Form W-2 (also known as the Wage and Tax Statement) is a document that employers must provide to their employees and to the Internal Revenue Service (IRS). It reflects an employee’s income earned and taxes withheld from the prior year to be reported on their income tax returns. Employers must report FICA taxes, submit the W-2 and W-3 forms to the Social Security Administration (SSA) by the end of January, and provide the employee with a copy on or before January 31st of the next year. When filing taxes, the employee should input the information found on their W-2 into a Form 1040 individual tax return, either by hand or electronically. The information on a W-2 includes the name and address of the employee and employer, Social Security number, taxable income, federal income tax withheld, Social Security tax and Medicare tax withheld, tips earned and reported, dependent care benefits received, deferred compensation, and state and local taxes. If an employee loses their W-2, they should contact their payroll or HR supervisor to access the form online or to request a new copy.

What is Form W-2?

The Form W-2, commonly referred to as the Wage and Tax Statement, serves as a crucial document that employers must furnish to their employees and the Internal Revenue Service (IRS) at the conclusion of each tax year. Essentially, the W-2 form provides a comprehensive summary of an employee’s yearly earnings, inclusive of the total wages accrued and the amount of taxes withheld from their paychecks.Typically, individuals are issued a W-2 when their annual income exceeds $600. However, employers also utilize this form to report FICA taxes on behalf of their employees. It’s imperative to note that all the pertinent information contained within the W-2 must be transcribed onto an individual’s Form 1040 tax return.

IRS Form W-2 – Who Needs to Fill It Out?

Form W-2, also known as the Wage and Tax Statement, is the form employees must receive from their employer and submit to the IRS every year. It contains the employee’s total wages, as well as information about how much was taken out of their paycheck in terms of income tax, Social Security tax, and Medicare tax. Employers must send a W-2 to each employee to whom they paid a salary, wage, or another form of compensation. Employers must also use a W-2 to report FICA taxes for employees to the Social Security Administration. To prevent audits, taxpayers are still required to report all salary, wage, and tip income, regardless of whether it is reported on a W-2 form.

Step-by-Step: Form W-2 Instructions For Filling Out the Document

Filing Form W-2 is an important annual process for employees and employers. Employees must provide their employers with their tax ID number, marital status, number of allowances and dependents, and other information through Form W-4. Employers then use this information to determine how much tax to withhold from the employee’s paycheck. At the end of the year, employers must then file Form W-2, along with Form W-3, with the Social Security Administration, which uses this information to calculate the employee’s Social Security benefits. Both the employee and employer must submit copies to the IRS as well. Finally, when the employee files their taxes, they input Form W-2’s information into Form 1040, either by hand or electronically.

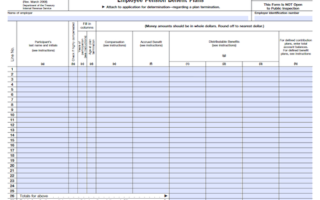

Below, we present a table that will help you understand how to fill out Form W-2.

| Information Required for Form W-2 | Details |

|---|---|

| Tax ID Number | Employee’s tax identification number |

| Marital Status | Employee’s marital status |

| Number of Allowances | Number of allowances claimed by the employee |

| Number of Dependents | Number of dependents claimed by the employee |

| Other Information | Additional information provided on Form W-4 |

| Tax Withholding | Amount of tax to be withheld from the paycheck |

Do You Need to File Form W-2 Each Year?

Do You Need to File Form W-2: Wage and Tax Statement Each Year? Yes, employees must receive their W-2 every year from their employer. Employers must send out the form to each employee on or before January 31, and they must also file the form, along with Form W-3, with the Social Security Administration (SSA) by the same date. This form records an employee’s total earnings from the previous year, as well as the amount of taxes withheld from their paychecks, so that they can easily input this data into their income tax returns when it is time to file. The employer also uses the information provided on the W-4 to calculate how much tax to deduct from the employee’s paycheck. Tax documents are filed for the previous year, so a W-2 form received in January 2023 will reflect income earned in the year 2022.

Download the official IRS Form W-2 PDF

On the official IRS website, you will find a link to download Form W-2. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form W-2

Sources:

https://www.irs.gov/forms-pubs/about-form-w-2

https://www.irs.gov/instructions/iw2w3