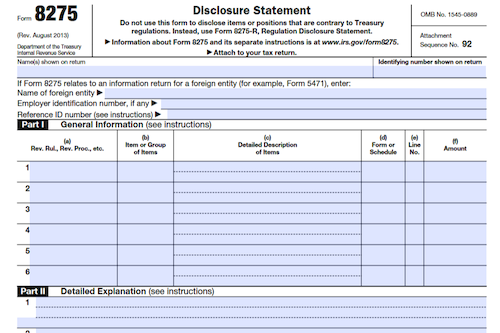

Form 8275 is used to disclose items or positions on a tax return to avoid certain penalties, including the accuracy-related penalty due to disregarding of rules, the economic substance penalty, and the preparer penalties for tax understatements.

What is Form 8275?

Form 8275 is an IRS filing used to disclose items or positions not adequately disclosed on a tax return to avoid certain penalties. It allows taxpayers and tax return preparers to reduce the portions of the accuracy-related penalty due to disregard of rules or to a substantial understatement of income tax, as long as the position has a reasonable basis and is disclosed correctly. The form is filed by individuals, corporations, pass-through entities, and tax return preparers, and should be accompanied by documented proof of reasonable basis in order to reduce these penalties.

IRS Form 8275 – Who Needs to Fill It Out?

IRS Form 8275 is used by taxpayers and tax return preparers to disclose items and positions that cannot be adequately shown on a tax return to avoid certain penalties. Items that can be disclosed include the disregard of rules or a substantial understatement of income tax for non-tax shelter items if the return has a reasonable basis. Individuals, corporations, pass-through entities, and tax return preparers must file Form 8275 or Form 8275-R (if contrary to a regulation) with their return or amended return to avoid the penalties. For items reported by a pass-through entity, disclosure should be made on the entity’s return or Form 8275. Guidance is published in a revenue procedure to identify circumstances when an item does not need to be disclosed. There are exceptions to filing Form 8275, such as reasonable cause or if there is adequate disclosure.

Step-by-Step: Form 8275 Instructions For Filling Out the Document

Filing Form 8275 is a crucial step to avoid penalties as it allows taxpayers and tax return preparers to disclose the positions not adequately disclosed on the return. Position taken contrary to a regulation must use Form 8275-R instead as it provides adequate disclosure for items attributable to a pass-through entity. There is also an annual guidance that identifies the circumstances when the items on the return are considered adequate disclosure. The accuracy-related penalty varies depending on the underpayment and the lack of economic substance. Reasonable cause and good faith exceptions apply, and reduction of understatement can be made if the item has substantial authority or is adequately disclosed. Lastly, preparers should note the penalty imposed for taking an unreasonable position or position with no reasonable basis.

Below, we present a table that will help you understand how to fill out Form 8275.

| Key Information for Form 8275 | Details |

|---|---|

| Disclosure Requirement | For positions contrary to regulations; Form 8275-R for pass-through entities |

| Accuracy-Related Penalty | Varies based on underpayment and lack of economic substance |

| Exceptions | Reasonable cause, good faith, substantial authority, adequate disclosure |

| Penalties | Imposed for unreasonable positions |

Do You Need to File Form 8275 Each Year?

Form 8275 is used to disclose tax positions, except those taken contrary to a regulation, in order to avoid penalties. Those filing this form are individuals, corporations, pass-through entities, and tax return preparers. Unless otherwise specified in a revenue procedure published annually in the Internal Revenue Bulletin, Form 8275 needs to be filed for each occurrence of an item or position. To satisfy the disclosure requirements, use Form 8275 to disclose sufficient facts about the position being taken. This avoids penalties for negligence, disregard of regulations, understatement of income tax for non-tax shelter items, valuation misstatements, overstatement of pension liabilities, and certain foreign financial asset understatement.

Download the official IRS Form 8275 PDF

On the official IRS website, you will find a link to download Form 8275. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8275

Sources: