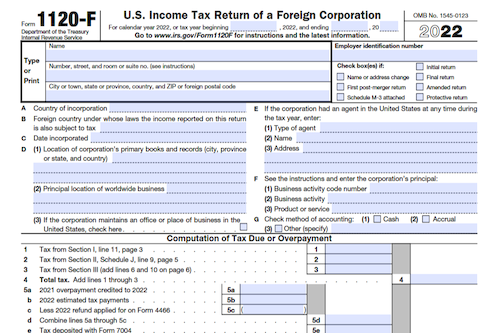

For foreign corporations conducting business in the United States, Form 1120-F must be filed to report income, deductions, credits, and figure U.S. tax liability. Unless one of the exceptions applies, a foreign corporation must file Form 1120-F to report engagement in a U.S. trade or business, effective connection with a U.S. trade or business, or income from U.S. sources.

What is Form 1120-F?

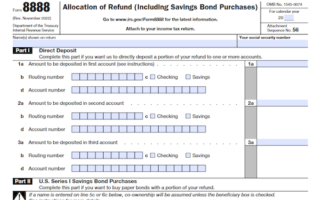

Form 1120-F is used by foreign corporations to report income, gains, losses, deductions, and credits, and calculate any U.S. income tax liability. It is also used to claim refunds and calculate a foreign corporation’s branch profits tax or tax on excess interest. It must be filed by a foreign corporation unless it meets certain exceptions such as full U.S. tax being withheld at source or its only U.S. source income being exempt from U.S. taxation. Other entities such as a beneficiary of an estate or trust or a mutual life insurance company must also file Form 1120-F in certain instances. A foreign eligible entity that elected to be classified as a corporation or a corporation filing to claim a treaty or Code exemption must also file this form. A foreign corporation may also want to file a protective return to safeguard its rights to deductions and credits. Additionally, foreign corporations must file this form to certify as a qualified opportunity fund and attach Form 8996, and to hold a qualified investment in a qualified opportunity fund, they must attach Form 8997.

IRS Form 1120-F – Who Needs to Fill It Out?

Form 1120-F must be filed by all foreign corporations engaged in a trade or business in the US and those with US source income whose tax liability has not been fully satisfied by chapter 3 of the Code. This form must also be filed by those making a claim for a refund of taxes, seeking deductions or credits, or being treated as a qualified derivatives dealer (QDD). There are a few special cases that may require filing Form 1120-F, including Mexican or Canadian branches of U.S. mutual life insurance companies, receivers, assignees, or trustees in dissolution or bankruptcy, or agents in the U.S. without a place of business. Exceptions from filing may include foreign corporations whose only U.S. source income is exempt from taxation or that had their full U.S. tax withheld at source.

Step-by-Step: Form 1120-F Instructions For Filling Out the Document

All foreign corporations must file Form 1120-F if, during the tax year, the corporation was engaged in a U.S. trade or business, had income, gains, or losses treated as effectively connected to a U.S. trade or business, or had income from any U.S. source but could not have had full U.S. tax withheld at source. This form must also be filed if the corporation is making a claim for refund, a deduction, a credit, or to report treaty-based return positions. There are certain exceptions to the filing requirement, such as if the full U.S. tax was withheld at source from only U.S. source income exempt from U.S. taxes and the foreign corporation did not engage in a U.S. trade or business. See the instructions for more information about exceptions, special returns, and protective return filers.

Below, we present a table that will help you understand how to fill out Form 1120-F.

| Information for Form 1120-F | Details |

|---|---|

| Filing Requirement | Foreign corporations engaged in U.S. trade or business, etc. |

| Exceptions | Full U.S. tax withheld at source from U.S. source income |

| Extensions | Can apply for an extension via Form 7004 |

| Filing Location | IRS center address in Ogden, UT or foreign country |

Do You Need to File Form 1120-F Each Year?

Yes, all foreign corporations with income, gains, losses, deductions, credits, and/or branch profits from a US trade or business, or from US source with U.S. tax liability, must file Form 1120-F unless an exception is met. For Mexican and Canadian branches of a U.S. mutual life insurance company, or a receiver, assignee, trustee, or agent, Form 1120-F is mandatory. An exemption for full tax withheld at source, or income exempted in Section 881, may be applied as exceptions. Form 1120-F is also required in cases of protective return, treaty or Code exemption, qualified opportunity fund, and qualified opportunity investment.

Download the official IRS Form 1120-F PDF

On the official IRS website, you will find a link to download Form 1120-F. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download Form 1120-F

Sources: