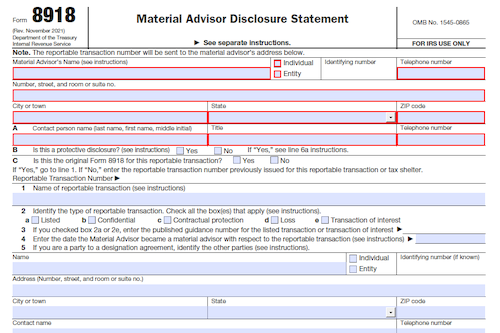

Filing Form 8918 with the IRS is now required by material advisors to any reportable transaction in order to disclose certain information related to the transaction and receive a reportable transaction number for tracking purposes. Every taxpayer who has participated in a reportable transaction must also disclose it on Form 8886. Who must file and who is considered a material advisor are discussed to help determine filing requirements.

What is Form 8918?

Form 8918 is an IRS form that material advisors must file for any reportable transaction. A material advisor is defined as an individual, trust, estate, partnership, or corporation who provides material aid, assistance, or advice and expects to receive gross income in excess of the applicable threshold amount. This includes providing a tax statement to a taxpayer, or another material advisor, that relates to a tax aspect of the reportable transaction. Additionally, fees received for analysis, implementation, documentation, or tax preparation are included in the gross income amount. However, employees who make a tax statement in their capacity as employees are exempt from filing. Those filing Form 8918 with the IRS will receive a reportable transaction number that must be provided to all taxpayers and material advisors involved.

IRS Form 8918 – Who Needs to Fill It Out?

Generally, any material advisor who provides tax statement(s) with respect to a reportable transaction and receives or expects to receive gross income in excess of $50,000 (for reportable transactions that provide substantially all of the tax benefits to individuals) or $250,000 (for all other transactions) must file Form 8918 with the IRS. This includes individuals, trusts, estates, partnerships, and corporations. Material advisors must provide the reportable transaction number to all taxpayers and material advisors for whom they act as a material advisor. The definition of “material advisor” includes those who make or provide tax statement(s) to or for a taxpayer, with respect to a reportable transaction that is or is expected to become a listed transaction or transaction of interest. Tax statements also include tax result protection, which is insurance offered to insure some or all of the tax benefits of a reportable transaction. Furthermore, reasonable fees received or expected to be received for services related to the transaction are included in the gross income calculation for this purpose. Generally, employees are excluded; however, exceptions may apply.

Step-by-Step: Form 8918 Instructions For Filling Out the Document

If you are a material advisor to a reportable transaction, you must file Form 8918 with the IRS. This form requires you to provide certain information about the reportable transaction and will provide you with a reportable transaction number. To determine whether you are a material advisor, you must provide any material aid, assistance, or advice with respect to the transaction and receive or expect to receive gross income in excess of the specified threshold amount ($50,000 or $250,000, depending on the type of transaction). Additionally, if you provide a tax statement to a taxpayer or material advisor relating to the reportable transaction, you are considered a material advisor. Fees related to the transaction must be included when determining the amount of gross income received. Exceptions may apply if the tax statement is made in the capacity of an employee, shareholder, partner, or agent of another person. You become a material advisor when all criteria have been met and the transaction is entered into by the taxpayer.

Below, we present a table that will help you understand how to fill out Form 8918.

| Instructions for Form 8918 | Details |

|---|---|

| Who must file | Material advisors to reportable transactions |

| Material advisor criteria | Provide material aid, assistance, or advice and receive gross income exceeding specified threshold |

| Tax statement | If providing a tax statement related to the transaction, you are a material advisor |

| Transaction exceptions | Exceptions may apply based on capacity and other criteria |

| Becoming a material advisor | Criteria met when all requirements are fulfilled |

Do You Need to File Form 8918 Each Year?

Generally, every material advisor to a reportable transaction must file Form 8918 each year if they provide material aid, assistance, or advice to any reportable transaction (as defined in the General Instructions) which give gross income in excess of the threshold amount specified in the form. This applies even if the material advisor provided the tax statement to another material advisor or the transaction wasn’t initially a reportable one but was later identified as a listed transaction or a transaction of interest. Furthermore, the taxpayer that entered into the particular reportable transaction also has to fulfill their own reporting requirements.

Download the official IRS Form 8918 PDF

On the official IRS website, you will find a link to download Form 8918. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8918

Sources: