Filing Form 5074 is required for U.S. citizens or resident aliens reporting at least $50,000 in Adjusted Gross Income (AGI) and $5,000 or more from Guam or CNMI sources. Learn more about determining the source of income and filing Form 5074 here.

What is Form 5074?

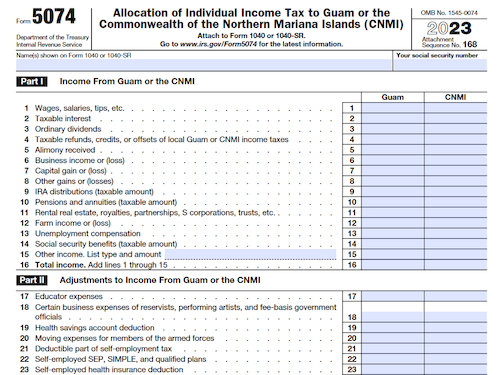

Form 5074 is a form that must be completed by U.S. citizens or resident aliens who have Adjusted Gross Income (AGI) of $50,000 or more and have at least $5,000 of gross income from Guam or CNMI sources. Form 5074 helps to determine the family’s resident status and subsequent tax treatment. It also aids in determining the source of income such as wages, interest income, dividends, alimony received, and gains or profits from the sale of property. Further details can be found in Publication 570, Tax Guide for Individuals With Income From U.S. Territories.

IRS Form 5074 – Who Needs to Fill It Out?

IRS Form 5074 is required to be filled out by U.S. citizens or resident aliens, excluding bona fide residents of Guam and the CNMI, who have a filing requirement, an AGI of $50,000 or more, and at least $5,000 of their gross income being derived from either Guam or CNMI sources. Joint returns also must be filed according to rules outlined on the form. Form 5074 must be sent to the appropriate IRS address depending on whether or not a check or money order is included. For further information or for amended returns, please refer to the IRS website or to Pub. 570.

Step-by-Step: Form 5074 Instructions For Filling Out the Document

Filing Form 5074 is necessary if you are a U.S. citizen or resident alien who is not a resident of Guam or the CNMI and have an adjusted gross income of $50,000 or more, as well as at least $5,000 of income from Guam or CNMI sources. The address to which the form should be filed depends on whether you include a check or money order. Furthermore, you must determine where each source of income originated, which the rules for doing so are explained in the relevant publications and regulations. For example, the source of wages, salaries, or tips is generally the place of performance and the source of dividends is generally where the paying corporation is created or organized. As such, it is important to be aware of the distinction between U.S. source and Guam / CNMI source of income.

Below, we present a table that will help you understand how to fill out Form 5074.

| Information Required for Form 5074 | Details |

|---|---|

| Income Threshold | Must have adjusted gross income of $50,000 or more |

| Income Source Determination | Determine the source of income based on relevant publications and regulations |

| Form Submission | File the form to the appropriate address based on circumstances |

Do You Need to File Form 5074 Each Year?

If you are a U.S. citizen or resident alien who files a U.S. tax return, reports an AGI of $50,000 or more, and has over $5,000 of gross income from Guam or CNMI sources, then you may need to file Form 5074. It is important to note that if you are filing a joint return and only one spouse is a bona fide resident, the status for both spouses is determined by the spouse with the higher AGI. Make sure to follow the federal guidelines for sources of income which are outlined in various publications.

Download the official IRS Form 5074 PDF

On the official IRS website, you will find a link to download Form 5074. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 5074

Sources: