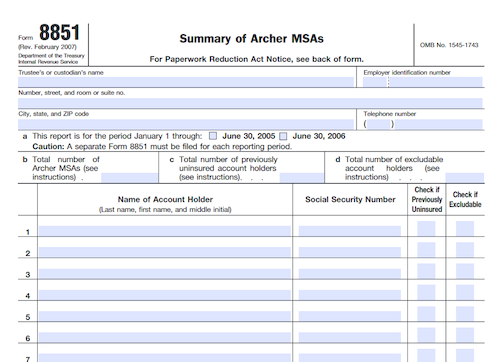

Trustees and custodians of Archer MSAs must file Form 8851 with the IRS to report their individual retirement arrangement. Approved by the IRS, the required form can be filed electronically and on paper, with electronic filing strongly encouraged.

What is Form 8851?

Form 8851 is required for those acting as trustee or custodian of an Archer MSA. This includes banks, insurance companies, and any other person approved by the IRS for the role. To file this form, those required to report 250 or more Archer MSAs must file electronically, while those reporting fewer can opt to file on paper, however filing electronically is strongly encouraged. Those needing assistance in filing electronically can find help online or call the IRS at 1-866-455-7438. Those who file electronically must transmit or fax the Form 8851 to the IRS.

IRS Form 8851 – Who Needs to Fill It Out?

Form 8851 needs to be filled out by the trustee or custodian of an Archer MSA, which could be a financial institution such as a bank or insurance company, or any other person approved by the IRS. Forms are to be sent to the IRS, and if you are reporting more than 250 Archer MSAs, you must file electronically- see Announcement 2007-15 for more information on filing electronically. You are also encouraged to file electronically if reporting fewer than 250 Archer MSAs, and you can obtain assistance on filing electronically by calling toll-free 1-866-455-7438.

Step-By-Step: Form 8851 Instructions For Filling Out the Document

To fill out Form 8851, first determine if you are a qualified trustee or custodian of an Archer MSA. If so, you must file Form 8851 to the applicable address depending on the number of MSAs you are required to report. If more than 250 MSAs, file electronically, and if fewer than 250 MSAs, file on paper. For more information on electronic filing, call 1-866-455-7438 or see Announcement 2007-15 in the Internal Revenue Bulletin 2007-8. Before submitting the form, make sure to provide all necessary information on the trustee or custodian section of the form.

Below, we present a table that will help you understand how to fill out Form 8851.

| Information Required for Form 8851 | Details |

|---|---|

| Trustee or Custodian | Determine if you are a qualified trustee or custodian |

| Filing Options | Choose electronic or paper filing based on the number of MSAs |

| Electronic Filing | Follow instructions for electronic filing if applicable |

| Required Information | Provide all necessary trustee or custodian information |

Do You Need to File Form 8851 Each Year?

Filing Form 8851 is required each year for anyone serving as a trustee or custodian of an Archer MSA. This could be a bank or other financial institution, an insurance company, or any other person approved as a trustee or custodian of an individual retirement arrangement (IRA) according to the IRS. For smaller numbers (less than 250) of Archer MSAs, filing on paper is an option, but electronically filing is highly encouraged. Visit www.irs.gov/pub/irs-irbs/irb07-08.pdf for more information on electronic filing and call 1-866-455-7438 with any questions. If you are filing electronically, make sure to include the trustee or custodian’s information on line A of Form 8851 and then transmit or fax it to the IRS.

Download the official IRS Form 8851 PDF

On the official IRS website, you will find a link to download Form 8851. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8851

Sources: