Filing taxes can be a daunting task, especially when dealing with specific forms like Schedule C for your IRS Form 1040. This comprehensive guide is designed to simplify the process, making it accessible even to those new to filing Schedule C. Whether you’re a small business owner, a sole proprietor, or just trying to understand your tax obligations, this post will provide valuable insights and tips.

Why Read This Article Before File a Schedule C Tax Form?

This article is an essential resource for understanding the IRS Form 1040 Schedule C. It is especially beneficial for small business owners, sole proprietors, and those receiving 1099-NEC forms. It provides a clear, step-by-step guide to accurately complete your tax forms and make the most of your deductions, ensuring compliance with IRS requirements and potentially reducing your tax liability.

What is Schedule C and Who Needs to File It?

Schedule C is a part of Form 1040 used to report income or loss from a business operated or a profession practiced as a sole proprietor. It is also applicable for single-member Limited Liability Companies (LLCs) and those with statutory employee income, qualified joint ventures, or certain 1099 forms. This form is crucial for small business owners, freelancers, contractors, and gig workers who need to report their business’s profit or loss, which is considered self-employment income.

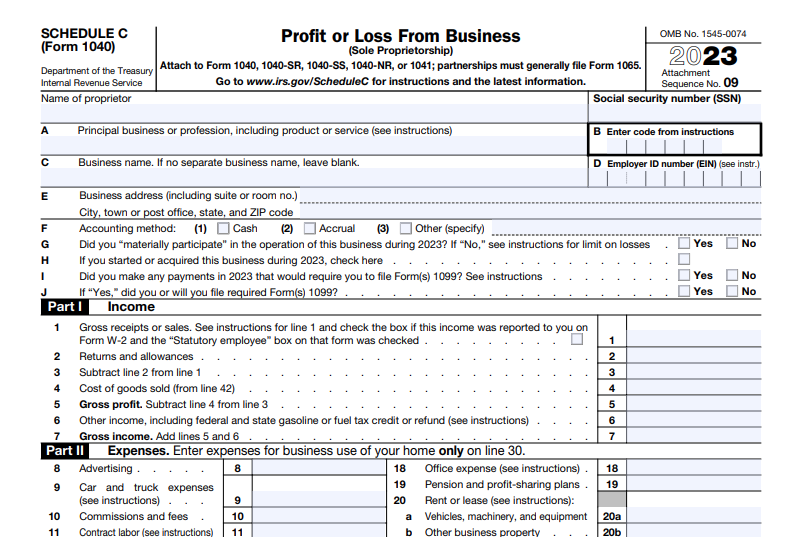

Step-by-Step Guide to Filling Out IRS Schedule C

To complete Schedule C, start by gathering your business’s income for the tax year, receipts or lists of expenses, inventory details, and mileage records if you use a vehicle for business. Schedule C consists of five parts, where you’ll list your income (Part I), add up expenses to determine net profit or loss (Part II), calculate cost of goods sold if applicable (Part III), provide vehicle information if used for business (Part IV), and list other eligible expenses not covered in Part II (Part V).

Understanding Business Tax: Income and Expenses on Schedule C

Income on Schedule C includes gross receipts from trade or business and other specific types of income like finance reserve income, scrap sales, and certain tax refunds. Deductible expenses must be both “ordinary” and “necessary” for your business, such as advertising, insurance, rent, and utilities. You can also deduct the actual expenses or use the standard mileage rate for business vehicle use.

Maximizing Tax Deductions for Small Business Owners

To maximize deductions, ensure to report all eligible business expenses. This includes contract labor, depletion, and depreciation. Be aware of specific exceptions and rules, like the capitalization rules for certain expenses.

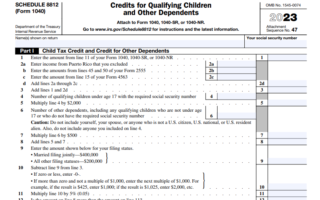

The Role of Schedule SE in Self-Employment Tax

If you file Schedule C, you’ll likely also need to complete Schedule SE for self-employment tax, covering Social Security and Medicare taxes based on your self-employment income.

Avoiding Common Mistakes When Filing Schedule C

Avoid typical errors such as underreporting income, overclaiming deductions, and missing deadlines. Ensure that all income, including payments reported on 1099 forms like 1099-NEC, is accurately reported.

How to Use Form 1099-NEC with Schedule C

Form 1099-NEC is used to report non-employee compensation. As a freelancer or independent contractor, it’s essential to understand how to report this income accurately on Schedule C.

Navigating Tax Time: Preparing for Schedule C Filing

Effectively managing tax time, especially when it comes to preparing your Schedule C for the Form 1040, requires a proactive and organized approach. As a sole proprietor or small business proprietor, it’s vital to maintain meticulous financial records throughout the tax year. This preparation is key to accurately report income or loss on your Schedule C form.

| Topic | Details |

|---|---|

| Organizing Financial Records | Maintain detailed records of business income and expenses, categorize transactions, keep receipts, and use accounting software or reliable tracking methods. |

| Understanding Schedule C | Familiarize with Schedule C requirements to report profit or loss as a sole proprietor, including reporting business income and expenses. |

| Utilizing Form 8829 for Home Office | Use Form 8829 to calculate and report home office expenses on Schedule C, impacting reported income or loss. |

| Reporting Various Types of Income | Prepare to report different income types on Schedule C, like income from Form 1099-NEC, Form W-2 for statutory employees, and other business earnings. |

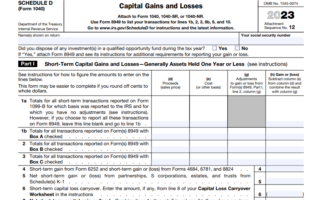

| Understanding Additional IRS Forms | Depending on business structure, file additional forms such as Schedule SE for self-employment tax, Schedule 1, or Schedule E for rental property income. |

| Seeking Certified Tax Professionals | Consider consulting with tax specialists for advice, accurate form filling, and IRS compliance. |

| Calculating Self-Employment Tax | Understand how to calculate self-employment tax, reported on Schedule SE, based on net profit or loss on Schedule C. |

| Meeting Deadlines | Be aware of and meet IRS filing deadlines to avoid penalties, ensuring timely filing of Schedule C and other forms. |

| Maximizing Deductions on Schedule C | Use Schedule C effectively to identify and maximize potential tax deductions related to your business, reducing taxable income. |

Seeking Professional Help: When to Consult a Tax Professional

When it comes to managing your Schedule C for the Form 1040, enlisting the aid of a tax professional can be pivotal, particularly in intricate scenarios or when uncertainties cloud your tax responsibilities. This comprehensive guide dives into various scenarios where the expertise of a tax professional is invaluable, ensuring your Schedule C tax form is handled accurately and efficiently.

Complex Business Structures and Schedule C: Navigating the complexities of Schedule C becomes essential when dealing with sophisticated business setups like partnerships, corporations, or multiple income sources. A tax expert can offer invaluable guidance, ensuring precise reporting in line with IRS regulations for your business tax.

Navigating Major Business Changes: Substantial shifts such as expansion, downsizing, or transitioning to a new business model can significantly affect your Schedule C tax obligations. A tax professional can provide crucial insight into the intricacies of these changes, aiding in accurate Schedule C filing.

Real Estate and Investment Reporting on Schedule C: Engaging in real estate or possessing significant investment income adds layers of complexity to your Schedule C tax form. Here, expert advice becomes indispensable, especially in optimizing tax deductions and ensuring compliance with tax laws.

International Business Operations: For businesses with global operations, including overseas clients or activities, understanding and complying with international tax laws is crucial. A tax specialist can guide you through the requirements and intricacies of international tax laws, impacting how you report income on Schedule C.

Handling Audits and Legal Tax Issues: Facing an IRS audit or legal tax complications requires professional expertise. A tax advisor not only represents your interests but also brings necessary knowledge and experience to the table, especially in navigating the specifics of Schedule C.

Maximizing Deductions for Small Business Owners: A seasoned tax professional can uncover potential deductions and credits, ensuring you utilize every opportunity to reduce your tax liability on Schedule C. Their expertise is particularly beneficial for small business proprietor seeking to optimize their tax returns.

Adapting to Frequent Tax Law Changes: Tax laws evolve constantly, impacting how you file Schedule C. Tax specialists stay abreast of these changes, providing advice on how new regulations affect your business tax filings.

Ensuring Peace of Mind: Even seemingly straightforward tax situations benefit from a professional’s review. Having an expert analyze your Schedule C offers peace of mind and confirms your adherence to tax regulations.

In summary, while many small business owners handle their taxes independently, navigating the complexities of Schedule C often necessitates the insight of a tax specialist. Their guidance can prevent costly errors, ensure regulatory compliance, and potentially lead to significant tax savings, particularly for those needing to file a Schedule C tax form with the IRS.

Future Planning: Organizing Profit of Loss for Next Year’s Schedule C

Future planning and meticulous record-keeping are vital for small business proprietor, particularly when preparing for the next year’s Schedule C tax filing. Effective organization of your financial records can significantly streamline your tax preparation process, ensuring an accurate and efficient experience. Here’s how you can achieve this:

Systematic Tracking of Gross Income and Expenses

Maintain a detailed record of all business transactions. This includes tracking every source of income and categorizing expenses. By doing this, you ensure that the gross income you report on your Schedule C is precise, reflecting the true financial state of your business.

Utilize Schedule C for Accurate Reporting

Schedule C is designed to report profit or loss from business activities. Use this form judiciously to itemize your business income and expenses. It’s an essential tool for small business tax reporting and helps in distinguishing personal expenses from business use.

Consolidate Business Use Records

Keep separate records for expenses that pertain strictly to business use. This includes costs like office supplies, business travel, and any other expenses incurred directly in the running of your business.

Integrate Instruction and Guidance

Regularly consult the IRS instructions for Schedule C. These guidelines can offer clarity on what constitutes legitimate business expenses, how to report different types of income, and other nuances of filing an income tax return for your business.

Manage Personal and Business Finances Separately

To avoid confusion during tax time, clearly differentiate between your personal tax return and your business tax affairs. This separation simplifies understanding the total business revenue and expenses for the year.

Documenting Profit or Loss from Business

Accurately record both your profits and losses. This comprehensive financial picture is crucial not only for tax purposes but also for understanding the financial health of your business.

Leverage Digital Tools for Efficiency

Consider using accounting software or digital tools to run your business finances. These can automate many aspects of record-keeping, making it easier to compile and report your financial data when it’s time to use Schedule C.

Regular Reviews and Updates

Periodically review your financial records throughout the year. Regular updates can prevent the last-minute rush and potential errors in your Schedule C reporting.

By following these practices, you can ensure that your record-keeping is robust and efficient, paving the way for a smoother process when it’s time to file your small business tax return using Schedule C. This preparation not only aids in accurate tax reporting but also provides valuable insights into the financial trajectory of your business.

Conclusion: Key Takeaways

- Understand if you need to file Schedule C and accurately report all business income and expenses.

- Maximize your tax deductions where applicable.

- Be aware of the interplay between Schedule C and SE for self-employment tax.

- Stay organized and consider professional advice for complex tax situations.

By following this guide, you’ll be better equipped to handle your Schedule C tax form, potentially saving money on your taxes. Remember, staying informed and organized is key to a successful tax filing experience.