ALE Members with 50 or more full-time employees and members of an Aggregated ALE Group must file Forms 1094-C and 1095-C to report the information required under sections 6055 and 6056, which are used to determine if an employer owes a payment and if employees are eligible for the premium tax credit.

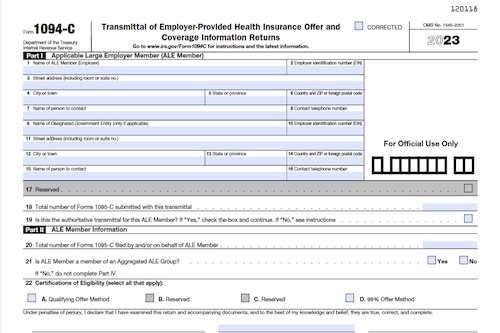

What is Form 1094-C?

Form 1094-C and 1095-C are reports submitted to the IRS by Applicable Large Employers (ALE Members) in order to fulfill their employer shared responsibility provisions under section 4980H. All ALE Members must submit one or more 1094-Cs, along with a 1095-C for each full-time employee they employ in any month of the calendar year. An ALE Member is generally an employer with 50 or more full-time employees across all entities under their common control. If the ALE Member is part of an Aggregated ALE Group, all of the group’s members must file Forms 1094-C and 1095-C (even if they have fewer than 50 full-time employees of their own). These forms also must be shared with the employee for the purpose of determining eligibility for the premium tax credit.

IRS Form 1094-C – Who Needs to Fill It Out?

Form 1094-C and 1095-C must be filled out by Applicable Large Employers (ALE Member) with 50 or more full-time employees (including full-time equivalent employees) in the previous year. Form 1094-C conveys summary information to the IRS while Form 1095-C contains individual coverage information to be reported to IRS and employees. Employers with self-insured coverage must also use Form 1095-C to report on individuals with minimum essential coverage. All ALE Members must submit a Form 1094-C and 1095-C for each full-time employee, while members of Aggregated ALE Groups must take into account all employers in the Group when determining their status as an ALE Member.

Step-by-Step: Form 1094-C Instructions For Filling Out the Document

Forms 1094-C and 1095-C must be completed and filed by Applicable Large Employers (ALEs) with 50 or more full-time/full-time equivalent employees from the previous year, along with any correlated Aggregated ALE Groups. Information about offers of health coverage and employee enrollment must be reported, as well as any employees who have been deemed to have minimum essential coverage under the employer plan. Employers must submit one or more Forms 1094-C (including a Form 1094-C as the Authoritative Transmittal) and a Form 1095-C for every full-time employee. All submitted documents must also be furnished to the employee. Further information can be found in the Definitions section.

Below, we present a table that will help you understand how to fill out Form 1094-C.

| Form | Who Must Complete | Information Required |

|---|---|---|

| 1094-C | Applicable Large Employers (ALEs) with 50 or more full-time/full-time equivalent employees from the previous year, along with any correlated Aggregated ALE Groups | Information about offers of health coverage and employee enrollment must be reported, as well as any employees who have been deemed to have minimum essential coverage under the employer plan. Employers must submit one or more Forms 1094-C (including a Form 1094-C as the Authoritative Transmittal) and a Form 1095-C for every full-time employee. All submitted documents must also be furnished to the employee. |

| Other Relevant Parties | Additional details as required | |

| 1095-C | Same as for 1094-C | Same as for 1094-C |

Do You Need to File Form 1094-C Each Year?

Generally, employers with 50 or more full-time employees must file Forms 1094-C and 1095-C each year, and an ALE Member is required to file these forms for each employee who was a full-time employee of the ALE Member in any month of the calendar year. An ALE Member is typically a single person or entity that is an Applicable Large Employer and, if applicable, each person or entity that is part of an Aggregated ALE Group with 50+ full-time employees. The forms are used to report offers of health coverage and enrollment information to the IRS, as well as to determine whether an ALE Member owes a payment under section 4980H and an employee’s eligibility for the premium tax credit.

Download the official IRS Form 1094-C PDF

On the official IRS website, you will find a link to download Form 1094-C. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1094-C

Sources: