If you are a U.S. citizen or resident alien and have income from sources in the U.S. Virgin Islands or from income effectively connected with the conduct of a trade or business in the U.S. Virgin Islands, you may owe taxes to both the United States and the USVI. Learn how to file Form 8689 and the penalties associated with its failure to complete.

What is Form 8689?

Form 8689 is a form used by U.S. citizens and resident aliens (other than bona fide residents of the USVI) with income from sources in the USVI or income connected to a trade or business in the USVI to figure how much USVI tax is due – a percentage of their federal income tax liability. The rules for determining the source of income are explained in sections 861 through 865 and 937, Regulations section 1.937-2, and chapter 2 of Pub. 570. Military spouses, those with de minimis exception income, and those with interest or dividends are all subject to different rules as stated in Pub. 570. If filing jointly, Form 8689 should be included unless both spouses are bona fide residents of the USVI. Form 8689 should be returned to the Department of the Treasury if not enclosing a check or money order, or to Internal Revenue Service if including a check or money order. A signed copy should be returned to the Virgin Islands Bureau of Internal Revenue. Penalties may apply should the required information not be provided.

IRS Form 8689 – Who Needs to Fill It Out?

IRS Form 8689 must be completed by any U.S. citizen or resident alien (other than a USVI bona fide resident) with income from sources in the USVI or income connected to a trade or business in the USVI. Joint returns require the individual whose adjusted gross income (AGI) is higher to fill out the form, unless they are a USVI bona fide resident for the entire tax year. Forms and instructions must be submitted to the Internal Revenue Service in Austin, TX or Charlotte, NC (with a check or money order included) and, separately, to the Virgin Islands Bureau of Internal Revenue in St. Thomas, VI. Information on determining the source of income, such as wages and interest income, is provided in the form’s instructions; failure to provide information may result in a penalty.

Step-by-Step: Form 8689 Instructions For Filling Out the Document

If you were a U.S. citizen or resident alien (other than a bona fide resident of the USVI) with income from sources in the USVI or income effectively connected with the conduct of a trade or business in the USVI, you may be liable for USVI tax. Form 8689 is used to file income tax returns to both the United States and the USVI. File the return with the Department of the Treasury for the United States, and with the Virgin Islands Bureau of Internal Revenue for the USVI – make sure to include a signed copy of the return with all attachments and forms. When filing, be sure to also check for any applicable exceptions or adjustments to the source of income from the USVI, such as de minimis exception and the Military Spouses Residency Relief Act. Lastly, check the Instructions for Form 8898 for any penalty related to failure to provide information.

Below, we present a table that will help you understand how to fill out Form 8689.

| Information Required for Form 8689 | Details |

|---|---|

| Steps to Complete Form 8689 |

|

| Special Considerations |

|

Do You Need to File Form 8689 Each Year?

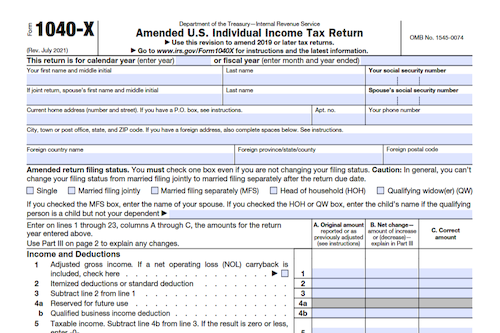

If you were a U.S. citizen or resident alien (other than a bona fide resident of the USVI) and had income from sources in the USVI or income effectively connected with the conduct of a trade or business in the USVI, you may owe tax to the USVI. You must file identical tax returns with the United States and the USVI, and you must submit a copy of your tax return (complete with all attachments, such as Form 8689) to the Virgin Islands Bureau of Internal Revenue. Amended returns may be filed electronically with tax filing software or in a paper Form 1040-X. Further information can be found in Pub. 570 and How To Get Tax Help in the Instructions for Form 1040.

Download the official IRS Form 8689 PDF

On the official IRS website, you will find a link to download Form 8689. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8689

Sources: