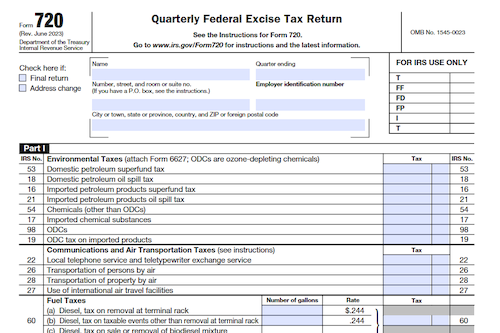

Form 720 is used by individuals liable for federal excise taxes to report quarterly obligations, who also have the option of claiming a credit via Schedule C. Those who receive a penalty notice after filing can reply with an explanation and determine reasonable-cause criteria.

What is Form 720?

Form 720 is a federal excise tax return provided by the Internal Revenue Service (IRS) used to report liability and pay any associated excise taxes owed. The form contains two parts; Part I applies to both domestic and imported items, while Part II contains taxes applicable to domestic items only. Individuals and businesses who are liable for, or responsible for collecting, any federal excise taxes listed on the form must file. These taxes must be reported for each quarter of the calendar year, beginning with the return due by April 30 and then due on July 31, October 31, and January 31 of the next year. Failure to file a timely return may result in penalties and interest being applied, as well as the trust fund recovery penalty being incurred in cases where taxes collected are not paid to the U.S. Treasury. Further guidance on filing procedure and obligations is provided in related publications 510, 509, 2005-4 (fuel tax guidance), 2005-24 (sales of gasoline on oil company credit cards), and more.

IRS Form 720 – Who Needs to Fill It Out?

IRS Form 720 should be filled out by those who were responsible for collecting any of the federal excise taxes listed on Form 720, Parts I and II, for a prior quarter or who are responsible for collecting any of the federal excise taxes listed on Form 720, Parts I and II, for the current quarter. All returns must be filed with the Department of the Treasury Internal Revenue Service Ogden, UT 84201-0009 by the due dates for each quarter, and may require additional forms or records for tax credits and refunds. Penalties and interest may apply if taxes are not paid, or to those responsible for collecting, accounting for, and paying taxes that have willfully not done so. Copies of all returns, records, and accounts should be kept for 4 years to show that the correct tax has been paid.

Step-by-Step: Form 720 Instructions For Filling Out the Document

To fill out Form 720, refer to the instructions in Internal Revenue Service (IRS) document Pub. 510, Excise Taxes. Ensure that all listed federal excise taxes (IRS Nos. 133, 20) across Parts I and II have been reported with final returns. File each quarterly return by the specified due dates using U.S. Postal Service or a designated private delivery service. For floor stocks taxes, the due date for filing is July 31 with the tax payment due June 30. To provide any amendments or adjustments, use Form 720-X. Include explanations for any penalty notices received after filing the return and refer to Notice 2005-4, Notice 2005-24, and more for fuel tax credits and refunds. Record records and accounts for 4 years to prove tax was paid and refer to IRS notices for any additional information.

Below, we present a table that will help you understand how to fill out Form 720.

| Form Name | Form 720 |

|---|---|

| Purpose | Report federal excise taxes for various categories, including fuel, air transportation, and more. |

| Filing Requirements | Refer to IRS Pub. 510 for instructions. File quarterly returns by specified due dates. Use Form 720-X for amendments or adjustments. |

| Additional Information | Keep records for 4 years to prove tax payment. Refer to IRS notices for additional information and penalties. |

Do You Need to File Form 720 Each Year?

You must file Form 720 each year if you are liable or responsible for collecting any of the federal excise taxes listed on the form for that quarter. Generally, each quarterly return must be filed by the last day of the month following the end of the quarter (April 30, July 31, October 31, or January 31). The floor stocks tax may require a return due by July 31 of each year with the taxation payment due by June 30. To help ensure that your return is timely, you can send it via the U.S. Postal Service or a designated private delivery service. Make sure to keep a copy of your return as well as all other records related to the transaction for at least four years. Any unpaid taxes or any late payments may result in a penalty, so make sure to pay on time to avoid this.

Download the official IRS Form 720 PDF

On the official IRS website, you will find a link to download Form 720. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 720

Sources: