accurately and comprehensively.

Comprehensive Guide to Filling Out IRS Schedule E

The process of completing Schedule E starts with gathering all necessary documentation related to your rental income and expenses. This includes records of rent received, as well as expenses such as mortgage interest, property taxes, maintenance costs, and insurance. The form itself is divided into several sections, each requiring specific information.

In Part I, you’ll list your rental real estate income, detailing each property separately. It’s important to accurately report the income and expenses for each property to correctly calculate the income or loss for the tax year. If you own multiple rental properties, each must be reported individually to ensure precise accounting.

The Connection Between Schedule E and Form 1040

Understanding the relationship between Schedule E and IRS Form 1040 is essential for accurately managing and reporting rental income on your tax return. Schedule E is a supplemental income and loss tax form used primarily for reporting income from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. When you earn rental income, it is reported on Schedule E and then the total income or loss from this form is transferred to your Form 1040, affecting your overall tax liability.

This relationship is significant because it determines how rental income contributes to your total income and, consequently, your income tax bracket. For example, if you have multiple rental properties generating substantial income, this could potentially push you into a higher tax bracket, increasing your tax rates on other forms of income. Conversely, losses reported on Schedule E can reduce your overall taxable income, potentially lowering your tax bracket and reducing your overall tax obligation.

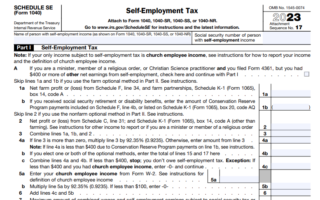

It’s important to note that while Schedule E handles rental income, certain situations, such as when rental activity is deemed a business as opposed to a passive activity, might require using Schedule C instead. This distinction is crucial because it influences how you report income and expenses and whether you’re subject to self-employment tax. To ensure compliance and optimize your tax situation, consulting a qualified tax professional, especially when dealing with complex scenarios like short-term rentals or multiple properties, is advisable.

Navigating Income and Expenses for Rental Properties

Mastering the categorization of income and expenses for rental properties on Schedule E is crucial for effective tax management. This process involves more than just reporting rental income; it also includes correctly documenting and deducting various expenses associated with rental properties. Understanding these nuances is key to ensuring that you accurately report your income or loss from rental activities and comply with IRS regulations.

Common deductible expenses include mortgage interest, property tax, operating expenses, depreciation, and repairs. Properly categorizing and documenting these expenses can significantly impact your taxable rental income. For instance, accurately calculating depreciation can provide a substantial deduction over the property’s useful life, lowering your taxable income each year. However, it’s essential to distinguish between repairs (immediately deductible) and improvements (depreciated over time), as this affects how these expenses are reported.

Landlords must also be aware of the passive activity loss rules. These rules can limit the amount of loss you can deduct from your other income, depending on your participation in the rental activity and your income level. Furthermore, if you’re a short-term rental owner, different rules might apply, especially if your activity is considered a business, which would require filing a Schedule C rather than Schedule E.

To navigate these complexities, it’s advisable to use tax software or consult with a tax professional. They can offer personalized advice and ensure that you’re taking advantage of all applicable deductions and credits, ultimately helping you report your rental income and expenses accurately and minimize your tax liability. Additionally, staying updated with IRS instructions and tax law changes is crucial, as these can affect how you should report your rental income and expenses.

Schedule E vs. Schedule C: Clarifying the Differences

When it comes to reporting rental income on your tax return, it’s crucial to understand the distinction between IRS Form 1040’s Schedule E and Schedule C.

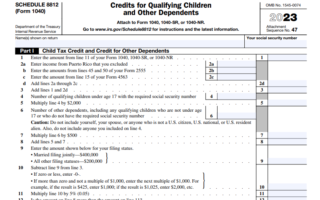

Below is a table to help you understand the difference between schedule E and schedule C:

| Aspect | Schedule E | Schedule C |

|---|---|---|

| Primary Use | Reporting income/losses from rental properties | Reporting income/loss from a business or sole proprietorship |

| Designed For | Landlords and property owners with rental income | Individuals operating a business or practicing a profession as a sole proprietor |

| Applicability | Typically for long-term rentals | Often for short-term rentals with substantial, regular, and ongoing activity |

| Type of Income | Considered passive income | Considered business income |

| Tax Implications | Subject to specific tax rules for passive income | Subject to self-employment tax; broader business-related deductions possible |

| Key Considerations | Report income and expenses related to rental real estate | Suitable for business-like operations, such as short-term rentals resembling hospitality businesses |

| Professional Advice | Advisable to consult a tax professional for accurate categorization and compliance with IRS regulations | |

| Tax Software Use | Can simplify the filing process and assist in decision-making | |

Schedule E is primarily used for reporting income or losses from rental properties and is an integral part of the form 1040 tax structure. It’s specifically designed for landlords and property owners who earn rental income. This form allows you to report income and expenses related to rental real estate and typically applies to long-term rentals. It’s important to note that the income reported here is considered passive income by the IRS, meaning it’s subject to different tax rules compared to active business income.

On the other hand, Schedule C is used for reporting income or loss from a business you operated or a profession you practiced as a sole proprietor. An essential aspect of Schedule C, particularly for short-term rental owners, is the classification of their activity as a business. If your rental activity is substantial, regular, and ongoing, it might be more appropriate to file a Schedule C rather than Schedule E. This is especially true for short-term rental owners, as their operations often resemble a hospitality business. Reporting on Schedule C means that your income is considered business income and may be subject to self-employment tax. However, it also allows for broader deductions related to the business, like advertising, insurance, and certain utilities.

The choice between filing Schedule E or Schedule C can significantly impact your tax situation. If you’re unsure, it’s advisable to consult a qualified tax professional. They can provide personalized advice based on the specifics of your rental activity and ensure that you comply with the IRS regulations. Remember, incorrectly categorizing your rental income can lead to issues with the IRS, so it’s essential to get it right. Additionally, using tax software can simplify the process, as most programs guide you through the decision-making process based on your input.

Maximizing Tax Deductions for Rental Real Estate

Reducing your tax bill legally through maximized deductions is a key goal for many property owners. This section is dedicated to uncovering the various deductions available to rental property owners and illustrating how to claim them effectively on Schedule E. From common expenses like repairs and maintenance to more nuanced deductions like depreciation, we’ll guide you through the myriad of options available, helping you to leverage these deductions to your advantage.

Common Pitfalls to Avoid in Schedule E Tax Filing

Filing the Schedule E tax form, an integral part of IRS Form 1040, requires meticulous attention to detail, especially when reporting rental income and expenses. One of the most common mistakes taxpayers make is inaccurately reporting income or loss from rental properties. It’s essential to understand that Schedule E is used to report income and losses specifically from rental real estate, and any inaccuracies can lead to IRS audits and potential penalties. Ensuring the correct use of this form, which is a crucial part of the income tax return, involves a comprehensive understanding of various factors, including rental income, expenses, and the distinction between passive income and business income.

When filling out a Schedule E, it’s vital to accurately report all rental income received. This includes not just the regular rental payments, but also any advance rent, security deposits (if they are not returned), and expenses paid by tenants. Misreporting or omitting any of these can result in discrepancies in your tax return and invite scrutiny from the IRS. Additionally, correctly categorizing and deducting expenses is key. Common deductible expenses include mortgage interest, property tax, operating expenses, depreciation, and repairs. However, it’s crucial to differentiate between repairs and improvements, as they are treated differently for tax purposes.

Furthermore, if you own multiple rental properties, each property must be reported separately on Schedule E to ensure clarity and compliance. This is crucial for accurate accounting and for the IRS to assess the income or loss for each property. For those who are unsure or find the process overwhelming, consulting a qualified tax professional can be invaluable. They can provide personalized advice and ensure that your Schedule E filing aligns with IRS requirements, thereby minimizing the risk of errors and audits.

Lastly, it’s important to be aware of and adhere to the tax filing deadlines to avoid late filing penalties. Utilizing reliable tax software can streamline the process, but it’s essential to review and verify all the information before submission. Remember, accurate and timely filing of Schedule E as part of your IRS Form 1040 is not just about compliance; it’s about ensuring that your rental real estate investments are correctly accounted for in your overall tax strategy.

File a Schedule E Tax: Summary of Common Errors

| Aspect | Details |

|---|---|

| Purpose of Schedule E | Used to report income and losses from rental real estate as part of IRS Form 1040. |

| Common Mistakes | Inaccurate reporting of income or loss from rental properties, leading to potential IRS audits and penalties. |

| Rental Income Reporting | Include all rental income: regular payments, advance rent, non-returned security deposits, and tenant-paid expenses. |

| Expense Categorization | Deduct expenses like mortgage interest, property tax, operating costs, depreciation, repairs (not improvements). |

| Multiple Properties | Report each rental property separately for clear accounting and IRS assessment. |

| Professional Assistance | Consider consulting a tax professional for accurate Schedule E filing in line with IRS requirements. |

| Tax Filing Deadlines | Be aware of and adhere to tax filing deadlines to avoid penalties. |

| Using Tax Software | Utilize reliable tax software for efficiency but verify all information before submission. |

| Overall Importance | Accurate and timely filing ensures proper accounting of rental real estate in overall tax strategy. |

Using Tax Software and Seeking Professional Advice

Navigating the complexities of Schedule E and the broader tax landscape can be challenging. This section discusses the benefits and limitations of using tax software, as well as the advantages of consulting a qualified tax professional. We aim to provide you with insights into these resources, helping you decide the best approach for your specific situation, whether it’s leveraging technology for efficiency or seeking expert guidance for peace of mind.

Key Takeaways

- Fundamental Understanding: Schedule E is used for reporting income or loss from rental real estate.

- Filing Requirements: Determine if your rental activities require you to file Schedule E.

- Accurate Income Reporting: Learn the correct way to report different types of rental income.

- Expense Deductions: Understand which expenses are deductible and how to report them.

- Avoiding Errors: Be aware of common filing mistakes and learn strategies to avoid them.

With this comprehensive guide to IRS Schedule E, you’re equipped to handle the nuances of reporting rental income, making your tax preparation process smoother and ensuring compliance with IRS regulations.