Understand your responsibilities as an independent contractor or freelancer when filling out the IRS Form W-9. From what type of information is requested to red flags to watch out for, this article provides a comprehensive review of the W-9 form.

What is Form W-9?

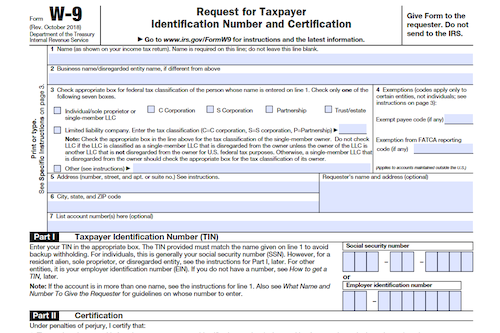

IRS Form W-9, also known as the Request for Taxpayer Identification and Certification, is required by independent contractors, self-employed workers, and consultants. It contains important information, such as the worker’s name, address, taxpayer identification number, and social security number, and is used to report income to the IRS. It is important for contractors and business owners to treat Form W-9 with caution due to the sensitive information included. Business owners must collect forms from contractors they hire while contractors must provide accurate information and use secure methods of delivery. Working with a tax professional is beneficial to both parties to ensure a smooth process and maximize deductions.

IRS Form W-9 – Who Needs to Fill It Out?

IRS Form W-9 is necessary for independent contractors, self-employed workers, and consultants. If you are hired as one of these, you may need to fill out Form W-9 to report your name, address, Taxpayer Identification Number, Social Security Number, and Employee Identification Number. You may also need to provide the name of the business or person requesting the form. If you’re an employer, it is your responsibility to collect Form W-9 from the independent contractors you have hired. Might have to be aware of potential identity theft when filling out this form. Businesses must also report these payments to the IRS on Form 1099-MISC. So, both employers and independent contractor must exercise caution when handling a W-9 form.

Step-by-Step: Form W-9 Instructions For Filling Out the Document

Form W-9 includes the worker’s name, address, Taxpayer Identification Number (TIN), Social Security Number (SSN), and Employee Identification Number (EIN). Self-employed individuals and independent contractors must submit a Form W-9 in order to meet their tax obligations to the IRS. When filling out Form W-9, it’s important to follow all the instructions carefully. These instructions will guide you step-by-step in providing the necessary information such as your name, street address, TIN/SSN, and exemptions. After that, answer the questions in Part I and II of the form before certifying your information. Make sure to deliver your W-9 via a secure method, such as mail, hand delivery, or encrypted email attachment. If you don’t recognize the source, double check who sent it before filling it out. Remember to exercise caution when filling out and handling Form W-9, as it contains sensitive information that can be used for identity theft. If you have any questions or concerns, consider hiring a tax professional for help.

Below, we present a table that will help you understand how to fill out Form W-9.

| Information Required for Form W-9 | Details |

|---|---|

| Name | Worker’s full name |

| Address | Current street address |

| Taxpayer Identification Number (TIN) | Unique identification number |

| Social Security Number (SSN) | Individual’s Social Security Number |

| Employee Identification Number (EIN) | Employer’s unique identification number |

| Form Submission | Submit Form W-9 to fulfill tax obligations |

| Instructions | Follow instructions for accurate completion |

| Part I and II | Answer questions in both sections |

| Delivery Method | Submit securely via mail, hand delivery, or encrypted email attachment |

| Identity Verification | Double-check the source before filling out the form |

| Caution | Exercise caution due to sensitive information |

| Professional Help | Consider hiring a tax professional if needed |

Do You Need to File Form W-9 Each Year?

Form W-9, also known as the Request for Taxpayer Identification and Certification, is generally filled out by independent contractors, self-employed workers, and consultants each year. It is used to ensure that the business that hires them can accurately report their earnings to the IRS on Form 1099-MISC. Companies typically need to request Form W-9 from workers they hire, and individuals must provide their name, address, tax identification number, and Social Security number/Employee Identification number. It’s important for both employers and independent contractors to take extra precaution when handling Form W-9, as it contains sensitive information which may be vulnerable to identity theft. If you’re an employer, ensure this information is stored safely. If you’re a contractor, double-check that you recognize the source of the form. Tax professionals from Community Tax can assist in helping you fill out the form correctly and safely.

Download the official IRS Form W-9 PDF

On the official IRS website, you will find a link to download Form W-9: Purpose, What You Need & Other Information. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form W-9

Sources:

https://www.irs.gov/forms-pubs/about-form-w-9

https://www.irs.gov/instructions/iw9