Navigating Form 8849, a form used for claiming an excise tax refund, can be complicated. This article explains which IRS addresses to submit the form to, how to file an annual claim, and other important related information.

What is Form 8849?

Form 8849 is an excise tax refund form used by the Internal Revenue Service (IRS) to determine and collect the correct amount of excise taxes from claimants. It is used to claim nontaxable uses of fuels such as on farms, off-highway business, exports, commercial fishing, intercity and local buses, and much more. It can also be used to make annual claims if no other claims are made during the tax year. Information such as the claimant’s EIN and Social Security Number, the month the tax year ends in, and the type of use must be entered. Paid preparers must provide their Preparer Tax Identification Number (PTIN) while the form and schedules are subject to the Paperwork Reduction Act. Additionally, the time needed to complete and file each schedule may vary.

IRS Form 8849 – Who Needs to Fill It Out?

Form 8849 is an IRS form used for claiming a refund of excise taxes paid. It must be filled out by taxpayers that used diesel fuel, kerosene, gasoline, or aviation gasoline. Generally, the form must be submitted by the registered credit card issuer, the registered ultimate vendor, or the ultimate purchaser, depending on the fuel used and the type of use. All necessary information, including the taxpayer’s EIN or SSN, period of the claim, item number from the Type of Use Table, rate, number of gallons, and amount of refund, must be included. Claims must be made within 3 years of the close of the taxable year, or else additional information must be provided.

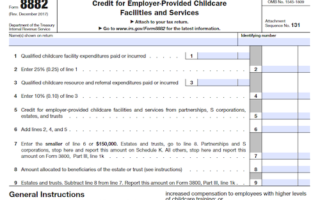

Step-by-Step: Form 8849 Instructions For Filling Out the Document

Following these instructions will guide you through filling out Form 8849. Start by entering your EIN or SSN and the month your income tax year ends in the boxes provided. Sign the form and include your address if you are a paid preparer. Taxpayers should attach information such as the type of use, rate, number of gallons, and amount of refund when making a claim. For schedules 1 and 6, send the form to Department of the Treasury Internal Revenue Service in Cincinnati, OH. For Schedules 2, 3, 5, and 8, send it to Internal Revenue Service in Covington, KY. If making an annual claim, use Form 4136. Be sure to review the Type of Use Table and Additional Instructions for Schedules 1, 2, and 3 for further information.

Below, we present a table that will help you understand how to fill out Form 8849.

| Information Required for Form 8849 | Details |

|---|---|

| Income Tax Year and EIN/SSN | Enter the income tax year, EIN/SSN, and other required information |

| Claim Details | Attach information such as type of use, rate, number of gallons, and refund amount |

| Form Submission | Send the form to the appropriate IRS address based on the schedule |

Do You Need to File Form 8849 Each Year?

Yes, Form 8849 must be filed each year in order to claim certain refunds of excise taxes. Generally, claimants must use Form 8849 (Schedule 1) for annual claims, and the annual claim must be filed within the 3 years following the close of the taxable year. Additionally, the taxable year is based on the calendar year or fiscal year which the claimant regularly uses to keep its books. More information can be found in the instructions accompanying Form 8849.

Download the official IRS Form 8849 PDF

On the official IRS website, you will find a link to download Form 8849. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8849

Sources: