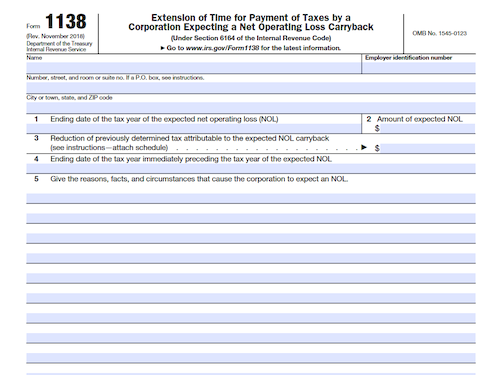

Corporations expecting a Net Operating Loss (NOL) carryback can reduce the amount due for the prior year’s tax with Form 1138: an Extension of Time for Payment of Taxes. This article examines the process for filing Form 1138, limitations of the extension, and IRS examination of the statement.

What is Form 1138?

Form 1138 is an application designed to extend the time for a corporation to pay taxes that have been reduced by an expected Net Operating Loss (NOL) Carryback. The statement must detail the tax year, carryback amounts and estimated NOL, as well as the amount of previously determined tax that will be reduced. If accepted, the extension will last until the due date for the NOL-generating return, at which time the corporation must file Form 1139 for a tentative refund. Furthermore, the IRS may limit, condition, or terminate the extension as it sees fit. Upon submitting and acceptance of Form 1138, the corporation can benefit from a reprieve in the payment of reduced taxes, but for any amount not covered by the application, the original due date will still apply.

H2-2 IRS Form 1138 – Who Needs to Fill It Out?

Companies that expect to have a Net Operating Loss Carryback (NOL) must fill out the IRS Form 1138 Extension of Time for Payment of Taxes by a Corporation Expecting a Net Operating Loss Carryback. This form must be filed within the year of the expected NOL, and include information such as the amount of the NOL, the reasons why it is expected, and the amount of the expected carryback. The amount of the extension can be subject to two limits – the amount of the taxes from the previous return and the amount of the NOL deduction. Companies who obtain an extension to pay their taxes must also keep track of deadlines such as the time to file Form 1139 or the extension may expire. The IRS can also examine the statement and decide to terminate it if they deem it unreasonable or erroneous.

Step-by-Step: Form 1138 Instructions For Filling Out the Document

Filing Form 1138 is the first step in applying for an extension of time for payment of taxes, when a corporation expects a Net Operating Loss Carryback. This form requires the corporation to set forth information like the tax year of the NOL, an estimated amount, the reasons for the NOL, and a breakdown of the taxes deferred and those not affected by the carryback. There are also two limitations placed on the amount that can be deferred; this amount cannot exceed the previously determined tax, nor the amount of the estimated carryback refund. If the corporation’s estimate of the NOL changes over the course of the year, they may file a revised Form 1138. The IRS can examine Form 1138 and terminate the extension if any part of the statement is specifcally erroneous. As mentioned, any estimated taxes must also be paid on notice and demand.

Below, we present a table that will help you understand how to fill out Form 1138.

| Information Required for Form 1138 | Details |

|---|---|

| Extension Request | Requesting an extension for payment of taxes due to Net Operating Loss Carryback |

| Limitations | Understanding limitations on the amount that can be deferred |

Do You Need to File Form 1138 Each Year?

Form 1138 is a statement required of corporations expecting a net operating loss carryback. It must be filed within the year that the NOL is expected, setting out information such as the tax year, estimated NOL amount, reasons, facts, and circumstances for expecting an NOL, and more. The extension may last until the last day of the month in which the return for the year the NOL arose is due, or until the IRS mails a notice allowing or disallowing it. If the estimated NOL amount changes, a revised statement may be filed. Finally, the IRS may terminate the extension for any part of the tax it determines to be false or unreasonable, in which case the tax must be paid when due.

Download the official IRS Form 1138 PDF

On the official IRS website, you will find a link to download Form 1138. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1138

Sources: