In this article, we explore like-kind exchanges and special rules for capital gains invested in Qualified Opportunity Funds (QOFs). Discover the eligibility of certain government officials for a section 1031 exchange, the qualifications of a QI exchange, and the definition of real and intangible property under section 1031.

What is Form 8824?

Form 8824 is an IRS filing that must be completed to report the exchange of real business or investment property for real property of the same kind. This form allows taxpayers to report any gain they are deferring as a result of the exchange and provides them with the proper basis for both the property they are exchanging and the property they are receiving. It also includes special rules for capital gains invested in Qualified Opportunity Funds, exchanges limited to real property, and exchanges involving a qualified intermediary.

IRS Form 8824 – Who Needs to Fill It Out?

Those that have exchanged business or investment real property for other real property of a like kind must fill out Form 8824 in order to figure the amount of gain deferred as a result of the exchange. This includes certain members of the executive branch of the federal government and judicial officers of the federal government. Moreover, a Form 8824 must also be filled out for the two years following the year of a related party exchange. Qualified investment in a Qualified Opportunity Fund must also otherwise be reported along with Form 8997. It must be filed with the current year’s return, or with the two years following the year of a related party exchange.

Step-by-Step: Form 8824 Instructions For Filling Out the Document

Filing Form 8824 is essential to properly report and properly defer any gains from like-kind exchanges of business or investment real property. This document outlines the steps for correctly filing the form, including the restrictions and special rules involved for capital gains invested in Qualified Opportunity Funds and exchanges limited to real property. It also outlines the definitions of real property and like-kind property, including special rules for intangible assets and for multi-asset exchanges. In the event of a deferred exchange, it is important to be aware of the timing requirements and proper use of a Qualified Intermediary. Additionally, personal property that is incidental to the real property received may be disregarded in determining whether the benefits of the exchange are limited.

Below, we present a table that will help you understand how to fill out Form 8824.

| Form 8824 | Instructions |

|---|---|

| Filing Form 8824 is essential to properly report and properly defer any gains from like-kind exchanges of business or investment real property. This document outlines the steps for correctly filing the form, including the restrictions and special rules involved for capital gains invested in Qualified Opportunity Funds and exchanges limited to real property. It also outlines the definitions of real property and like-kind property, including special rules for intangible assets and for multi-asset exchanges. In the event of a deferred exchange, it is important to be aware of the timing requirements and proper use of a Qualified Intermediary. Additionally, personal property that is incidental to the real property received may be disregarded in determining whether the benefits of the exchange are limited. |

|

Do You Need to File Form 8824 Each Year?

Yes, if during the tax year you transferred property to another party in a like-kind exchange, you must file Form 8824 with your tax return for that year. You must also file Form 8824 for the two years following the year of the related party exchange. If you make multiple like-kind exchanges, you can file a summary on one Form 8824 with your own detailed statement. Additionally, exchanges made using a Qualified Exchange Accommodation Arrangement may need to be filed using Form 8824.

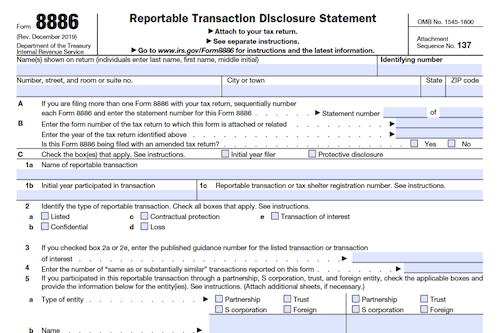

Download the official IRS Form 8824 PDF

On the official IRS website, you will find a link to download Form 8824. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8824

Sources: