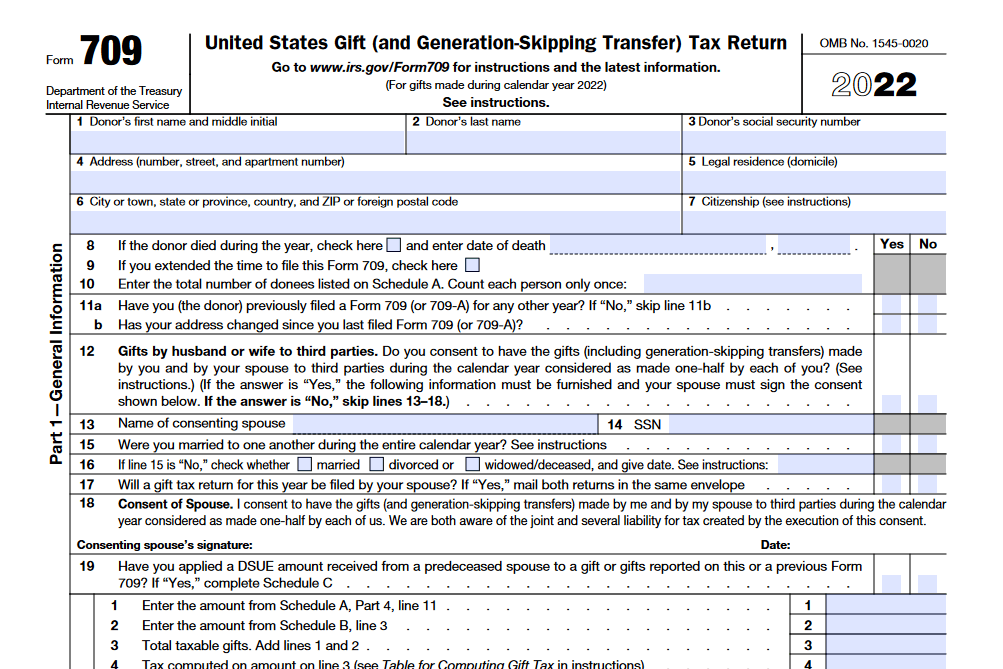

Form 709 is an IRS form required when transferring assets that may be subject to federal gift or generation-skipping transfer taxes. Filing this form does not necessarily mean there is tax owed–certain limits and exclusions apply–but filing must be completed if gifts of cash, property or other assets total more than $17,000 in 2023.

What is Form 709?

IRS Form 709 is used to report transfers of assets such as cash, property, or other assets that may be subject to the federal gift tax and/or certain generation-skipping transfer taxes. The annual exclusion for 2023 is $17,000, and the lifetime exemption is $12.92 million. If a taxable gift is made, the giver is responsible for filing Form 709 and for paying the taxes on it. This form must be filed with your tax return for the year following the gift and it should be mailed to the IRS. Exclusions to the gift tax include gifts falling within the annual exclusion limit, gifts to your spouse, tuition or medical expenses paid directly to the biller, and gifts to qualifying charities. Understanding tax law when filing Form 709 can be tricky, so it may be wise to consult a tax professional before finalizing your return.

IRS Form 709 – Who Needs to Fill It Out?

IRS Form 709 is used to report taxable gifts and generation-skipping tax exemptions. Single individuals must file Form 709 if gifts they give to any individuals exceed the annual exclusion limit of $16,000 in 2022, or $17,000 in 2023. The form should be filed with the taxpayer’s main tax return, and is generally due by April 15th of the following tax year. Exclusions for the gift tax include gifts to a spouse, tuition or medical expenses (which must be paid directly to the biller), or gifts to qualifying charities. The lifetime gift tax exemption is currently $12.92 million for 2023, and there is no inheritance tax on amounts up to this limit received from a parent.

Step-by-Step: Form 709 Instructions For Filling Out the Document

Form 709 is used to report transfers of assets that are subject to federal gift tax and generation-skipping transfer taxes. The form should be completed and included with your tax return for any year in which you make a taxable gift, such as giving cash or property to someone or making funds deposits into a 529 college savings account. Make sure to complete and report each part of the form, and double-check your entries with annual exclusion limits and tax-free scenarios in mind. You may consult a tax professional or refer to the IRS website if needed. To file Form 709, download the form from the IRS website for free and mail it along with the rest of your tax return to the IRS before the annual filing deadline. An extension for Form 709 filing can be requested by completing IRS Form 8892, but don’t forget to also file for a tax return extension using Form 4868 if necessary.

Below, we present a table that will help you understand how to fill out Form 709.

| Information Required for Form 709 | Details |

|---|---|

| Purpose | Report transfers subject to federal gift tax and generation-skipping transfer taxes. |

| When to File | File with your tax return for any year in which you make a taxable gift. |

| Examples of Taxable Gifts | Cash or property gifts, funds deposited into a 529 college savings account. |

| Completing the Form | Fill out all sections of the Form 709. |

| Annual Exclusion Limits | Consider these limits when reporting gifts. |

| Consultation | Seek advice from a tax professional or refer to the IRS website. |

| How to File | Download the form from the IRS website and submit it with your tax return. |

| Extension | Request an extension with IRS Form 8892 if needed. File for a tax return extension using Form 4868 if necessary. |

Do You Need to File Form 709 Each Year?

In general, if you made any taxable gifts during a given tax year, then you must file IRS Form 709 with your tax return for that year. If you made any gifts exceeding the annual exclusion limit of $16,000 in 2022 (or $17,000 in 2023) then you will need to file the form. Certain types of gift may be exempt from the gift tax, such as those given to your spouse, donations to charity, or payments made directly to tuition and medical providers. The lifetime gift tax exemption is $12.06 million in 2022, and $12.92 million in 2023, so you can inherit up to that amount from your parents without paying the gift tax. Filing Form 709 is required by April 15th, but you can file for an extension using Form 8892.

Download the official IRS Form 709 PDF

On the official IRS website, you will find a link to download Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 709

Sources:

https://www.irs.gov/forms-pubs/about-form-709

https://www.irs.gov/instructions/i709