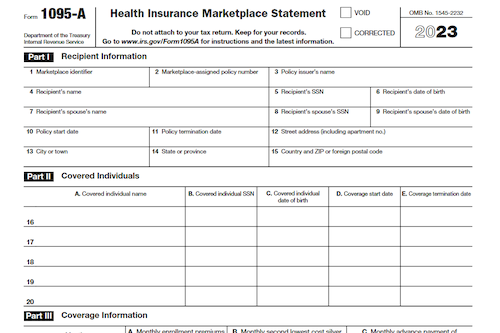

It is important to be aware of Form 1095-A: Health Insurance Marketplace Statement and its role in your life. This form is sent to Americans who obtained health insurance coverage through a Marketplace carrier. It includes information such as the effective date of coverage, monthly premiums, and any advance payments of the premium tax credit or subsidy. When you receive this form, you do not need to submit it; however, if you are eligible for a subsidy or tax credit, you must use the information on the form to complete Form 8962 and submit it with your tax return. Additionally, if you don’t receive your form, or there is an error on it, you can contact HealthCare.gov for assistance. Be sure to receive and keep Form 1095-A as a record of your past coverage.

What is Form 1095-A?

Form 1095-A is a form sent to Americans who purchase health insurance through a Health Insurance Marketplace. It includes the effective date of the coverage, the amount of monthly premiums paid, and any premium tax credits or subsidies that may have been issued. This form was created as part of the Affordable Care Act, commonly known as Obamacare. When preparing their taxes, individuals who have received a Form 1095-A must use it or acknowledge its receipt on their federal tax returns. Those who are eligible for a premium tax credit may need to include Form 8962 as well. Form 1095-A should be received by mid-January of the year following the coverage year, either by mail or in an individual’s HealthCare.gov account. If it is not received, or there are inaccuracies, contact HealthCare.gov directly.

IRS Form 1095-A – Who Needs to Fill It Out?

If you have health insurance that was bought through the Marketplace, you should receive a Form 1095-A. This form contains personal information such as your name, address, Social Security number, policy number, and insurance carrier name. It also lists each month of coverage, total premiums paid, and any advance payments of the premium tax credit or subsidy. You don’t need to send the form in, but if you are eligible for a subsidy or tax credit you must copy the information to Form 8962 and include it with your tax return. You should expect to receive the form by mid-January of the year after the coverage year. If you don’t receive it or notice an inaccuracy, you should contact HealthCare.gov.

Step-by-Step: Form 1095-A Instructions For Filling Out the Document

Form 1095-A is a document that provides essential information regarding an individual’s health insurance coverage through a Health Insurance Marketplace carrier. This form includes data such as the effective date of the insurance, as well as premium amounts and advance payments of the premium tax credit or subsidies. If eligible, individuals must transfer the relevant information from the 1095-A form to the 8962 form and include it with their tax return. The form should be available by mid-January following the year of coverage, either in mail or in the buyer’s HealthCare.gov account. Individuals who don’t receive their form should contact HealthCare.gov for help. The form does not need to be sent in with the tax return, but those eligible for a subsidy or tax credit must transfer the needed information to Form 8962.

Below, we present a table that will help you understand how to fill out Form 1095-A.

| Information Required for Form 1095-A | Details |

|---|---|

| Effective Date of Insurance | Date when the insurance coverage started |

| Premium Amounts | Cost of health insurance premiums |

| Advance Payments of Premium Tax Credit or Subsidies | Amounts received in advance to help pay for insurance premiums |

| Transfer to Form 8962 | Relevant information must be transferred to Form 8962 for tax purposes |

| Availability | Form should be available by mid-January following the year of coverage, either in mail or in the buyer’s HealthCare.gov account |

| Contact Information | If you don’t receive the form, contact HealthCare.gov for assistance |

| Submission with Tax Return | The form does not need to be sent in with the tax return, but those eligible for a subsidy or tax credit must transfer the needed information to Form 8962 |

Do You Need to File Form 1095-A Each Year?

Do You Need to File Form 1095-A Each Year? Form 1095-A is a key form for individuals who purchase health insurance via the Marketplace created by the ACA, as it can be used to confirm the date of coverage, premiums paid, and any tax credits or subsidies they are eligible for. If you are eligible for a premium tax credit, Form 8962 will need to be filled out and submitted as part of your tax return. Form 1095-A should be received by mid-January of the year following your coverage year, either by mail or in your HealthCare.gov account. If you don’t receive it, contact HealthCare.gov. You don’t need to send Form 1095-A as part of your tax return, but you do need to transfer any relevant information from the form to Form 8962.

Download the official IRS Form 1095-A PDF

On the official IRS website, you will find a link to download Form 1095-A. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1095-A

Sources:

https://www.irs.gov/forms-pubs/about-form-1095-a

https://www.irs.gov/instructions/i1095a