Tax-exempt entities may be required to file Form 8886-T to disclose certain information related to prohibited tax shelter transactions, as well as potentially face penalties for failure to comply. This article explains the filing requirements and potential penalties for tax-exempt entities.

What is Form 8886-T?

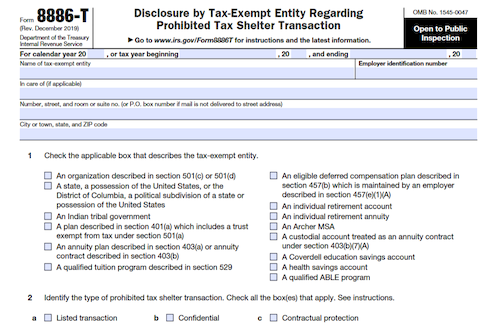

Form 8886-T is a filing required for certain tax-exempt entities to disclose information with respect to any prohibited tax shelter transaction to which they are a party. A tax-exempt entity is a party if it facilitates the transaction or is identified in published guidance, by type, class, or role, as a party to the transaction. Examples of tax-exempt entities include organizations described in section 501(c) or 501(d) and qualified tuition programs described in section 529. Form 8886-T must be filed for each prohibited tax shelter transaction, and a separate penalty is assessed for each failure to timely file. A completed Form 8886-T is available for public inspection as required under section 6104.

IRS Form 8886-T – Who Needs to Fill It Out?

IRS Form 8886-T needs to be filed by certain tax-exempt entities, such as organizations described in section 501(c) or 501(d) and plans described in section 401(a), that are parties to a prohibited tax shelter transaction. A tax-exempt entity that facilitates the transaction by reason of its tax-exempt, tax indifferent, or tax-favored status needs to file the form on or before May 15 of the year following the transaction. An entity manager needs to file the form for plan entities. Not filing this form or incomplete information may lead to monetary penalties for the tax-exempt entity or entity manager.

Step-by-Step: Form 8886-T Instructions For Filling Out the Document

This form is required for certain tax-exempt entities who are parties to a prohibited tax shelter transaction. Different filing requirements apply based on whether the purpose of the transaction is to reduce federal tax liability or facilitate due to its tax-exempt, tax indifferent, or tax-favored status. Records need to be kept and filed by May 15 of the following year. Penalties may be assessed for failure to disclose information or by inclusion of “Information provided upon request” statements. Form 8886-T is also publicly inspectable in accordance to section 6104.

Below, we present a table that will help you understand how to fill out Form 8886-T.

| Information Required for Form 8886-T | Details |

|---|---|

| Purpose | Required for certain tax-exempt entities in prohibited tax shelter transactions |

| Filing Requirements | File based on the purpose of the transaction and keep records |

| Deadlines | File by May 15 of the following year |

| Penalties | Penalties for failure to disclose information or inclusion of specific statements |

Do You Need to File Form 8886-T Each Year?

A separate Form 8886-T must be filed for each prohibited tax shelter transaction. A single disclosure is required for each prohibited tax shelter transaction, and a penalty is assessed if the form is not timely filed in accordance with the instructions and Regulations section 1.6033-5. The due date for filing Form 8886-T depends on if the tax-exempt entity is reducing its own federal tax liability or if it is facilitating the transaction by its tax-exempt status. Form 8886-T must be kept and is available for public inspection.

Download the official IRS Form 8886-T PDF

On the official IRS website, you will find a link to download Form 8886-T. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8886-T

Sources: