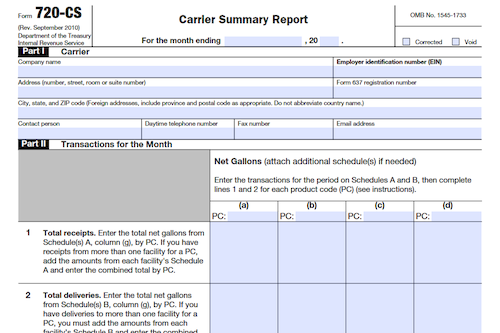

Bulk transport carriers must file Form 720-CS with the IRS to report monthly receipts and disbursements of liquid products at a designated storage location. Filing rules and requirements are outlined in this article.

What is Form 720-CS?

Form 720-CS is a required form to be filed monthly by bulk transport carriers. It is used to report the receipts and disbursements of liquid products at a storage location designated by a Facility Control Number (FCN). It is due the last day of the month following when the transaction has occurred. If the due date falls on the weekend or a legal holiday, you can file your return on the next business day. If you make an error, you can file a corrected return. Make sure to keep a copy of your return on file for at least 3 years in case you need to reconstruct them. Failure to file on time may incur a penalty, unless you can show reasonable cause. Use Private Delivery Services or the US Postal Service to mail your return and make sure to follow the instructions and not staple, tear, or tape any of the forms.

IRS Form 720-CS – Who Needs to Fill It Out?

The IRS Form 720-CS must be filled out by bulk transport carriers (barges, ships, and pipelines) that receive or deliver reportable liquid products in or out of storage at a terminal or any other location designated by an FCN. The form must be submitted monthly to the IRS, with the report due the last day of the month following the month in which the transaction occurs. If the due date falls on a weekend or holiday, it can be filed on the next business day. Additional forms and instructions can be found in Pub. 1167 and Pub. 3536. Extensions may be granted if requested in writing and corrections may be made if necessary. Records must be kept for 3 years. Penalties may apply for not filing correctly.

Step-by-Step: Form 720-CS Instructions For Filling Out the Document

Filing Form 720-CS is a requirement for bulk transport carriers who receive or deliver reportable liquid products in or out of storage at a designated facility control number (FCN). It must be filed monthly and is due the last day of the following month of the transaction. The form should be sent by mail or through a designated private delivery service with the “timely mailing as timely filing/paying” rule in mind. Forms should be submitted in flat mailings with 10-pitch or 12-pitch type, with input in the middle of the boxes, and no entries in data entry boxes where none is required. Extensions of time and instructions for correcting previously filed returns are available through the IRS. It is also important to keep a copy of the form for three years to be available for IRS inspection. Penalties apply if the form is not filed correctly and timely.

Below, we present a table that will help you understand how to fill out Form 720-CS.

| Form Name | Form 720-CS |

|---|---|

| Purpose | File monthly for bulk transport carriers handling reportable liquid products in or out of storage at a designated facility control number (FCN). |

| Filing Requirements | File monthly by the last day of the following month of the transaction. File using a designated private delivery service. Keep a copy for three years. |

| Additional Information | Ensure proper filing and timely submission to avoid penalties. Follow IRS instructions for corrections and extensions. |

Do You Need to File Form 720-CS Each Year?

Bulk transport carriers, such as barges, ships, and pipelines, must file Form 720-CS each month to report the receipts and disbursements of all liquid products at a designated storage facility. The report is due the last day of the month following the month in which the transaction occurs, however, this due date may be extended if requested within the given timeframe. Private delivery services, as well as the U.S. Postal Service, are accepted for submitting the form, as outlined in the instructions on the form. Failure to submit a correct and timely Form 720-CS will result in a penalty, so ensuring accurate and proper filing is essential.

Download the official IRS Form 720-CS PDF

On the official IRS website, you will find a link to download Form 720-CS. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: this link to download the official Form 720-CS