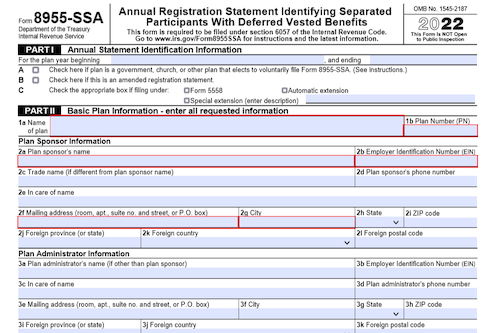

Plan administrators of plans subject to the vesting standards of section 203 of ERISA must file Form 8955-SSA, with optional, voluntary filing available for other, government, church, and other plans. The form must be filed by the last day of the seventh month following the close of the plan year, but extensions of time may be allowed under certain circumstances.

What is Form 8955-SSA?

Form 8955-SSA is used by plan administrators of plans subject to the vesting standards of section 203 of ERISA. This includes section 403(b) plans. The form must be filed no later than the last day of the seventh month following the plan year. Extensions can be obtained through filing Form 5558 or filing the same tax year as the employer. This form can be used to file corrected errors and omissions in previously filed statements, as well as to report deferred participants for prior years before 2009. Plan administrators must also report separated participants after they have completed two successive 1 year breaks in their service. Furthermore, participants do not have to be reported on Form 8955-SSA if they are paid some or all of their benefit, return to service, or forfeit all their vested benefits.

IRS Form 8955-SSA – Who Needs to Fill It Out?

The IRS Form 8955-SSA must be filled out by plan administrators of plans that are subject to the vesting standards of section 203 of ERISA. This includes the administrators of section 403(b) plans, but does not have to apply to government, church, or other plans that are exempt. Generally, the form must be filed by the last day of the seventh month following the end of the plan year, though an extension may be requested by filing Form 5558. If the employer has been granted an extension for their federal income tax return, the Form 8955-SSA may be extended to the same date by checking the “automatic extension” box. A full and complete Form 8955-SSA must be filed to correct any errors, omissions, or wrong information. For separated participants, the form should be filed no later than the plan year after their separation unless otherwise announced. Any payment of the vested retirement benefit must be reported on the Form 8955-SSA filed for the plan year following the last plan year within which the payment ceased.

Step-by-Step: Form 8955-SSA Instructions For Filling Out the Document

Plan administrators of plans subject to the vesting standards of ERISA are required to file Form 8955-SSA for their deferred vested participants. For plans not subject to section 203 of ERISA, the filing of Form 8955-SSA is voluntary. A plan administrator must file Form 8955-SSA by the last day of the seventh month following the end of the plan year (plus extensions). For any errors or omissions in a previously filed statement, a full and complete Form 8955-SSA must be filed and declared as an amended registration statement. In general, a participant must be reported on Form 8955-SSA if they separate from the plan in a given year or incur two consecutive 1-year breaks in service. There may be exceptions for annuity contracts or custodial accounts issued before January 1, 2009. There may also be special extensions due to disasters or service in a combat zone. Finally, separate employees need not be reported if they receive their deferred vested benefit, return to service, or forfeit their benefit before Form 8955-SSA is due.

Below, we present a table that will help you understand how to fill out Form 8955-SSA.

| Form 8955-SSA Filing Information | Details |

|---|---|

| Plan Administrator Requirement | Filing is required for plans subject to ERISA vesting standards. |

| Voluntary Filing | For plans not subject to ERISA section 203, filing is voluntary. |

| Filing Deadline | File by the last day of the seventh month following the plan year’s end (with extensions). |

| Amended Filing | If errors or omissions exist, a complete Form 8955-SSA must be filed as an amendment. |

| Participant Reporting | Report participants who separate from the plan or have two consecutive 1-year breaks in service. |

| Exceptions | Exceptions may apply for annuity contracts or custodial accounts issued before January 1, 2009. |

| Special Extensions | Extensions may be granted due to disasters or service in a combat zone. |

| Separate Employees | Not required to report if they receive their benefit, return to service, or forfeit the benefit before the deadline. |

Do You Need to File Form 8955-SSA Each Year?

Yes, plan administrators of plans subject to the vesting standards of section 203 of ERISA must file a Form 8955-SSA each year. Additionally, sponsors and administrators of government, church, and other plans that are not subject to the vesting standards of section 203 of ERISA may elect to file Form 8955-SSA voluntarily. Generally, if a Form 8955-SSA must be filed for a plan year, it must be filed by the last day of the seventh month following the last day of that plan year (plus extensions). An extension of time to file may be obtained by filing a Form 5558 on or before the normal due date (not including any extensions). Additionally, an automatic extension of time to file Form 8955-SSA until the due date of the federal income tax return of the employer is granted if certain conditions are satisfied. A full and complete Form 8955-SSA must be filed to correct errors and/or omissions in a previously filed statement. Lastly, Form 8955-SSA should be filed for all plan years.

Download the official IRS Form 8955-SSA PDF

On the official IRS website, you will find a link to download Form 8955-SSA. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8955-SSA

Sources: