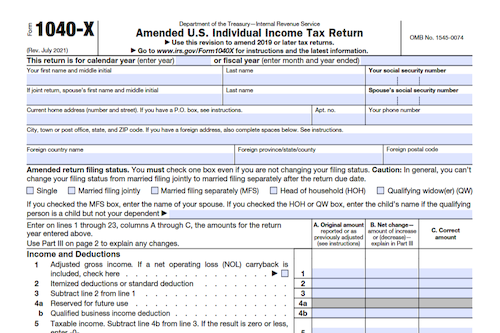

Filing an amended tax return with Form 1040-X is used by taxpayers to correct errors made on previously filed federal tax returns. Common corrections on 1040-X forms include filing status, number of dependents, and omitted deductions and credits. The time period for filing a Form 1040-X for a refund is limited.

What is Form 1040-X?

Form 1040-X, Amended U.S. Individual Income Tax Return is used by taxpayers who need to correct errors in a previously filed federal tax return, such as filing status, number of dependents, or omitted credits or deductions. It should not be used to correct simple math errors, as the IRS will fix these during the processing of returns. Taxpayers can electronically file this form or mail it to the IRS along with any unreported income forms, attachments, and documents to support the amended return. To get a refund, the form must be filed within three years of the original return or within two years of paying the taxes, whichever is later. The IRS provides tips to taxpayers filing a 1040-X, and may offer additional refunds or deductions when your return is amended.

IRS Form 1040-X – Who Needs to Fill It Out?

IRS Form 1040-X should be filled out by anyone who has already filed a federal tax return and needs to correct errors that were made. Common mistakes corrected by this form include changes in the filing status, number of dependents, or credits/deductions that were omitted. It is important to note that Form 1040-X should not be used to fix simple math errors made in the return, as these are routinely corrected by the IRS. When filling out this form, it must be accompanied by the full revised return, any attachments, and unsubmitted documents in order to be complete. This form must be filed within three years after the original return was filed or two years after the tax was paid, whichever is later. Additionally, be sure to look out for any potential credits or deductions you may have missed in your original filing.

Step-by-Step: Form 1040-X Instructions For Filling Out the Document

Filing Form 1040-X is the best way for taxpayers to amend a previously filed federal tax return for errors related to filing status, dependents, credits, deductions, or other material changes. In order to receive a credit, you must file the form within three years after the original return was filed or within two years after the tax was paid, whichever is later. When filing the form, make sure to include the revised version of your 1040 or 1040-SR, along with any supporting documents such as W-2s or 1099s, and a brief description of the amendment and why. The IRS recommends filing electronically if you e-filed the original return and cautions that refunds based on amended returns are not eligible for direct deposit. In most cases, it can take up to 16 weeks to process. You can use the Where’s My Amended Return? page on the IRS website to track the status of your filing.

Below, we present a table that will help you understand how to fill out Form 1040X.

| Information for Form 1040-X Amendment | Details |

|---|---|

| Filing Form 1040-X | The best way to amend a previously filed federal tax return for errors related to filing status, dependents, credits, deductions, or other material changes. |

| Time Limit | File the form within three years after the original return was filed or within two years after the tax was paid, whichever is later. |

| Required Documents | Include the revised version of your 1040 or 1040-SR, along with any supporting documents such as W-2s or 1099s, and a brief description of the amendment and why. |

| E-filing Recommendation | The IRS recommends filing electronically if you e-filed the original return. |

| Refund Processing Time | In most cases, it can take up to 16 weeks to process. |

| Where’s My Amended Return? | Track the status of your filing using the “Where’s My Amended Return?” page on the IRS website. |

Do You Need to File Form 1040-X Each Year?

Filing Form 1040-X is used to amend a previously filed U.S. Individual Income Tax Return if mistakes have been made such as errors in filing status, number of dependents, or omissions of credits or deductions. To get a refund, the form must be filed within three years after the original return was filed or within two years after the tax was paid, whichever is later. Filing Form 1040-X can be done electronically or by mail, and the necessary documents to accompany the form must be included in the filing. Benefits to filing Form 1040-X exists if unused credits or deductions have not been included on the original return. These may be claimed, and a potential larger refund may be returned to the taxpayer. However, be aware that direct deposit of refunds from a 1040-X filing is not currently available. Upon filing, checking the status of the amended return can be done on the IRS website. Be aware that it can take up to 16 weeks (20 weeks due to COVID-19) to process Form 1040-X and receive the refund.

Download the official IRS Form 1040-X PDF

On the official IRS website, you will find a link to download Form 1040-X, Amended U.S. Individual Income Tax Return. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1040-X

Sources:

https://www.irs.gov/forms-pubs/about-form-1040x

https://www.irs.gov/instructions/i1040x