Form 8979 is used to designate or revoke a partnership representative or designated individual with the IRS. It can be filed by a partnership, partnership representative, or designated individual in certain situations, such as when submitting an AAR or with Form 8985. An individual must have substantial presence in the United States in order to serve as a partnership representative or designated individual.

What is Form 8979?

Form 8979 is an IRS form used by partnerships to designate or revoke the designation of a partnership representative or designate an individual to act on behalf of the entity partnership representative. Both the partnership representative and designated individual must reside in the United States and have a U.S. taxpayer ID, street address, and phone number with a U.S. area code. The form can be filed with the current IRS employee point of contact, with an administrative adjustment request, with a Form 8985, Pass-Through Statement, with a Form 8988, or with a Form 921-M. A partnership representative or designated individual may also file Form 8979 directly to the current IRS employee point of contact. If the address of the partnership representative or designated individual changes, the IRS does not require a new Form 8979, simply a dated written notification with the new contact information.

IRS Form 8979 – Who Needs to Fill It Out?

Form 8979 must be filled out by the partnership (through an authorized member) when needing to revoke the current partnership representative or designated individual, or to designate a new partnership representative. Furthermore, Form 8979 must be filled out by the partnership representative or designated individual if they are resigning. To be qualified, both the partnership representative and designated individual must have a U.S. taxpayer identification number (TIN), a U.S. street address, and a telephone number with a U.S. area code. Generally, Form 8979 must be filed with an administrative adjustment request, a Form 8985, a Form 8988, or a Form 921-M. However, it can also be submitted directly to the current IRS employee point of contact after certain IRS letters have been issued.

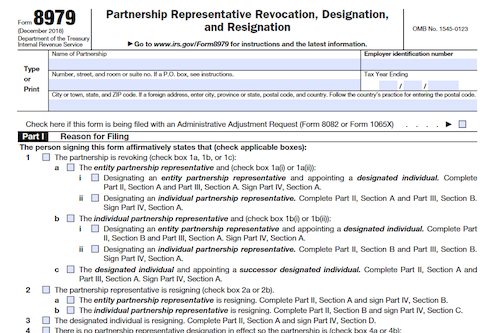

Step-by-Step: Form 8979 Instructions For Filling Out the Document

Form 8979 is used to revoke a partnership representative designation, appoint a designated individual, or both. When a partnership chooses to file Form 8979, it must send it to the current IRS employee point of contact (e.g. revenue agent, appeals officer, or counsel). The designated partnership representative must have a U.S. taxpayer identification number (TIN) and a U.S. street address and contact number. A partnership representative or designated individual may also submit Form 8979 to resign. If the address of a partnership representative or designated individual has changed, the IRS does not require a new Form 8979. The IRS should be notified with a written notification including the new contact information and signature of the said individual.

Below, we present a table that will help you understand how to fill out Form 8979.

| Information Required for Form 8979 | Details |

|---|---|

| Form Purpose | Used to revoke a partnership representative designation, appoint a designated individual, or both |

| Submission | Must be sent to the current IRS employee point of contact |

| Designated Representative | Must have a U.S. taxpayer identification number (TIN) and a U.S. street address and contact number |

| Resignation | Form can be submitted to resign as a partnership representative or designated individual |

| Address Change | Notify the IRS with a written notification for address changes |

Do You Need to File Form 8979 Each Year?

No, Form 8979 does not need to be filed each year. It should only be filed when directed by the IRS, such as when a partnership revokes a partnership representative or designated individual, or when a partnership representative or designated individual resigns. A partnership must also file if it failed to designate a partnership representative on the initially filed Form 1065. If the partnership does receive a notification from the IRS that there is no current designation in effect, then the partnership has 30 days to file Form 8979. Instructions on where and when to file are provided in detail on the form as well as on IRS.gov.

Download the official IRS Form 8979 PDF

On the official IRS website, you will find a link to download Form 8979. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download Form 8979

Sources: