This article focuses on providing information about the form 8621-A, which is used by U.S. persons to make a late purging election with respect to a former or Section 1297(e) PFIC under the rules of Regulations sections 1.1298-3 and 1.1297-3.

What is Form 8621-A?

Form 8621-A is used by a U.S. person who is a shareholder of a former Passive Foreign Investment Company (PFIC) or Section 1297(e) PFIC in order to make a purging election under section 1298(b)(1). This is a deemed dividend or a deemed sale election made in accordance to the rules in Regulations sections 1.1298-3(b), 1.1298-3(c), 1.1297-3(b) or 1.1297-3(c). If the election is made late, taxpayers must pay an interest on the amount due determined for the period beginning on the due date (without extensions) for the taxpayer’s income tax return for the election year. To complete the form, taxpayers must check the applicable box in Part I of the form, complete the applicable lines in Part II or III and compute the tax and interest due in Part IV. Additional filing requirements (Closing Agreement, balance sheet) may also apply.

IRS Form 8621-A – Who Needs to Fill It Out?

IRS Form 8621 is required to be filed by any U.S. person who is a direct or indirect shareholder of a former Passive Foreign Investment Company (PFIC) or a Section 1297(e) PFIC, in order to make a purging election under section 1298(b)(1) and be taxed under the relevant regulations. This applies even if the shareholder is subject to the CFC Overlap Rules and the qualified portion of their holding in the PFIC. Form 8621-A is used to make a late purging election and must include all relevant information, such as the type of election being made, who is making the election, and amounts due with respect to the late purging election. A separate Form 8621-A must be filed for each PFIC, and multiple forms can be filed together if the shareholder owns multiple PFICS. The form and any checks due must be filed with the IRS Deposit Team, and a copy kept for records.

Step-by-Step: Form 8621-A Instructions For Filling Out the Document

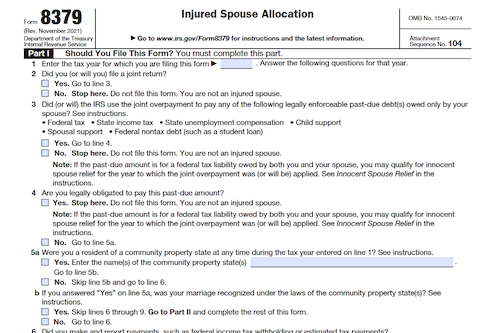

Filing Form 8621-A is necessary for any U.S. person who is a direct or indirect shareholder of a former Passive Foreign Investment Company (PFIC) or a Section 1297(e) PFIC and wishes to make a purging election under section 1298(b)(1). The form can be used both to make a timely filed purging election as well as a late purging election; with the latter requiring filing of a closing agreement and payment of interest for the period beyond the due date of taxpayer’s income tax return for the election year. When filling out Form 8621-A, the shareholder must check the applicable box corresponding to their election, complete the applicable lines in Part II, III, or IV of the form (including any attachments requested on those lines), sign and date the form, file the closing agreement (if the election year is a closed tax year), make a payment, and store a copy of the form. Please refer to the Instructions for Form 8621-A for definitions of Controlled Foreign Corporation (CFC), CFC Overlap Rules, Qualified portion of holding period, CFC qualification date, Section 1297(e) PFIC, Election Year, Former PFIC, Indirect Shareholder, Passive Foreign Investment Company (PFIC), Qualified Electing Fund (QEF), Shareholder, and Termination Date.

Below, we present a table that will help you understand how to fill out Form 8621-A.

| Key Information for Form 8621-A | Details |

|---|---|

| Purging Election | Direct or indirect shareholder of a former PFIC; timely or late election |

| Form Completion | Check applicable box, complete relevant lines, sign, file, attach agreements |

| Definitions | Various terms defined in the Instructions for Form 8621-A |

Do You Need to File Form 8621-A Each Year?

Form 8621 is used by U.S. persons who are direct or indirect shareholders of former Passive Foreign Investment Companies (PFICs) and Section 1297(e) PFICs to make a purging election under section 1298(b)(1). This form is required each year in order to remain subject to taxation under section 1291, and if the purging election is made late, Form 8621-A must be filed. This form requires the shareholder to report basic information and compute the tax and interest due, and in some cases the taxpayer must enter into a closing agreement and be sure to include full payment of the amount shown on line 21.

Download the official IRS Form 8621-A PDF

On the official IRS website, you will find a link to download Form 8621-A. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8621-A

Sources: