Form 2350 is a tool to help taxpayers request an extension of time to file a U.S. income tax return. It allows individuals who are unable to file their return by the due date to request up to six months of extra time. The form must be filed by the original due date of the return.

What is Form 2350?

Form 2350 is a form used to request an extension of time to file a U.S. income tax return. This request is only applicable to individuals who are unable to file their return by the original due date. The form can be filed by the due date to receive an extension of up to six months. Completion and filing of the form before the original due date is required in order to receive the automatic extension of time.

IRS Form 2350 – Who Needs to Fill It Out?

Form 2350 is an option available to individuals who are unable to file their return by the due date. This form must be filled out and filed by the original due date of the return and can grant an extension of up to six months. Its purpose is to request an extension of time to file the U.S. income tax return and is provided for those individuals who need additional time to do so.

Step-by-Step: Form 2350 Instructions For Filling Out the Document

Form 2350 is used to request an extension of time up to six months to file a U.S. income tax return. It must be filed by the original due date of the return. When completing the form, individuals should ensure that all required fields are filled out correctly and that the form is submitted on time in order for the extension to be granted automatically. Furthermore, all information and instructions in the package must be followed to ensure a successful submission.

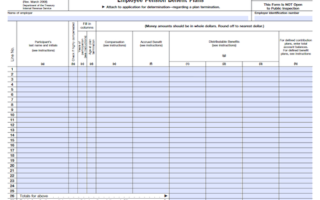

Below, we present a table that will help you understand how to fill out Form 2350.

| Information Required for Form 2350 | Details |

|---|---|

| Extension Request | Requesting an extension of time to file a U.S. income tax return |

| Submission Deadline | Original due date of the return |

Do You Need to File Form 2350 Each Year?

No, Form 2350 only needs to be filed when a taxpayer needs an extension of time to file a U.S. income tax return. If the form is properly completed and filed by the original due date of the return, an extension of up to six months is granted automatically. Individuals who are unable to file their return by the due date can use Form 2350 to extend their filing timeline.

Download the official IRS Form 2350 PDF

On the official IRS website, you will find a link to download Form 2350. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 2350

Sources: