In today’s rapidly digitalizing world, businesses are continually seeking innovative ways to enhance customer experience and streamline operations. The banking sector, in particular, has embraced the concept of virtual branches. …

In today’s rapidly digitalizing world, businesses are continually seeking innovative ways to enhance customer experience and streamline operations. The banking sector, in particular, has embraced the concept of virtual branches. …

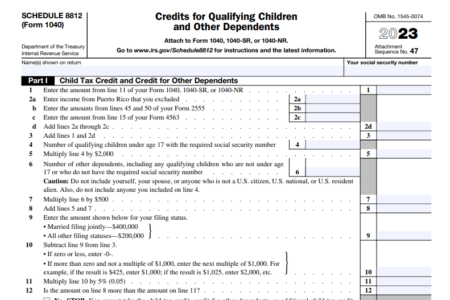

The U.S. IRS tax code is a complex web of regulations, forms, and deductions that can baffle even the most seasoned taxpayers. One such form that often confounds individuals and …

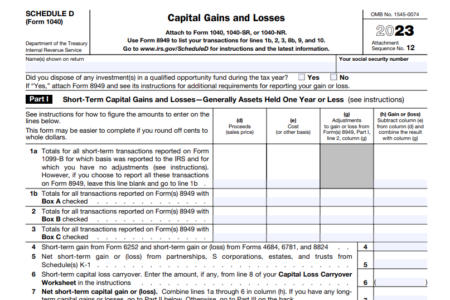

If you’ve recently earned money from investments or disposed of capital assets, it’s essential to understand how to report your capital gains and losses to the IRS. Filing these correctly …

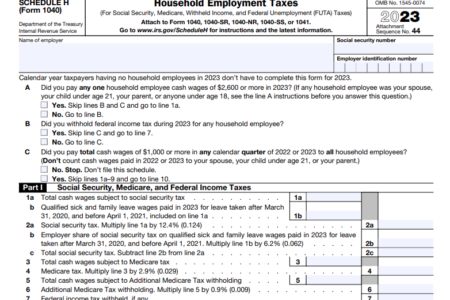

If you employ household workers or domestic help, it’s essential to understand your tax obligations. Schedule H is a tax form used by household employers to report and pay household …

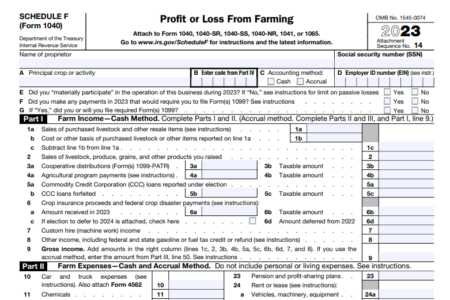

In the complex world of federal workforce management, Schedule F has emerged as a pivotal concept, especially in recent years. The evolution of this executive order and its implications for …

In the ever-evolving world of taxes, staying informed about your refund status can be both challenging and essential. This article dives deep into the intricacies of tracking both federal and …

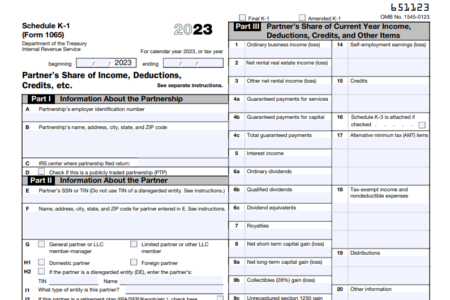

Are you a business owner wondering about the intricacies of tax forms, specifically the Schedule K-1? Are terms like “form 1065,” “tax deduction,” and “irs schedule k-1” making your head …

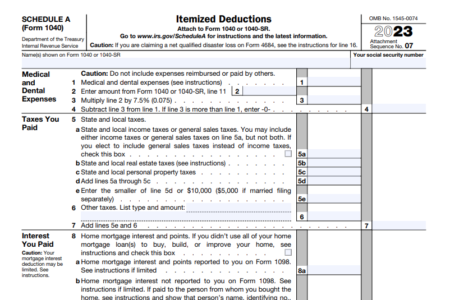

When it comes to filing your federal income tax return in the United States, understanding the nuances of tax forms and deductions is essential to minimize your tax liability. One …

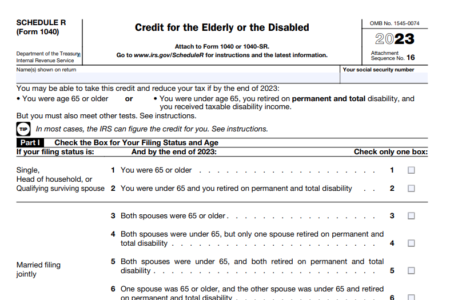

If you’re elderly or disabled and looking for ways to maximize your tax savings, you’ve come to the right place. In this comprehensive guide, we’ll delve into the intricacies of …

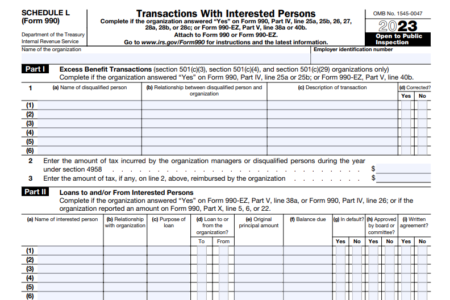

IRS Schedule L, a lesser-known but crucial component of various tax forms such as 990, 1120s, and 1065, often raises questions and concerns among taxpayers. This article aims to unravel …

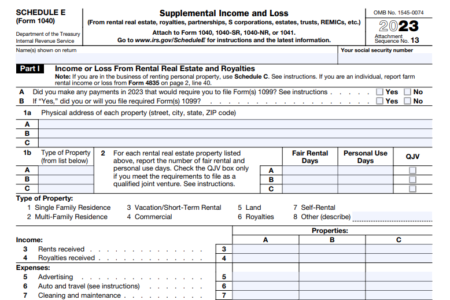

Managing rental properties requires a keen understanding of financial responsibilities, especially when it comes to reporting rental income to the IRS. This comprehensive guide is centered on the IRS Form …

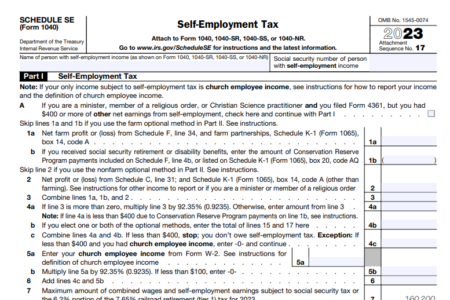

Navigating the world of taxes can be complex, especially when it comes to understanding the nuances of self-employment tax. This comprehensive guide is designed to demystify IRS Schedule SE, an …

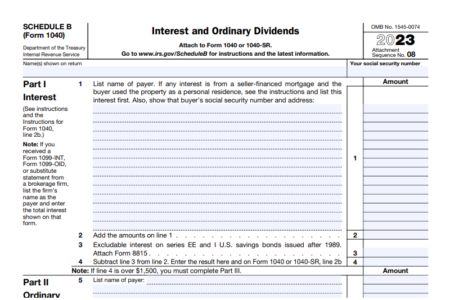

Understanding the intricacies of IRS forms can be daunting, especially when it comes to declaring specific types of income like interest and dividends. This comprehensive guide delves into IRS Form …

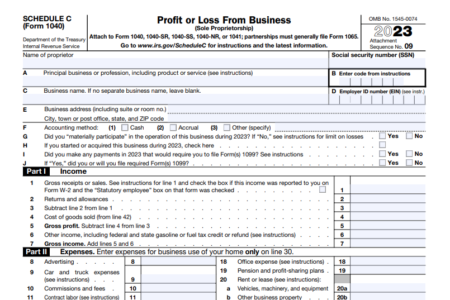

Filing taxes can be a daunting task, especially when dealing with specific forms like Schedule C for your IRS Form 1040. This comprehensive guide is designed to simplify the process, …

Reporting your tax ID number correctly is crucial to ensure smooth processing of tax refunds and payments from your employer. This article provides a step-by-step guide on how to report …

Calculating total revenue is an essential part of preparing an income statement. It involves determining the total income before deducting expenses, which can include sales, interest, and dividends. This article …

When it comes to tax purposes, the IRS does not recognize a limited liability company (LLC) as a separate entity. Instead, it considers LLCs as disregarded entities. This means that …

Small businesses are required to report their profit and loss deductions to the IRS, regardless of their success or failure. This article will explain what profit and loss deductions are …

Calculating your taxable income and tax liability for your business may seem daunting, but with proper record-keeping and understanding of the process, it can be manageable. By keeping track of …

When it comes to preparing a corporate tax return, having the right documents is crucial. Whether you have a corporation or a limited liability company (LLC), understanding the necessary paperwork …