Form 56-F must be filed with the IRS within 10 days of a receiver or conservator being appointed. It should be filed in every subsequent tax year if the fiduciary continues to act for that financial institution. Furthermore, special instructions are required for completion of the form.

What is Form 56-F?

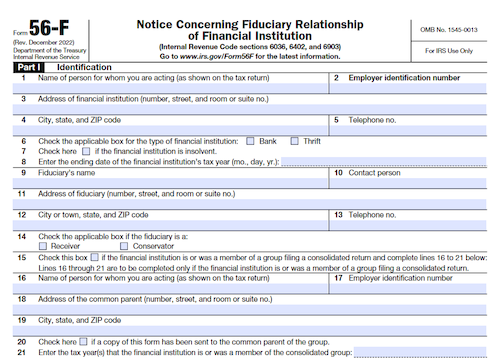

Form 56-F is a document required to be filed by a fiduciary appointed to act as a receiver or conservator of a financial institution to the Internal Revenue Service. The information needed to complete the form includes the financial institution’s identification number, the fiduciary’s details, and common parent information (if applicable). In addition, this form must also be filed in every subsequent tax year in which the fiduciary continues to act as the receiver or conservator. For those previously filing Form 56 and are now required to fill Form 56-F, the form should be filled out as soon as possible. Instructions for filing the form are found within the form itself.

IRS Form 56-F – Who Needs to Fill It Out?

IRS Form 56-F must be filled out by a fiduciary of a financial institution appointed within 10 days from the date of appointment. The form must also be filed in every subsequent tax year that the fiduciary continues to act as the receiver or conservator. Additional instructions include specific parts of the form with required information such as the financial institution’s identification number and the fiduciary’s full name. The form should be sent depending on the purpose, whether it is for compliance with 6402(k), or for section 6036. Lastly, it must be signed under penalty of perjury and the tax return filings should be addressed to the fiduciary.

Step-by-Step: Form 56-F Instructions For Filling Out the Document

Form 56-F must be filed with the IRS within 10 days from the date the fiduciary is appointed to act as a receiver or conservator and each subsequent year the fiduciary remains in the role. For purposes of section 6402(k) and 6903, file the form to the Internal Revenue Service Center where the financial institution files its income tax return, and for purposes of 6036, submit it to the Advisory Group Manager of the area office of the IRS. Part I of the form requires identification information for the financial institution and fiduciary, as well as the common parent of a consolidated group, if applicable. Part II requires that a copy of the appropriate order be attached. Parts III and IV concern taxes and Revocation or Termination of Notice, respectively. When finished, sign Form 56-F under penalty of perjury. The form should not be sent to the IRS address below; instead, refer to the “Where To File” section provided.

Below, we present a table that will help you understand how to fill out Form 56-F.

| Information Required for Form 56-F | Details |

|---|---|

| Filing Deadline | Within 10 days from the date the fiduciary is appointed |

| Filing Location | IRS Center or Area Office, depending on the purpose |

| Part I | Identification information for the financial institution and fiduciary |

| Part II | Attachment of the appropriate order |

| Part III | Taxes |

| Part IV | Revocation or Termination of Notice |

| Signature | Sign Form 56-F under penalty of perjury |

| Where to File | Refer to the “Where To File” section provided |

Do You Need to File Form 56-F Each Year?

Form 56-F must be filed with the IRS with 10 days after a fiduciary is appointed, and must be refiled for each subsequent tax year in which the fiduciary continues to serve for purposes of section 6402(k). If an institution becomes insolvent, the fiduciary must refile Form 56-F and check the box on line 7. Furthermore, prior fiduciaries that have filed Form 56 must file Form 56-F as soon as possible, and should include all necessary information regarding the financial institution and the fiduciary themselves. The form should be sent to the Internal Revenue Service Center or the Advisory Group Manager of the area office of the IRS.

Download the official IRS Form 56-F PDF

On the official IRS website, you will find a link to download Form 56-F. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 56-F

Sources: