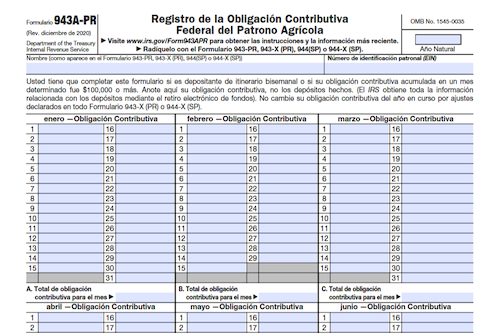

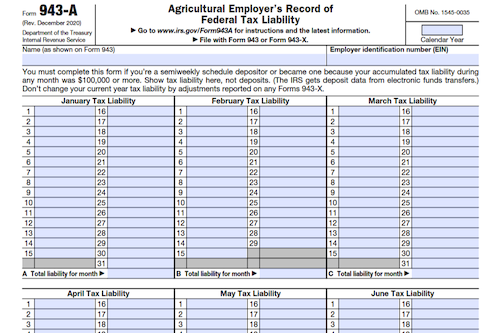

Federal tax filers in Puerto Rico must use Form 943A-PR to report their tax obligation when they are biweekly schedule depositors. This form must be included with Form 943-PR, 943-X (PR), 944(SP), and 944-X (SP) to determine if tax deposits have been made in a timely fashion, or else the IRS may propose an “averaged” Failure to Deposit penalty.

What is Form 943-A-PR?

Form 943A-PR is used to report tax obligations for Puerto Rican employers who are biweekly schedule depositors. The form is used to specify tax obligation each day, based on salary payments for employer and employee Social Security and Medicare contributions. To avoid an “averaged” Failure to Deposit (FTD) penalty from the IRS, it must be accurately completed with Form 943-PR or 944(SP). Do not attach Form 943A-PR to Form 941-PR and instead use Schedule B (Form 941-PR). The IRS does not require record of deposits since they are obtained electronically.

IRS Form 943-A-PR – Who Needs to Fill It Out?

Who Needs to Fill Out IRS Form 943A-PR? If you are a biweekly schedule depositor as defined in section 11 of Publication 179, Federal Tax Guide for Puerto Rican Employers, use Form 943A-PR to report and specify your tax obligation for each day. Include both employer and employee Social Security and Medicare contributions. Form 943A-PR should not be used to record federal tax deposits, and must not be attached to Form 941-PR. Not completing or filing Form 943A-PR correctly may result in an FTD penalty.

Step-by-Step: Form 943-A-PR Instructions For Filling Out the Document

Form 943A-PR is used to report your tax obligation if you are a biweekly schedule depositor. You must specify your tax obligation for each day, including both employer and employee Social Security and Medicare contributions. Do not use Form 943A-PR to record federal tax deposits made, as the IRS obtains this information through electronic funds withdrawal. Additionally, if you report contributions on Form 941-PR, do not attach Form 943A-PR to it; instead, use Schedule B (Form 941-PR). The IRS may propose an “averaged” Failure to Deposit (FTD) penalty if Form 943A-PR is not completed and filed correctly.

Below, we present a table that will help you understand how to fill out Form 943-A-PR.

| Information Required for Form 943A-PR | Details |

|---|---|

| Form Type | Form 943A-PR |

| Tax Obligation | Biweekly schedule depositor’s tax obligation, including employer and employee Social Security and Medicare contributions |

| Use of Form | Report tax obligation for each day, excluding federal tax deposits (handled electronically), and do not attach to Form 941-PR; use Schedule B (Form 941-PR) |

| FTD Penalty | Possible “averaged” Failure to Deposit (FTD) penalty if Form 943A-PR is not completed and filed correctly |

Do You Need to File Form 943-A-PR Each Year?

Yes, if you are a biweekly schedule depositor you need to file Form 943A-PR each year. This form helps you report your tax obligation based on wages paid. Make sure to include both employer and employee Social Security and Medicare contributions. You should not use Form 943A-PR to record federal tax deposits; the IRS obtains that information electronically. However, if you report contributions on Form 941-PR, don’t attach Form 943A-PR to it; use Schedule B (Form 941-PR) instead. Failure to file Form 943A-PR correctly and on time may incur an “averaged” Failure to Deposit penalty.

Download the official IRS Form 943-A-PR PDF

On the official IRS website, you will find a link to download Form 943-A-PR. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 943-A-PR

Sources: