Have you lost your portion of a joint tax refund due to your spouse’s unpaid obligations? Learn how to apply for injured spouse allocation and get back your owed refund using IRS Form 8379.

What is Form 8379?

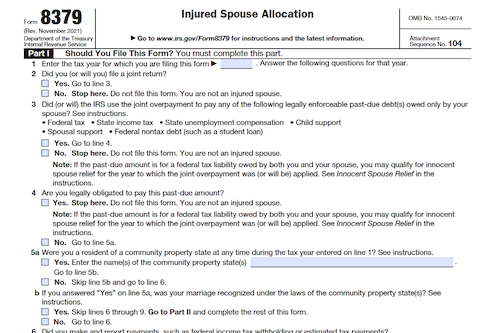

IRS Form 8379 is used to allow taxpayers to get back their share of a jointly filed tax refund if it has been taken by the IRS to pay a debt or obligation owed solely by the taxpayer’s spouse. This process is known as an “injured spouse allocation”, where the “injured spouse” is the one who does not owe the debt. To be eligible for an injured spouse allocation, the taxpayer cannot be responsible for the debt in question and they must have contributed income or claimed a refundable tax credit for the taxes they owe. Injured spouse relief is exclusively for individuals who have lost some or all of their refund and can not help with jointly filed taxes owed. To apply, Form 8379 must be filled out and sent to the IRS along with 1099 forms and W-2s for both the taxpayer and the spouse. This form can be submitted off or on a tax return, depending on the specifics of the situation. If approved, the taxpayer will receive their portion of the refund from which the debt has been taken.

IRS Form 8379 – Who Needs to Fill It Out?

IRS Form 8379 must be filled out by taxpayers who had part of their joint tax refund seized to pay a debt or obligation solely owed by their spouse. To qualify, taxpayers must not be liable for the debt in question, either premarital or while married, and must have contributed income or claimed a refundable tax credit on the tax return. Furthermore, Form 8379 does not apply to the joint tax liability, only to the refund. After downloading the form from the IRS website and attaching the necessary documents, it can either be included with the original joint tax return or mailed separately to the IRS. A response is usually received within 14 weeks. Those living in community property states may be subject to special rules.

Step-by-Step: Form 8379 Instructions For Filling Out the Document

Filing IRS Form 8379 is a way for a married individual to get back their share of a joint tax refund if it’s been taken to pay off a sole debt of their spouse. This process is typically reserved for debts incurred before the marriage, such as past-due child support, federal and state tax debts, and federally backed student loans. Eligibility for the injured spouse allocation requires that the individual filing not be liable for the debt, and must have contributed income or a refundable tax credit to the taxes paid in on the return. To apply, complete and submit the form with all applicable documents, such as 1099 and W-2 forms. Depending on the method of filing, it may be necessary to include the spouse’s Social Security number as well. The IRS states that it typically processes the form and responds in 14 weeks, although an earlier response time may be possible if filed electronically. The funds recovered in these situations are based on percentage of taxes paid in, typically the claiming individual’s proportion, and cannot be used to relieve debt on a joint return.

Below, we present a table that will help you understand how to fill out Form 8379.

| Information Required for IRS Form 8379 | Details |

|---|---|

| Filing Purpose | Recovery of a share of a joint tax refund |

| Debt Type | Sole debt of the spouse, incurred before the marriage (e.g., past-due child support, federal and state tax debts, federally backed student loans) |

| Eligibility |

|

| Required Documents | Complete Form 8379 and submit with applicable documents (e.g., 1099, W-2 forms) |

| Spouse’s Social Security Number | May be required, depending on the filing method |

| Processing Time | Typically 14 weeks for IRS response (earlier response possible if filed electronically) |

| Funds Recovery | Based on the percentage of taxes paid in, typically the claiming individual’s proportion, not to be used to relieve debt on a joint return |

Do You Need to File Form 8379 Each Year?

Each year, individuals can use IRS Form 8379 to request an “injured spouse allocation” to receive back their part of a joint tax refund that was taken to pay for their spouse’s separate debt. To qualify, they must not be responsible for the debt in question and have contributed income, withholding, or a refundable tax credit to the joint return. While this option provides relief from losing their refund to their spouse’s obligations, it does not provide relief from liability on a joint tax debt. Filing instructions for Form 8379 can be found on the IRS website and should be submitted either with the original joint tax return or, if filing after the original return has been completed, to the IRS address where the original return was filed. Those who live in community property states may be subject to additional rules and restrictions. As requests are processed within 14 weeks, individuals should contact a tax professional if they have missed their deadline to submit Form 8379.

Download the official IRS Form 8379 PDF

On the official IRS website, you will find a link to download Form 8379. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8379

Sources:

https://www.irs.gov/forms-pubs/about-form-8379

https://www.irs.gov/instructions/i8379