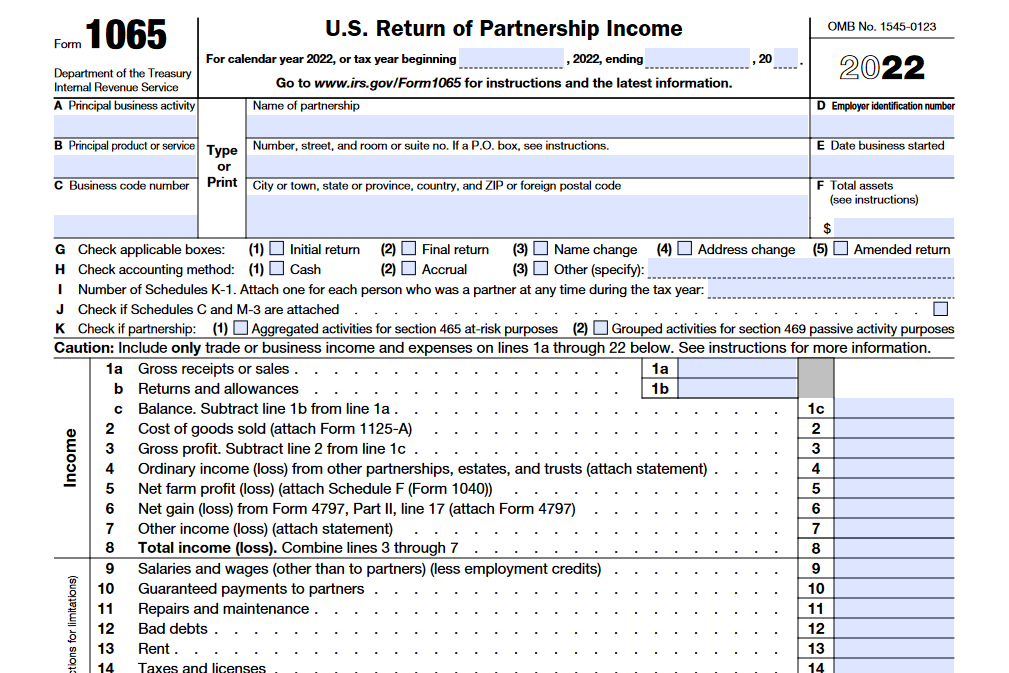

All domestic partnerships must file IRS Form 1065: U.S. Return of Partnership Income to declare profits, losses, deductions and credits of the business for tax filing purposes. Partner’s share of business income is reported and paid via compiled Schedule K-1, and Form 1065 provides the IRS with a snapshot of a company’s financial status for the year.

What is Form 1065?

Form 1065: U.S. Return of Partnership Income is an important tax document issued by the IRS used to report the profits, losses, deductions, and credits of a business partnership for the applicable tax year. It is required to be filed by all domestic partnerships, foreign partnerships with U.S. income, and nonprofit religious organizations. The form must be filed by the 15th day of the third month following the date the tax year ended for the business, and it must be accompanied by a completed Schedule K-1 prepared for each partner. Form 1065 is necessary to obtain an accurate picture of the company’s financial status for the year and to ensure the correct assessment of income taxes on the partners. Late filing will result in apenalty of $220 per month per applicable partner.

IRS Form 1065 – Who Needs to Fill It Out?

Form 1065: U.S. Return of Partnership Income is a mandatory tax filing for all partnerships, including domestic partnerships, foreign partnerships with income in the U.S., and nonprofit religious organizations classified as 501(d). Partners must provide the IRS with their profits, losses, deductions, and credits for the year and must pay taxes on their share of the partnership income on their personal tax returns. Form 1065 must include the Employer Identification Number (EIN), or Tax ID, the number of partners in the business, start dates for the business’s inception, and information about the partners and their percentage of ownership. The IRS won’t contact businesses to approve filing extensions, though each partner may need to file Form 7004 for an extension. Late filers will be assessed a penalty of $220 per applicable partner, per month. Be sure to file by the due date to avoid any penalties.

Step-by-Step: Form 1065 Instructions For Filling Out the Document

Filing Form 1065 is a necessary step for any domestic partnership to declare profits, losses, deductions, and credits of their business. In addition to Form 1065, partnerships must also submit a completed Schedule K-1 for each partner. The document must contain important year-end financial statements, such as a profit and loss statement and balance sheet. Form 1065 should also include the Employer Identification Number, the number of partners, and start dates associated with the business. In most cases, it must be due by March 15th, but an extension may be requested by filing Form 7004. If Form 1065 is not filed by the appropriate date, late filing penalties may be assessed against the partnership, per applicable partner.

Below, we present a table that will help you understand how to fill out Form 1065.

| Information | Details |

|---|---|

| Form Required | Form 1065 |

| Purpose | Declare profits, losses, deductions, and credits of the business |

| Additional Requirement | Schedule K-1 for each partner |

| Year-End Financial Statements | – Profit and loss statement – Balance sheet |

| Required Information on Form 1065 | – Employer Identification Number (EIN) – Number of partners – Business start dates |

| Filing Deadline | March 15th (in most cases) |

| Extension Option | Form 7004 for extension request |

| Late Filing Penalties | Assessed if not filed by the appropriate date |

Do You Need to File Form 1065 Each Year?

Every domestic partnership must file Form 1065: U.S. Return of Partnership Income each year, unless it does not receive any income or does not have any expenditures that can be treated as deductions or credits for federal income tax purposes. If the form is filed late, the partnership may be assessed a penalty of $220 per applicable partner per month for returns due in 2023. Form 1065 requires important year-end financial statements, such as a profit and loss statement, deductible expenses, a balance sheet, and K-1 documents for each partner. All the necessary forms may be found on the IRS website.

Download the official IRS Form 1065 PDF

On the official IRS website, you will find a link to download Form 1065: U.S. Return of Partnership Income. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1065

Sources:

https://www.irs.gov/forms-pubs/about-form-1065

https://www.irs.gov/instructions/i1065