Form 4952: Investment Interest Expense Deduction is a tax form used by the IRS to determine the amount of investment interest expense that can be deducted and any interest expense that can be carried forward to a future tax year. This article explores who can file Form 4952, how it’s used, and exceptions that don’t qualify.

What is Form 4952?

Form 4952: Investment Interest Expense Deduction is a tax form used by the Internal Revenue Service (IRS) to calculate the allowable deduction for investment interest an individual, estate, or trust may claim. It must be filed if there is interest expense from borrowing for an investment, and the interest income may come from money used to purchase investments such as land, stocks, and bonds. It consists of three parts that must be filed to determine the amount of disallowed expense that may be carried forward to the subsequent year. Different rules apply depending on the source of the interest and what kind of interest it is. Home mortgage interest, qualified dividends, and certain expenses cannot be deducted. It is important to file Form 4952 to ensure you are claiming allowable deductions.

IRS Form 4952 – Who Needs to Fill It Out?

IRS Form 4952: Investment Interest Expense Deduction allows individuals, estates, and trusts to claim a deduction for investment interest expenses. This form must be completed for loan proceeds used to purchase investments such as land, properties, stocks, and non-tax-exempt bonds. Completion requires the calculation of total investment interest expense (Part I) and net investment interest (Part II), then entering the final figure from Part III onto Schedule A. Certain expenses are not deductible, such as home mortgage interest, qualified dividends, and expenses allocable to passive activities. Form 4952 can be found on the IRS webpage.

Step-by-Step: Form 4952 Instructions For Filling Out the Document

Filing Form 4952: Investment Interest Expense Deduction is necessary for individuals, estates, or trusts seeking a deduction for investment interest expenses. The form requires three parts for calculation, where Part I calculates the total investment interest expense, Part II caluculates the net investment interest after adjustments to gross income from property, and the final part determines any part III disallowed expenses that can be carried forward to future years. Certain expenses cannot be deducted, such as home mortgage interest and qualified dividends. Additional government restrictions apply when filing Form 4952 to ensure proper interest rule use and to limit the deduction to the taxpayer’s net income from an investment.

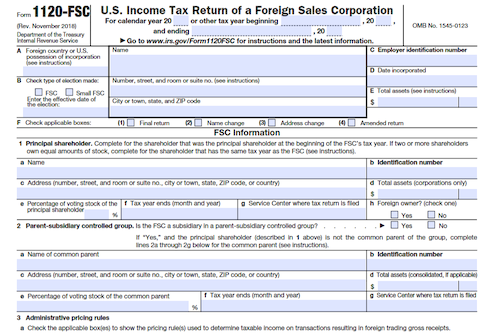

Below, we present a table that will help you understand how to fill out Form 4952.

| Form 4952 Information | Details |

|---|---|

| Filing Eligibility | Individuals, estates, or trusts seeking investment interest deduction |

| Form Parts | Part I: Total investment interest expense Part II: Net investment interest after adjustments Part III: Disallowed expenses for future years |

| Non-Deductible Expenses | Home mortgage interest, qualified dividends, and others |

| Government Restrictions | Ensure proper interest rule use and limit deduction to net investment income |

Do You Need to File Form 4952 Each Year?

Do You Need to File Form 4952: Investment Interest Expense Deduction Each Year? Form 4952: Investment Interest Expense Deduction must be filed each year by individuals, estates, or trusts seeking to deduct investment interest expenses. The form can be used to calculate the amount of investment interest expense that can be deducted as well as any interest expenses that can be carried forward to future tax years. Certain expenses are not deductible, such as interest used to generate tax-exempt income, qualified dividends and long-term capital gains. This form must be filed annually and is available on the IRS webpage.

Download the official IRS Form 4952 PDF

On the official IRS website, you will find a link to download Form 4952: Investment Interest Expense Deduction. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 4952

Sources:

https://www.irs.gov/forms-pubs/about-form-4952