Form 8996 is the form that corporations and partnerships must complete to certify that they are organized to invest in qualified opportunity zone (QOZ) property and to report yearly on their QOZ investment standard. This article explains the definitions of a QOZ, a QOF, the 90% investment standard, cash not immediately invested, QOF reinvestment in QOZ property, U.S. possessons, total assets, and QOZ property.

What is Form 8996?

Form 8996 is used to certify a corporation or partnership’s organization as an investment in a qualified opportunity zone (QOZ) and report the success of meeting the 90% investment standard established by the Tax Cuts and Jobs Act (TCJA). QOZs are designated in Notice 2018-48 and Notice 2019-42, while investments must be a domestic corporation stock or a capital/profits interest in a domestic partnership. QOZ property includes stock, partnership interest, and tangible property used in a trade/business such as real estate that straddles a QOZ and a non-QOZ. Purchased tangible property must be substantially improved in a 30-month period that begins after the acquisition of the property, and the use/improvement must largely originate from the QOF. Notice 2021-10 expired as of 2021-03-31, but any QOZ property undergoing substantial improvement during 2020-04-01 to 2021-03-31 has its substantial improvement period tolled.

IRS Form 8996 – Who Needs to Fill It Out?

Form 8996 must be completed by a corporation or partnership organized to invest in QOZ property. The form is used to certify it is organized to invest in QOZ property, and also to report if the QOF meets the 90% investment standard, or in the event it fails to meet the investment standard. To be eligible, the investment vehicle must be organized in one of the 50 states, a federally recognized Indian tribe, the District of Columbia, or a U.S. possession. Exclusions to the 90% investment standard apply, including for cash not immediately invested or QOF reinvestment in QOZ property. Additional requirements apply for QOZ stock, QOZ partnership interest, and QOZ business property. For real property that straddles a QOZ and a non-QOZ, special rules apply to determine if it can be treated as QOZ business property.

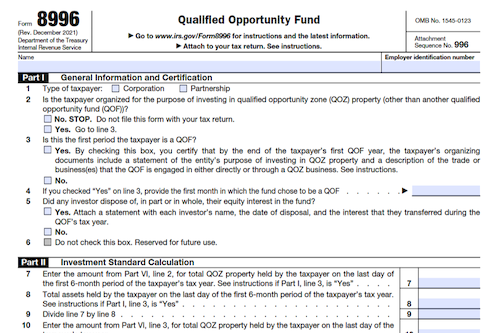

Step-by-Step: Form 8996 Instructions For Filling Out the Document

Step-by-Step: Form 8996 Instructions For Filling Out the Document are provided to help taxpayers understand the benefits in investing in QOZ property through a qualified opportunity fund (QOF) in designated census tracts. Investors must ensure that a QOF satisfies the 90% investment standard in QOZ property by calculating and filing Form 8996 annually. Additionally, to qualify as QOZ property, any tangible property must satisfy certain criteria depending on whether it was acquired by purchase or lease. Furthermore, cash contributions to a QOF must be invested into QOZ property within six months or it may be excluded from the 90% investment standard. Real property that straddles a QOZ and a non-QOZ may also be eligible for treatment as QOZ property.

Below, we present a table that will help you understand how to fill out Form 8996.

| Key Information for Form 8996 | Details |

|---|---|

| Purpose | Calculate the Qualified Opportunity Fund (QOF) investment standard |

| Eligibility | Investors in designated census tracts, QOF investment criteria |

| Criteria | Requirements for tangible property, cash contributions, and real property |

Do You Need to File Form 8996 Each Year?

Yes, corporations or partnerships using Form 8996 must file it annually to certify their investment in Qualified Opportunity Zone (QOZ) property and to report that the 90% investment standard of section 1400Z-2 is met. Failure to meet the investment standard results in a penalty. Form 8996 is not filed by QOZ businesses; however, the investment vehicle must hold at least 90% of its total assets in QOZ property and purchasable property must satisfy rules related to substantial improvement in order to qualify. Notice 2021-10 has expired, although the substantial improvement period is still tolled for property undergoing improvement between April 1, 2020 and March 31, 2021.

Download the official IRS Form 8996 PDF

On the official IRS website, you will find a link to download Form 8996. However, to make it easier for you, we are providing the link in our article, which comes directly from the official IRS.gov website! Click to download: Form 8996

Sources: