Form 966 is a document that is typically filed by C corporations that have made the decision to terminate their existence and initiate winding up their affairs. It enables the corporation to obtain tax clearance from the IRS and notify it of its intention to dissolve or liquidate, helps to fulfill tax obligations, and finalize the winding down process.

What is Form 966?

Form 966 is an important form for C corporations (including those that used to be S corporations) and LLCs that elect to be taxed as C corporations to file when dissolving or liquidating. It serves to notify the IRS of the corporation’s intention to dissolve or liquidate, obtain tax clearance from the government, and initiate the process of filing final tax returns. Filing Form 966 also benefits the corporation by finalizing the winding down process, terminating tax obligations, halting the accrual of penalties and interest, establishing a final tax year, and providing legal protection.

IRS Form 966 – Who Needs to Fill It Out?

Form 966 is required to be filled out by C corporations (including former S corporations) that have decided to terminate their operations. Limited liability companies (LLCs) that elected to be taxed as a C corporation at any point also need to submit Form 966 when they dissolve or liquidate. Unfortunately, foreign corporations are not eligible to file Form 966. Filing of this form enables the corporation to notify the IRS of its intention to dissolve or liquidate, obtain tax clearance, process the final tax returns, finalize the winding down process, stop the accrual of penalties and interests, establish a final tax year, and provide legal protection to the corporation and its officers.

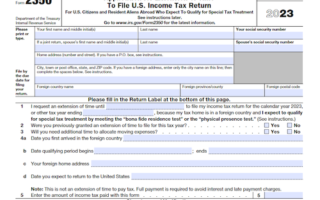

Step-by-Step: Form 966 Instructions For Filling Out the Document

Filing Form 966 is an important step for C corporations and S corporations that have previously held C corporation status and are dissolving or liquidating. The form serves multiple purposes, such as notifying the IRS of your intention to dissolve or liquidate and obtaining tax clearance. It also helps process final tax returns, finalizes the winding down process, terminates tax obligations, stops the accrual of penalties and interest, establishes a final tax year, and provides legal protection. Eligibility to file Form 966 is limited to C and S corporations that have previously held C Corporation status, while LLCs and foreign corporations are not eligible.

Below, we present a table that will help you understand how to fill out Form 966.

| Information Required for Form 966 | Details |

|---|---|

| Corporate Dissolution | Notifying the IRS of the dissolution or liquidation of a corporation |

| Eligibility | Eligibility limited to C and S corporations that have previously held C Corporation status |

Do You Need to File Form 966 Each Year?

No, Form 966 does not need to be filed annually. It is typically used by C corporations (including S corporations that were previously C corporations) that have made the decision to terminate their existence and wind up their affairs. Filing Form 966 allows a corporation to notify the IRS of its intention to dissolve or liquidate and obtain tax clearance in the process. The benefits of filing this form include finalizing the winding down process, termination of tax obligations, stopping the accrual of penalties and interest, establishing a final tax year, and providing legal protection.

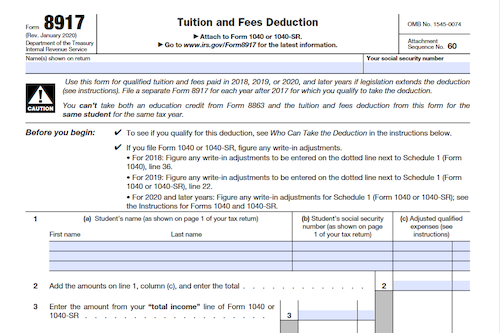

Download the official IRS Form 966 PDF

On the official IRS website, you will find a link to download Form 966. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 966

Sources: