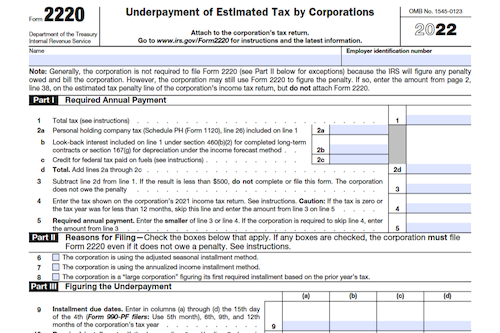

Tax-paying corporations, tax-exempt organizations subject to the unrelated business income tax, and private foundations require Form 2220 to determine if they are subject to a penalty for underpayment of estimated tax and, if so, the amount of the penalty.

What is Form 2220?

Form 2220 is used by corporations (including S corporations), tax-exempt organizations, and private foundations to determine whether they are subject to the penalty for underpayment of estimated tax, and if so, how much they owe. It takes into account the various period timescales in order to calculate the respective penalty amount.

IRS Form 2220 – Who Needs to Fill It Out?

Form 2220 must be completed and submitted by all corporations (including S corporations) who are subject to the unrelated business income tax, as well as any tax-exempt organizations or private foundations. This form is used by the IRS to assess whether an underpayment penalty is applicable and what the amount for the penalty should be for the period.

Step-by-Step: Form 2220 Instructions For Filling Out the Document

Filling out Form 2220 is an important step for individuals filing corporate taxes, as well as tax-exempt organizations and private foundations. The form is used to determine whether a taxpayer is subject to the penalty for underpayment of estimated taxes and, if so, calculate the amount of penalty for the specified period. Carefully read through all instructions and enter the appropriate information in each field to ensure your tax filing is accurate.

Below, we present a table that will help you understand how to fill out Form 2220.

| Information Required for Form 2220 | Details |

|---|---|

| Name | Individual’s or organization’s full name |

| Taxpayer Type | Indicate whether the taxpayer is an individual, corporate entity, tax-exempt organization, or private foundation |

| Penalty Calculation | Calculate the penalty for underpayment of estimated taxes |

| Specified Period | Specify the time period for which the penalty is being calculated |

| Instructions | Carefully read through all instructions provided for Form 2220 |

Do You Need to File Form 2220 Each Year?

Whether you need to file Form 2220 each year depends on the type of organization you have. Corporations, S corporations, tax-exempt organizations subject to the unrelated business income tax, and private foundations may use Form 2220 to calculate the amount of the underpayment penalty for their financial period. Filing this form might be required to avoid the penalty for underpayment of estimated tax.

Download the official IRS Form 2220 PDF

On the official IRS website, you will find a link to download Form 2220. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click here to download Form 2220

Sources: