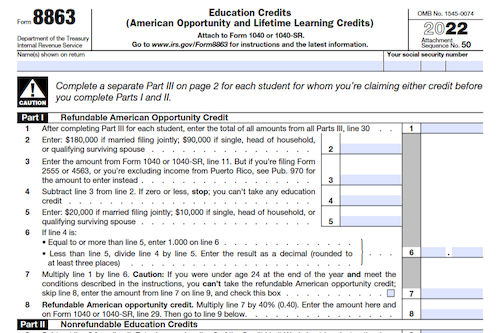

Brushing up on your taxes for 2022? It’s important to be aware of the differences between the two education credits the American opportunity credit and the lifetime learning credit. Both have different rules that could affect your eligibility, such as income limits and refundability. Learn more about these credits here.

What is Form 8863?

Form 8863 is an Internal Revenue Service (IRS) form that is used by individuals to calculate and claim education credits. These credits are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary), with two options to choose from depending on your criteria: the American opportunity credit and the lifetime learning credit. The amount of credit (up to $2,500 or $2,000, respectively) and whether it is refundable or nonrefundable (40% refundable for AOC and nonrefundable for LLC) are both important factors to consider. There are other criteria that could affect your eligibility to claim such as modified adjusted gross income (MAGI) and type of program requirement as outlined in Table 1. Requirements for TIN, EIN, and payment due dates also need to be considered. Who can claim an education credit depends on who is enrolled and/or which expenses were paid, in which case the details surrounding tax filing status and who is claiming the expenses must be taken into account.

IRS Form 8863 – Who Needs to Fill It Out?

If you, your spouse, or the dependent you are claiming have paid adjusted qualified education expenses to an eligible educational institution, you may be able to fill out Form 8863 in order to figure and claim your allowed education credits. The American Opportunity Credit is up to a maximum of $2,500 per eligible student, and may be refundable in part; while the Lifetime Learning Credit is up to $2,000 per return, and is nonrefundable. Other factors to consider include modified adjusted gross income (MAGI) limits, the student’s felony drug conviction status, payment periods for academic expenses, and the educational institution’s employer identification number (EIN). Both credits may not be claimed for the same student, and you cannot claim a credit on your return if you are claimed as a dependent on someone else’s return.

Step-by-Step: Form 8863 Instructions For Filling Out the Document

Filling out Form 8863 can be an exciting process! Use it to figure and claim any education credits based on your adjusted qualified education expenses paid to an eligible educational institution (postsecondary). To determine eligibility, there are two credits to consider: the American opportunity credit, which may be refundable, and the lifetime learning credit, which is nonrefundable. Refer to Table 1 for a comparison of these to know the differences and rules for each, including information regarding MAGI eligibility, which credit is refundable, the educational institution requirements, number of courses, years of postsecondary education, tax years, and more. Additionally, you may be able to claim an education credit if you, your spouse, or a dependent you claim is a student enrolled at or attending an eligible educational institution. Remember, you cannot claim an education credit if you’re claimed as a dependent or if you or your spouse are nonresident aliens for part of the year, or if your MAGI is over a certain threshold. For more details, refer to Pub. 970.

Below, we present a table that will help you understand how to fill out Form 8863.

| Form Name | Information Required | Details |

|---|---|---|

| Form 8863 | Filling out Form 8863 | Used to figure and claim education credits based on adjusted qualified education expenses paid to an eligible educational institution. Provides details on the American opportunity credit, lifetime learning credit, and eligibility criteria. |

Do You Need to File Form 8863 Each Year?

Yes, you should file Form 8863 each year to figure and claim your education credits, which are based on your adjusted qualified education expenses paid to an eligible educational institution. The type of credit you are eligible for – American Opportunity credit or Lifetime Learning credit – will depend on your filing status, income levels, and the type of program you are enrolled in. Additionally, if someone else is paying for the student’s expenses and that student is claimed as a dependent on someone else’s return, only the person who is claiming the student is eligible to claim the credit. It is important to meet the filing requirements of having the student’s tax identification number, the educational institution’s employer identification number, and paying for the academic periods on time.

Download the official IRS Form 8863 PDF

On the official IRS website, you will find a link to download Form 8863. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8863

Sources: