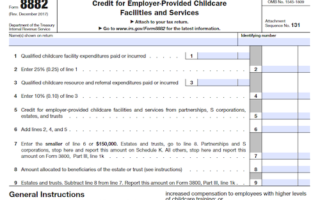

Taxpayers who produce, grow, or extract qualified production activities income (QPAI) within the United States may be eligible to claim the Domestic Production Activities Deduction (DPAD), which is calculated using Form 8906 and reported on Form 1040, Schedule 1, Line 9.

What is Form 8906?

Form 8906 is an IRS form which taxpayers can use to claim the Domestic Production Activities Deduction. To qualify for the deduction, the taxpayer must produce, grow, or extract qualified production activities income (QPAI) from the United States, and the deduction amount is the lesser of 9% of the taxpayer’s QPAI or 50% of the taxpayer’s W-2 wages allocable to QPAI. In order to complete Form 8906, the taxpayer must attach a copy of their W-2 forms as well as complete Form 8903, and the deduction is reported on Form 1040, Schedule 1, Line 9.

IRS Form 8906 – Who Needs to Fill It Out?

IRS Form 8906 must be completed and attached to the taxpayer’s Form 1040 to claim the Domestic Production Activities Deduction (DPAD). This deduction is available to taxpayers who produce, grow, or extract qualified production activities income (QPAI) from within the United States. The deduction is equal to the lesser of 9% of the taxpayer’s QPAI or 50% of the taxpayer’s W-2 wages allocable to QPAI reported on Form 1040, Schedule 1, Line 9. Taxpayers must also attach a copy of their W-2 forms and any other documents necessary to support the deduction, and complete Form 8903 to calculate the deduction.

Step-by-Step: Form 8906 Instructions For Filling Out the Document

Step-by-Step: Instructions For Filling Out the Document: Form 8906 is the form to be completed in order to claim the available Domestic Production Activities Deduction (DPAD). This deduction is intended for those who have produced, grown, or extracted qualified production activities income (QPAI) from the US. Form 8906 must be completed and attached to Form 1040 with copies of W-2s and any other necessary documents supporting the deduction. Additionally, Form 8903 is used to calculate the deduction, which is equal to either 9% of QPAI or 50% of W-2 wages related to QPAI, whichever is lesser. The taxpayer is then to report it on Form 1040, Schedule 1, Line 9.

Below, we present a table that will help you understand how to fill out Form 8906.

| Information Required for Form 8906 | Details |

|---|---|

| Qualified Production Activities Income (QPAI) | For those who have produced, grown, or extracted QPAI from the US |

| Attachment to Form 1040 | Must be attached to Form 1040 with supporting documents |

| Deduction Calculation | Calculate the deduction, based on 9% of QPAI or 50% of W-2 wages related to QPAI |

| Reporting on Form 1040, Schedule 1, Line 9 | Report the deduction on Form 1040, Schedule 1, Line 9 |

Do You Need to File Form 8906 Each Year?

Form 8906 must be filed each year if you are claiming the Domestic Production Activities Deduction (DPAD). With Form 8906, you must also submit a copy of your W-2 forms and any other documents needed to support the deduction. In addition, you must fill out Form 8903, Domestic Production Activities Deduction, to calculate the deduction. The deduction is reported on your Form 1040, Schedule 1, Line 9. Make sure to attach this form to your completed Form 1040 when filing.

Download the official IRS Form 8906 PDF

On the official IRS website, you will find a link to download Form 8906. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8906

Sources: