Ever wondered what forms to use to report and pay withholding tax under section 1446? This article will cover General Instructions, Purpose of Forms, Taxpayer Identification Numbers (TINs), Applying for an EIN, Who Must File, Who Must Sign Form 8804, Paid Preparers, and When to File Forms 8804, 8805, and 8813.

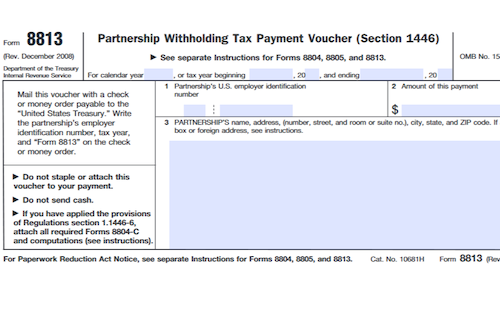

What is Form 8813?

Form 8804, 8805, and 8813 are used to pay and report section 1446 withholding tax based on ECTI income allocated to foreign partners. Form 8804 is used to report the total liability of the partnership for the year, while Form 8805 details the ECTI and total tax credit allocated to foreign partners and must be filed separately for each partner. The foreign partner must attach Form 8805 to their U.S. income tax return to claim a credit for their share of the Section 1446 withholding tax. Form 8813 must accompany each payment of section 1446 tax from the partnership. A U.S. TIN or EIN must be provided for each foreign partner, while Form W-7 should be completed if the partner doesn’t have an SSN. Form 8804 and 8805 must be filed on or before the 15th day of the 3rd and 6th months respectively, while Form 8813 must be filed on or before the 15th day of the 4th, 6th, 9th, and 12th months of the partnership’s tax year. An extension of time can be requested with Form 7004.

IRS Form 8813 – Who Needs to Fill It Out?

IRS Form 8804, 8805, and 8813, need to be filled out by partnerships with effectively connected taxable income (ECTI) allocable to foreign partners, to pay and report section 1446 withholding tax. The partnership must file one Form 8804 to report the total liability for the year, along with one Form 8805 for each foreign partner, which should be attached to Form 8804. Form 8805 is used by foreign partners to claim a withholding credit, and Foreign trusts and estates must complete Schedule T of Form 8805 to report withholding tax to the beneficiaries. Whenever a foreign partner is paying section 1446 withholding tax, Form 8813 must accompany each payment. To ensure proper crediting, tax identification numbers (TINs) need to be provided for each foreign partner. To apply for an EIN for a partner, visit IRS.gov/EIN or call 267-941-1099 (toll call). Forms 8804, 8805, and 8813 must be filed on or before certain dates that differ depending on the form; requesting an extension can be done through Form 7004.

Step-by-Step: Form 8813 Instructions For Filling Out the Document

Forms 8804, 8805 and 8813 must be used to pay and report section 1446 withholding tax based on effectively connected taxable income allocated to foreign partners. Form 8804 is to report the total tax liability and serve as a transmittal form for Form 8805. Form 8805 must be filled out for each foreign partner and attached to copy A of Form 8804 when filing with the IRS. Form 8805 is used for the foreign partner to claim withholding credit from the partnership for their income tax return. Form 8805 can also be completed by foreign trusts or estates; a separate Schedule T of the form must be completed for beneficiaries to claim withholding tax credit. Lastly, Form 8813 accompanies each payment of section 1446 tax made throughout their tax year. Foreign partners must provide a U.S. Taxpayer Identification Number (TIN) to ensure proper crediting of withholding tax reported to the IRS; if needed, they can apply for one using Form W-7. Forms 8804 and 8805 must be filed on or before the 15th day of the 3rd month following the close of the partnership’s tax year, while Form 8813 must be filed on or before the 15th day of the 4th, 6th, 9th and 12th months of the tax year. An extension can be requested by filing Form 7004 if needed.

Below, we present a table that will help you understand how to fill out Form 8813.

| Instructions for Forms 8804, 8805, and 8813 | Details |

|---|---|

| Form purposes | Used to pay and report section 1446 withholding tax based on effectively connected taxable income allocated to foreign partners |

| Form 8804 | Report total tax liability and serve as a transmittal for Form 8805 |

| Form 8805 | Filed for each foreign partner to claim withholding credit |

| Form 8813 | Accompanies each payment of section 1446 tax |

| U.S. Taxpayer Identification Number (TIN) | Required for proper crediting of withholding tax |

| Filing deadlines | Forms 8804 and 8805 by the 15th day of the 3rd month following the close of the partnership’s tax year; Form 8813 on or before the 15th day of the 4th, 6th, 9th, and 12th months |

| Extension | Request an extension using Form 7004 if needed |

Do You Need to File Form 8813 Each Year?

Every partnership (other than a publicly traded partnership) that has effectively connected gross income allocable to a foreign partner must file Form 8804, even if there is no withholding tax liability under section 1446. Form 8805 should also be filed for each partner on whose behalf the partnership paid section 1446 tax, regardless of whether distributions were made during the tax year. Generally, these forms should be filed on or before the 15th day of the 3rd month following the partnership’s tax year, or the 15th day of the 6th month if keeping records/books of account outside the U.S. and Puerto Rico. If a due date falls on a weekend or holiday, file by the next business day. Additionally, Form 8813 should be filed on or before the 15th day of the 4th, 6th, 9th, and 12th months of the partnership’s tax year for U.S. income tax purposes.

Download the official IRS Form 8813 PDF

On the official IRS website, you will find a link to download Form 8813. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8813

Sources: