If you’re elderly or disabled and looking for ways to maximize your tax savings, you’ve come to the right place. In this comprehensive guide, we’ll delve into the intricacies of Schedule R, a crucial form that can help you claim tax credits designed to ease your financial burden. We’ll explore everything from how to complete Schedule R to understanding the eligibility criteria for these valuable credits. By the end of this article, you’ll have a clear understanding of how to navigate tax season with confidence and potentially reduce your tax liability. Let’s get started!

What is Schedule R Form?

Schedule R is an essential IRS form designed to help elderly and disabled taxpayers claim the Credit for the Elderly or the Disabled. This nonrefundable tax credit is intended to reduce your overall tax liability, providing much-needed financial relief. To claim this credit, you must meet specific criteria outlined by the IRS, which we will discuss in detail later in this article.

Filing Requirements and Eligibility Criteria

To qualify for the Credit for the Elderly or the Disabled, you need to meet several criteria. First and foremost, you must be elderly or permanently and totally disabled. The IRS defines “elderly” as being 65 or older at the end of the tax year. “Permanently and totally disabled” refers to individuals who are unable to engage in any substantial gainful activity due to a physical or mental condition expected to last at least a year or result in death.

Additionally, your filing status matters. If you’re married, you must be filing jointly to claim this credit. If you’re married but filing separately, you won’t be eligible. Ensure that you meet these requirements before proceeding with your tax return.

Completing Schedule R: A Step-by-Step Guide

Filling out Schedule R may seem daunting, but it’s a necessary step to claim the credit successfully. Here’s a step-by-step guide to help you complete this form:

- Gather Your Information: Before you begin, make sure you have all the necessary documents, such as your Form 1040 and any additional tax-related paperwork.

- Locate Schedule R: Find Schedule R in your tax preparation software or IRS tax forms booklet.

- Personal Information: Provide your name, Social Security number, and the name of your spouse if applicable.

- Calculate Your Credit: Use the provided worksheet to calculate your credit based on your filing status, adjusted gross income, and other relevant factors.

- Enter the Result: Transfer the calculated credit amount to your Form 1040 or 1040A.

- Review and File: Double-check all the information on Schedule R for accuracy before filing your taxes.

Who Qualify for the Credit? How Much Can You Claim?

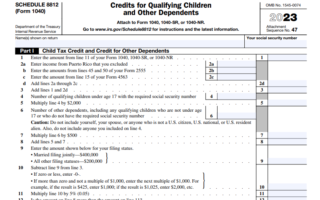

The amount of the Credit for the Elderly or the Disabled can vary from person to person, depending on factors like your filing status, income, and the nature of your disability. To calculate the credit, you’ll need to refer to the instructions provided by the IRS on Schedule R.

The credit is nonrefundable, meaning it can reduce your tax liability to zero but won’t result in a tax refund if it exceeds your tax liability. However, it’s still a valuable way to reduce the amount you owe to the IRS.

Common Pitfalls and How to Avoid Them

When dealing with tax forms and credits, there are common pitfalls that taxpayers often encounter. Here are some examples and how to resolve them:

Pitfall 1: Incorrect Filing Status – Make sure you’re filing as “married filing jointly” if you’re married. Choosing the wrong filing status can result in your ineligibility for the credit.

Pitfall 2: Not Meeting Disability Criteria – Ensure that you meet the IRS’s criteria for being permanently and totally disabled. If you’re unsure, consult with a tax specialist.

Pitfall 3: Incorrect Calculation – Carefully follow the instructions provided by the IRS to calculate your credit accurately. Errors in this calculation can lead to discrepancies in your tax return.

By being aware of these potential pitfalls and addressing them proactively, you can streamline the process of claiming the credit for the elderly or the disabled.

Claiming the Credit: Tips for a Smooth Process

To ensure a smooth experience when claiming the Credit for the Elderly or the Disabled, consider these tips:

- File Electronically: E-filing can expedite the processing of your return and reduce the chances of errors.

- Keep Detailed Records: Maintain organized records of your medical expenses and any disability-related documentation, as these may be required to substantiate your claim.

- Review Annually: Check your eligibility for the credit each tax year, as your circumstances may change.

Additional Tax Considerations for the Elderly or Disabled for Schedule R

In addition to completing Schedule R, there are several crucial tax considerations that may apply to elderly and disabled taxpayers, which can significantly impact their tax liability. Understanding these additional factors is essential for individuals who want to maximize their tax benefits.

One important aspect to consider is the eligibility for nontaxable social security benefits. Many elderly or disabled individuals receive social security income, which is often not subject to federal income tax. This means that a portion, or in some cases, the entirety of their social security benefits may be tax-free, reducing their overall taxable income.

Similarly, nontaxable pensions can also play a significant role in tax planning for the elderly or disabled. Pensions earned through certain government programs or specific retirement plans may be exempt from federal income tax. This exemption can lead to substantial tax savings for eligible individuals.

Moreover, there are potential deductions related to medical expenses that elderly or disabled taxpayers should explore. Medical expenses can quickly accumulate, and the IRS allows taxpayers to deduct qualified medical expenses that exceed a certain percentage of their adjusted gross income (AGI). This deduction can provide additional tax relief for those facing substantial medical costs.

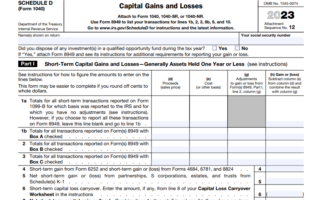

To claim these benefits and deductions effectively, taxpayers must complete Form 1040, the standard individual income tax return form, along with Schedule R. The IRS provides detailed instructions for Schedule R, which can be found on their official website.

It’s important to note that the tax laws and regulations regarding elderly and disabled taxpayers can be complex and subject to change. Therefore, it’s advisable for individuals in these situations to consult with a tax professional or use tax software that specializes in handling their specific needs. A tax specialist can help determine eligibility for the various tax credits and deductions, ensuring that taxpayers receive the maximum benefit allowed by law.

Schedule R is essential for elderly and disabled taxpayers, it’s equally important to be aware of these additional tax considerations, such as nontaxable social security benefits, nontaxable pensions, and potential medical expense deductions. Taking advantage of these provisions can help reduce tax liability and provide financial relief for those who need it most.

Consulting with a Tax Professional to Calculate the Credit: Is It Necessary?

While many individuals can successfully complete Schedule R on their own, there are cases where consulting with a tax specialist is advisable. This is particularly true if you have complex financial situations, multiple sources of income, or doubts about your eligibility for the credit. A tax professional can provide expert guidance and ensure you take advantage of all available tax benefits.

State Tax Credits for the Elderly and Disabled: Schedule R

When it comes to maximizing your tax savings, don’t overlook the valuable opportunities provided by State Tax Credits for the Elderly and Disabled, particularly through Schedule R. Many states recognize the unique financial challenges faced by elderly and disabled individuals and offer their own tax credits and deductions to alleviate some of the burden.

To qualify for this credit, you must meet specific criteria outlined by the Internal Revenue Service (IRS). Generally, you should be either elderly (usually aged 65 or older) or permanently and totally disabled at the beginning of the tax year. Additionally, your income must fall within certain limits, and you should not engage in substantial gainful activity due to a physical or mental condition.

To claim the credit, complete Schedule R as part of your annual tax return. This form will help you calculate the credit amount you are eligible for, and it’s crucial to follow the provided instructions carefully. The credit is nonrefundable, meaning it can reduce your tax liability but won’t result in a tax refund if it exceeds your tax owed.

In addition to the federal credit, it’s essential to be aware of state-specific tax credits and deductions available in your state. These credits can vary widely and provide even more opportunities for tax savings. To explore the options in your state, consult with a tax specialist or use IRS resources to find the necessary information.

Conclusion: Key Takeaways for Tax Season

In conclusion, understanding these additional tax considerations is crucial for elderly and disabled individuals during tax season. By leveraging nontaxable benefits, deductions, and seeking professional guidance when necessary, you can effectively reduce your tax liability and improve your financial well-being. Don’t forget to explore state-specific tax credits to maximize your savings even further. When it comes to taxes, knowledge is power, and the more you know, the better you can plan and save.

Key Takeaways:

- Schedule R helps elderly and disabled individuals claim the Credit for the Elderly or the Disabled.

- Meeting eligibility criteria is essential, including being elderly or permanently and totally disabled.

- Complete Schedule R accurately to calculate and claim your credit.

- Be aware of common pitfalls, such as incorrect filing status or calculation errors.

- Consult a tax professional when in doubt, and explore state-specific tax credits for additional savings.

As you navigate tax season, use this guide as a reference to ensure that you’re taking full advantage of the tax credits available to you as an elderly or disabled taxpayer.