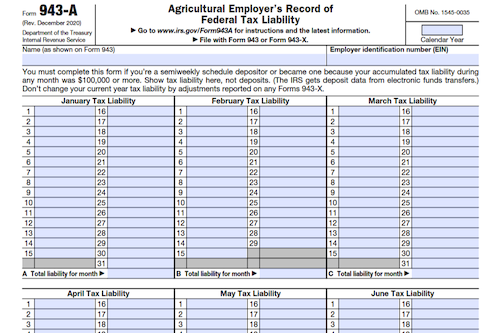

Form 943-A is used to report the federal tax liability of semiweekly schedule depositors based on the dates wages were paid. It must be filed along with Form 943, and includes both employer and employee taxes. The $100,000 Next-Day Deposit Rule may trigger semiweekly deposition for some employers.

What is Form 943-A?

Form 943-A is a tax reposting form used to report a liability for semiweekly schedule depositors. Employers must report taxable wages paid to their employees as well as employee and employer contributions of social security and Medicare taxes. This form should not be used to report taxes on wages paid to nonfarm workers, as they are reported on other forms. Form 943-A should be filed with Form 943, and its due date follows the due date of Form 943. Those who become a semiweekly schedule depositor as a result of the $100,000 Next-Day Deposit Rule must file Form 943-A for the entire year. A net tax liability of less than $2,500 or monthly schedule depositors who have not accumulated a liability over $100,000 are not required to file this form.

IRS Form 943-A – Who Needs to Fill It Out?

Form 943-A must be completed by semiweekly schedule depositors to report their tax liability for each day. Those who have accumulated $100,000 or more of tax liability in any month must use this form for the entire year. Those with a net tax liability for the year (Form 943, line 13) of less than $2,500 must not complete Form 943-A, and monthly schedule depositors must not complete it unless their tax liability exceeds the threshold of $100,000 in a month. The due date of Form 943-A is the same as applicable Form 943, which can be found in the instructions. Certain situations may require it to be filed with Form 943-X – details for this can be found in the form instructions.

Step-by-Step: Form 943-A Instructions For Filling Out the Document

Form 943-A is used to report your tax liabilities as a semiweekly schedule depositor. List any tax liabilities that you owe, based on the dates you paid your wages. This includes the federal income tax you withheld from employees, as well as both the employee and employer portions of Social Security and Medicare taxes. Do not use this form to report federal tax deposits, report on wages paid to nonfarm workers, or to report any reductions of your liability from nonrefundable credits. Filing and due dates depend on whether you are a monthly or semiweekly schedule depositor. Refer to Pub. 51 for more information about if you are required to file and due dates. If your net tax liability for the year (Form 943, line 13) is less than $2,500, do not complete Form 943-A.

Below, we present a table that will help you understand how to fill out Form 943-A.

| Information Required for Form 943-A | Details |

|---|---|

| Purpose | Report tax liabilities as a semiweekly schedule depositor |

| Tax Liabilities | Include federal income tax withheld from employees, Social Security, and Medicare taxes |

| Filing Requirements | Depend on whether you are a monthly or semiweekly schedule depositor |

| Threshold for Form 943 | If net tax liability for the year (Form 943, line 13) is less than $2,500, Form 943-A not required |

Do You Need to File Form 943-A Each Year?

Form 943-A must be filed if you are a semiweekly schedule depositor, or if your tax liability for any month during the year was $100,000 or more and you are a monthly schedule depositor. If your net tax liability for the year is less than $2,500 or you are a monthly schedule depositor and did not accumulate tax liability of $100,000 during any month of the year, Form 943-A is not needed. Form 943-A is due on the same day as Form 943, so it is important to familiarize oneself with the due dates. In some cases, Form 943-A may be filed with Form 943-X, so it is important to read the instructions to be sure.

Download the official IRS Form 943-A PDF

On the official IRS website, you will find a link to download Form 943-A. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click the link to download Form 943-A

Sources: