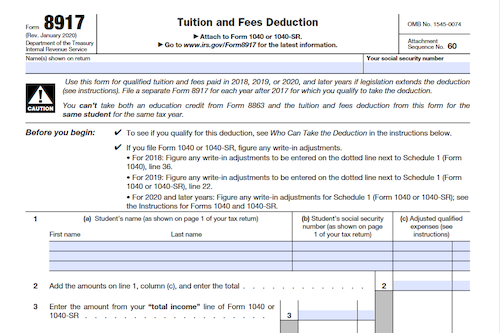

Form 8917 is an Internal Revenue Service (IRS) tax form that accompanies Form 1040 and is used to claim the tuition and fees deduction. The deduction is available for qualified tuition and fees that were paid in the calendar years of 2018, 2019, and 2020. The maximum deduction amount is $4,000 for single filers with modified adjusted gross incomes (MAGI) below $65,000 ($130,000 for married filing jointly). Eligible individuals must have been enrolled in a qualified educational institution and have received a Form 1098-T from that institution. Nonresident aliens, married filing separately (MFS), dependents claimed on someone else’s return, and taxpayers who filed for educational tax credits on Form 8863 are not eligible for the Form 8917 tuition and fees deduction. To file Form 8917, you need to include important information such as the student’s first and last name, Social Security number, and adjusted qualified expenses. Line 1 should include the qualified expenses for each eligible student, with line 2 totaling those amounts. Lines 3-5 calculate the MAGI in order to determine eligibility and maximum allowable deduction. Line 6 is the lesser of the amount from line 2 or the maximum allowable deduction. The amount from line 6 should be copied to Schedule 1 of Form 1040.

What is Form 8917?

Form 8917: Tuition and Fees Deduction is an Internal Revenue Service (IRS) tax form that applies towards a tax deduction for eligible qualified educational expenses paid in calendar years 2018, 2019, and 2020. These expenses may include tuition, books, supplies, required fees, and other charges. To be eligible to claim the deduction, MAGI must be less than certain limits: $80,000 as a single filer or $160,000 if filing as married filing jointly; also the taxpayer, their spouse, or a claimed dependent must have been enrolled in a qualified institution during the relevant tax year. Filing Form 8917 is an important step in obtaining the deduction; just be sure not to claim the same educational expenses on Form 8863, Educational Tax Credits.

IRS Form 8917 – Who Needs to Fill It Out?

IRS Form 8917 is used to claim the Tuition and Fees Deduction for tax year 2020. To qualify, the taxpayer, their spouse, or dependent must have been enrolled in a qualified institution during the tax year, and must have received a Form 1098-T. Those filing as married filing separately, Nonresident aliens without elected resident status, those claimed as a dependent, and those who have filed Form 8863 are ineligible. The maximum allowable deduction is $4,000 if MAGI is under $65,000 ($130,000 for MFJ), and $2,000 if MAGI is between $65,000 and $80,000 ($160,000 for MFJ).

Step-by-Step: Form 8917 Instructions For Filling Out the Document

Filling out IRS Form 8917: Tuition and Fees Deduction is simple! First, you’ll need to know your Adjusted Qualified Expenses, which is the total amount paid to the higher education institution in a given year. Who’s eligible? The taxpayer, their spouse or a dependent claimed on the tax return must have been enrolled in a qualified educational institution during the tax year. If filing as Married Filing Separately you will not qualify, nor can a taxpayer who was claimed as dependent on another’s return. Line 1 of the form should have all the pertinent information, like the student’s name and SSN. Follow the directions on the form to subtract Adjusted Gross Income (on line 3) from your Modifier Adjusted Gross Income (on line 5), and refer to the MAGI cutoffs and maximum amount allowed to deduct – $4,000 for those with a MAGI of less than $65,000 ($130,000 for Married Filing Jointly). Once you have calculated your adjusted qualified expenses and completed Form 8917, you can claim the deduction on your Form 1040.

Below, we present a table that will help you understand how to fill out Form 8917.

| Information for IRS Form 8917 | Details |

|---|---|

| Adjusted Qualified Expenses | The total amount paid to the higher education institution in the tax year. |

| Eligibility | The taxpayer, their spouse, or a dependent claimed on the tax return must have been enrolled in a qualified educational institution during the tax year. |

| Married Filing Separately | Not eligible. |

| Dependent on Another’s Return | Not eligible. |

| Line 1 | Includes student’s name and SSN. |

| Subtraction Calculation | Subtract Adjusted Gross Income (on line 3) from Modifier Adjusted Gross Income (on line 5). |

| MAGI Cutoffs | $4,000 deduction for MAGI less than $65,000 ($130,000 for Married Filing Jointly). |

| Form 1040 | Claim the deduction on your Form 1040. |

Do You Need to File Form 8917 Each Year?

Do You Need to File Form 8917: Tuition and Fees Deduction Each Year? Yes, you need to file Form 8917 every year that you qualify for the deduction. The deduction is available for qualified tuition and fees expenses paid during the calendar year in question, and any prepaid tuition and fees from the tax year for academic periods starting in the first three months of the following year. To qualify, you must have been enrolled in a qualified educational institution during the tax year, and have a modified adjusted gross income (MAGI) of less than $80,000 as a single filer ($160,000 if filing as married filing jointly). There are restrictions if you file as married filing separately or are claimed as a dependent on someone else’s return. You may also need to provide a Form 1098-T from the qualified educational institution. The maximum allowable deduction is $4,000.

Download the official IRS Form 8917 PDF

On the official IRS website, you will find a link to download IRS Form 8917. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: IRS Form 8917

Sources:

https://www.irs.gov/forms-pubs/about-form-8917