Applying for an Individual Taxpayer Identification Number (ITIN) can be necessary for non-U.S. citizens or unauthorized residents who can’t otherwise get a Social Security Number. Learn more about the process, including obtaining an IRS Form W-7, consulting with an Acceptance Agent, and preparing the right documents to apply for an ITIN.

What is Form W-7?

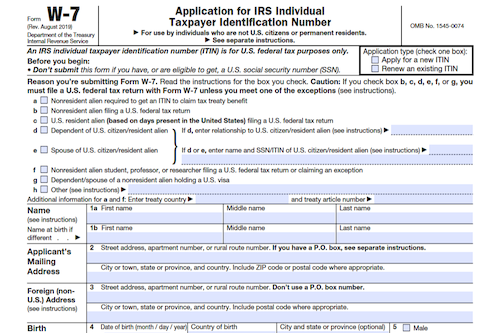

IRS Form W7 is a necessary application that must be completed in order to obtain an Individual Taxpayer Identification Number, or ITIN. This nine-digit number is issued by the IRS to individuals who are not eligible for a Social Security Number, but are required to file taxes in the United States. The application process requires obtaining an original, valid document that proves identity and foreign status, such as a passport or foreign driver’s license. The form must be filled out, along with additional paperwork such as a certificate of accuracy, and submitted to the IRS either by mail or through an authorized acceptance agent. Once approved, an ITIN allows individuals to participate in tax-related activities, such as filing taxes and opening a bank account, despite their inability to obtain a Social Security Number.

IRS Form W-7 – Who Needs to Fill It Out?

IRS Form W7 is required to obtain an Individual Taxpayer Identification Number (ITIN). This form can be used by immigrants, unauthorized residents, dependents, or spouses of US citizens and residents who are ineligible for a Social Security Number. An authorized acceptance agent must be consulted and the form must be accompanied by documents that both verify identity and foreign status. The four ways to submit the form and paperwork are by mail, through a private delivery service, in person, or through an acceptance agent. The IRS will notify applicants of their ITIN application status up to seven weeks after submission, or 9-11 weeks if applying from overseas. An ITIN can open bank accounts, secure driver’s licenses in some states, and provide proof of residency, but does not provide legal immigration status or work authorization.

Step-by-Step: Form W-7 Instructions For Filling Out the Document

Applying for an ITIN is a straightforward process and the IRS Form W7 is the document to complete. Consult with an authorized acceptance agent to assist in filling out the W7. An AA or CAA can review your form, authenticate documents, and submit them to the IRS, in addition to providing expert advice. After completing and gathering the form, tax return, and supporting documents, they can be sent by mail, used a private delivery service, apply in person at a designated IRS Taxpayer Assistance Center, or submit through an acceptance agent. It can take up to seven weeks for the IRS to notify you of your status, during which you may call the IRS at 800-829-1040 for updates. An ITIN serves only tax-related purposes and does not provide work authorization or legal immigration status. You may be eligible for the Child Tax Credit (CTC) and use your ITIN to open an interest-bearing bank account or provide proof of residency. Consult a tax advocate for assistance with filing your own tax return.

Below, we present a table that will help you understand how to fill out Form W-7.

| Information Required for ITIN Application | Details |

|---|---|

| IRS Form | Form W7 |

| Consultation | Consult with an authorized acceptance agent |

| Form Review | Review of your form by AA or CAA |

| Document Authentication | Authentication of supporting documents |

| Submission | Submission to the IRS |

| Submission Methods | Mailed, private delivery service, in-person, or through an acceptance agent |

| Processing Time | Up to seven weeks for IRS notification |

| IRS Contact | Call the IRS at 800-829-1040 for updates |

| ITIN Purpose | Tax-related purposes only, no work authorization or legal immigration status |

| Additional Benefits | Eligibility for Child Tax Credit (CTC), opening an interest-bearing bank account, proof of residency |

| Tax Advocate | Consult a tax advocate for assistance with tax return filing |

Do You Need to File Form W-7 Each Year?

While ITINs remain valid for multiple years, tax obligations require annual filing, and submitting an IRS Form W7 each year may become necessary. You have the option to personally apply for an ITIN using Form W7, but it is advisable to seek guidance from an “authorized acceptance agent” approved by the IRS. To initiate this process, you must furnish documentation verifying your identity and foreign status, in addition to the required tax return. Once your application is submitted, you should anticipate receiving your ITIN number within seven weeks, although during peak periods in January and April, this duration may extend to two months. While an ITIN permits you to file taxes annually, it cannot be utilized for immigration enforcement purposes and does not make you eligible for certain US benefits.

Download the official IRS Form W-7 PDF

On the official IRS website, you will find a link to download IRS Form W7: Applying for Individual Taxpayer Identification Number. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form W7

Sources:

https://www.irs.gov/forms-pubs/about-form-w-7

https://www.irs.gov/instructions/iw7