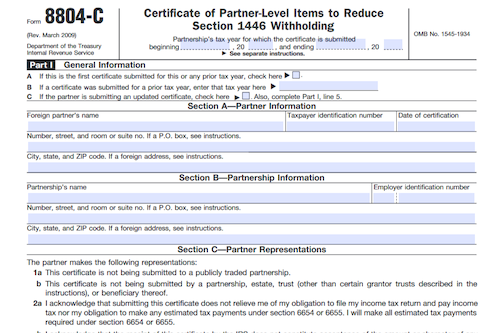

Form 8804-C is used by a foreign partner to provide a certification to a partnership under Regulations section 1.1446-6 to reduce or eliminate the 1446 tax obligation on the partner’s allocable share of income. The partnership may consider the Form 8804-C to reduce or eliminate the withheld and paid 1446 tax with respect to the foreign partner.

What is Form 8804-C?

Form 8804-C is used by a foreign partner to provide a certification to a partnership under Regulations section 1.1446-6. This form can be used to reduce or eliminate the partnership’s withholding tax obligation with respect to the foreign partner’s share of effectively connected taxable income (ECTI). With this form, the foreign partner can certify to the partnership that it has partner-level deductions and losses that will reduce or eliminate the 1446 tax, or that its investment in the partnership is its only activity that will give rise to ECTI. Each foreign partner must submit a separate Form 8804-C, and a partnership that receives a Form 8804-C must attach a copy of it to its Form 8813 for the first installment, or a statement for subsequent installments certifying deductions and losses for the partner. Failure to provide accurate information or comply with filing requirements may result in the IRS rejecting the Form 8804-C.

IRS Form 8804-C – Who Needs to Fill It Out?

Foreign partners who choose to make use of the Regulations section 1.1446-6 provisions for reducing or eliminating the partnership’s withholding tax obligation for their share of effectively connected taxable income must complete Form 8804-C. This form certifies partner-level deductions and losses to the partnership, or that the partner’s investment in the partnership is the only activity that gives rise to effectively connected income, gain, loss, or deduction. Partnerships that receive Form 8804-C from foreign partners may consider them in calculating, paying, and reporting the 1446 tax due on the foreign partner’s allocable share of ECTI. Each partner must submit their own Form 8804-C for each tax year, and the partnership must submit a copy of the Form 8804-C to the IRS when applicable. Special tiered partnership rules apply to upper-tier partnerships with direct or indirect foreign partners. All necessary documentation should be sent to the IRS to ensure compliance with every requirement.

Step-by-Step: Form 8804-C Instructions For Filling Out the Document

Form 8804-C must be filled out and submitted by the foreign partner to the partnership in order to certify that the partner has certain deductions and losses or is their only activity giving rise to effectively connected taxable income, in order to reduce or eliminate the 1446 tax on the partner’s allocable share. The foreign partner should submit a separate Form 8804-C for each tax year in which they claim the provisions. The partnership is able to consider the Form 8804-C in calculating, paying, and reporting the due 1446 tax. The partnership must attach a copy of the Form 8804-C to the Form 8813 for the first installment period the Form 8804-C is considered, or a statement with the foreign partner’s name, taxpayer ID, and any amounts certified due, as well as to the Form 8805 when filing for the year. The partnership must also attach a computation of the 1446 tax due to each form for any period the Form 8804-C is considered. Don’t forget to sign and date Part IV, and attach a copy of the power of attorney if applicable! Tiered partnership rules also apply – see the source text for more information.

Below, we present a table that will help you understand how to fill out Form 8804-C.

| Form Name | Form 8804-C |

|---|---|

| Purpose | Fill out and submit to certify deductions and losses, reducing or eliminating the 1446 tax on the partner’s allocable share. |

| Filing Requirements | Submit a separate form for each tax year claiming provisions. Attach to Form 8813 and Form 8805 when filing. Include computation of 1446 tax due. |

| Additional Information | Follow tiered partnership rules and include necessary documentation. Sign and date Part IV. Attach power of attorney if applicable. |

Do You Need to File Form 8804-C Each Year?

Each foreign partner who wishes to reduce or eliminate the 1446 tax the partnership must withhold and pay on ECTI allocable to them should submit a separate Form 8804-C to the partnership each year. Partnerships that receive a form from a foreign partner have the option to consider it when calculating the 1446 tax due with respect to that partner. However, each installment period for which the form is considered, requires a copy of the form to be submitted with Forms 8813, 8805, and Partnership Withholding Tax Payment Voucher (Section 1446). As such, it is highly recommended that foreign partners submit a new Form 8804-C each year to ensure that their investment in the partnership can be taken into account when calculating the 1446 tax due.

Download the official IRS Form 8804-C PDF

On the official IRS website, you will find a link to download Form 8804-C. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8804-C

Sources: