Individuals subject to self-employment tax on the net earnings from their ministerial services must complete and sign Form 4361 to apply for exemption. The form must be filed with the IRS within two years of the date the individual first became subject to tax.

What is Form 4361?

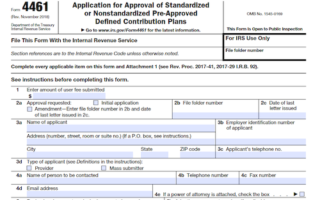

Form 4361 is used by ministers, members of religious orders, and Christian Science Practitioners to apply for exemption from self-employment tax on the net earnings from their ministerial services. The form must be completed, signed, and filed with the IRS within two years of the date the individual first became subject to self-employment tax. This package contains Form 4361 and the instructions necessary to help individuals submit their application for exemption.

IRS Form 4361 – Who Needs to Fill It Out?

Individuals who want to be exempt from self-employment tax on the net earnings from their ministerial services must fill out and submit Form 4361 to the IRS within two years of initially becoming subject to it. This form is part of the package, which contains information and instructions for the application of exemption.

Step-by-Step: Form 4361 Instructions For Filling Out the Document

Form 4361 must be signed and submitted by the individual applying for exemption from self-employment tax on the net earnings from their ministerial services. Before submitting it to the IRS, the form must be filled out completely and accurately. It is important to understand the purpose of the form, which is to apply for exemption, as well as the package contents, which include Form 4361, Application for Exemption from Self-Employment Tax for Use by Ministers, Members of Religious Orders and Christian Science Practitioners. Once completed, the form must be filed with the IRS within two years of the individual first becoming subject to self-employment tax.

Below, we present a table that will help you understand how to fill out Form 4361.

| Information Required for Form 4361 | Details |

|---|---|

| Filing Deadline | Within two years of becoming subject to self-employment tax |

| Completeness | Fill out the form completely and accurately |

| Purpose | Apply for exemption from self-employment tax |

| Package Contents | Form 4361 and necessary documentation |

| Filing Location | File with the IRS |

Do You Need to File Form 4361 Each Year?

No, Form 4361 does not need to be filed each year. The form must only be filed with the IRS within two years of the date the individual first became subject to self-employment tax on the net earnings from their ministerial services. The individual must complete and sign the form in order to apply for an exemption from the self-employment tax on the net earnings from their ministerial services.

Download the official IRS Form 4361 PDF

On the official IRS website, you will find a link to download Form 4361. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 4361

Sources: