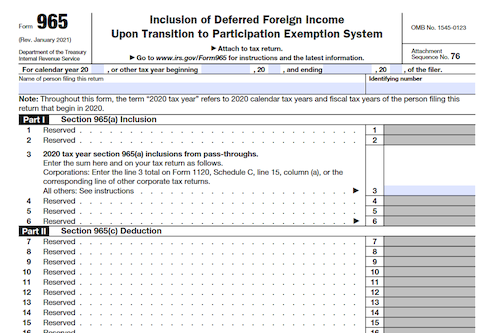

U.S. persons required to report their section 965(a) inclusions, section 965(c) deductions, and applicable percentage for disallowance of foreign taxes for their 2020 tax year must complete Form 965 and, as applicable, separate Schedules F and H to their income tax returns. Eligible individuals and domestic corporations must use Schedules F and H to determine foreign taxes deemed paid and the portion of such taxes disallowed under section 965(g).

What is Form 965?

Form 965 is an Internal Revenue Service (IRS) form used to report income for U.S. shareeholders of controlled and deferred foreign income corporations (CFC/DFIC) or any foreign corporation with respect to which one or more domestic corporations is a U.S. shareholder. This form is filed by any person that is required to include amounts in income under section 965(a) of the Code in their 2020 tax year due to the their status as a direct or indirect partner in a domestic partnership, a shareholder in an S corporation, or a beneficiary of another pass-through entity. When filing, Form 965 and separate Schedules F and H are attached to the income tax return or other applicable forms, and electronic filing is available. Up to separate Schedules F and H may be completed more than once for each applicable separate category of income.

IRS Form 965 – Who Needs to Fill It Out?

Any person that is required to include amounts in income under section 965(a) of the Code in its 2020 tax year because the person is a direct or indirect partner in a domestic partnership, a shareholder in an S corporation, or a beneficiary of another pass-through entity, and such pass-through entity is a U.S. shareholder of a DFIC, must fill out and attach Form 965 and, as applicable, separate Schedules F and H to their income tax return. While an organization exempt from tax under section 501(a) should only file Form 965 if the tax amounts are subject to related business income or private foundation investment income, all U.S. persons should file Form 965 and separate Schedules F and H to account for their share of section 965(a) and 965(c) inclusions and deductions, as well as the foreign taxes deemed paid and disallowed under section 965(g).

Step-by-Step: Form 965 Instructions For Filling Out the Document

Form 965 is used to report 2020 tax year share of section 965(a) inclusions, section 965(c) deductions, foreign taxes deemed paid with respect to section 965(a) inclusions, and foreign taxes disallowed under section 965(g). U.S. persons required to include the information must attach the form and any applicable separate Schedules F and H to their income tax return by the due date, and electronic filing of the form is possible. Corrections can be made by filing a corrected Form 965 and Schedules F and H with an amended tax return, as well as attaching a statement of changes. Separate Schedules F and H may need to be completed more than once for each applicable separate category of income.

Below, we present a table that will help you understand how to fill out Form 965.

| Form 965 | Instructions |

|---|---|

| Form 965 is used to report 2020 tax year share of section 965(a) inclusions, section 965(c) deductions, foreign taxes deemed paid with respect to section 965(a) inclusions, and foreign taxes disallowed under section 965(g). |

|

Do You Need to File Form 965 Each Year?

Form 965 must be completed and filed each tax year when the filer is required to include in their income amounts under section 965 of the Code. It must be filed as an attachment to their income tax return, or other applicable form, such as a partnership or exempt organization return. An organization exempt from tax is still recommended to complete Form 965 and separate Schedules F and H if the section 965 amounts are subject to tax under other section codes. Each owner and beneficiary of a U.S. shareholder pass-through entity must receive information on their share of section 965(a) and section 965(c) amounts, and must complete separate Schedules F and H in order to properly determine their foreign taxes deemed paid and disallowances. Eligible individuals making a section 962 election, and domestic corporations, can use Schedules F and H to also claim foreign tax credits.

Download the official IRS Form 965 PDF

On the official IRS website, you will find a link to download Form 965. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 965

Sources: