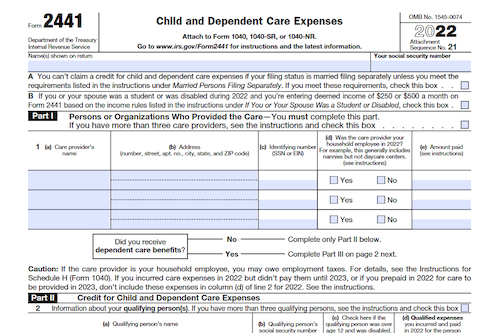

If you pay for childcare services or a professional caretaker for your child or disabled loved one, you may be able to take advantage of a child and dependent care tax credit. Form 2441 can help you determine if your expenses are eligible for a tax credit, and navigate the instructions to maximize your return.

What is Form 2441?

Form 2441 is a tax form used to claim the Child and Dependent Care Credit, a form of financial relief for those who pay for childcare services or a professional caretaker for a dependent. In order to use this form, the individual must have a dependent child under the age of 13 or a disabled dependent of any age. Payments made to family members for caregiving services may also qualify for a tax credit as long as the family member is 19 years or older. Besides caregiving services, expenses such as food, clothing, and housing won’t be exempt. Professional tax preparation services can help in understanding the instructions of Form 2441, as well as determining eligibility for the credit, filling out forms, and calculating the total credit.

IRS Form 2441 – Who Needs to Fill It Out?

IRS Form 2441 is required for those who pay for childcare, professional caretaking services, or a nanny for a dependent child under the age of 13 or a disabled loved one of any age who is physically or mentally unable to care for themselves. Notably, payments made to family members who tend to and care for your dependent can’t be deducted unless they are your adult children (19 years or older). In order to calculate your credit, it is important to understand the requirements and enter the provided information accurately on the form. More difficult questions or confusion can be addressed with a professional tax preparation service that can guide you through the instructions and help with filing a return.

Step-by-Step: Form 2441 Instructions For Filling Out the Document

Filling out Form 2441 can be a daunting task for those seeking to claim the Child and Dependent Care Credit. Fortunately, there are a few simple steps to ensure your form is filled out correctly and maximize your tax return. Start by finding out if you qualify for the credit. Your dependent must be 13 years old or younger, or a disabled spouse/dependent of any age. Next, ensure your expenses are eligible – only expenses related to caring for your dependent while you work qualify. The cost of daycare, nannies, or physical/mental caretaking services will qualify. Now, you can fill out Form 2441. Line 1, columns a-d require the information of care providers. Line 2, columns a-c require information about the dependent. Line 4 and 5 require the W-4 and gross incomes of yourself and your spouse respectively. From there, you’ll ensure you’re not receiving a double tax break and calculate your credit limit on line 10. Finally calculate your credit using lines 4-11 and enter the total on your form 1040, line 49. Although this may seem complex, professional tax preparation services can help guide you through it and maximize your return.

Below, we present a table that will help you understand how to fill out Form 2241.

| Information Required for Form 2441 | Details |

|---|---|

| Dependent Age | 13 years old or younger, or a disabled spouse/dependent of any age |

| Eligible Expenses | Expenses related to caring for your dependent while you work, including daycare, nannies, or physical/mental caretaking services |

| Form 2441, Line 1 (a-d) | Information of care providers |

| Form 2441, Line 2 (a-c) | Information about the dependent |

| Form 2441, Line 4 | W-4 income of yourself |

| Form 2441, Line 5 | Gross income of your spouse |

| Form 2441, Line 10 | Calculation of your credit limit |

| Form 2441, Lines 4-11 | Calculate your credit |

| Form 1040, Line 49 | Enter the total credit on your Form 1040, Line 49 |

Do You Need to File Form 2441 Each Year?

Do You Need to File Form 2441 Each Year? Yes, if you qualify and require financial assistance in caring for a dependent you need to file Form 2441 each year. According to the IRS, you must have a child under the age of 13 or a physically or mentally disabled spouse or dependent of any age. Additionally, payments made to family members may not qualify as a deduction unless they are your adult children 19 years or older. Generally, expenses related to looking for work or working are the only ones qualifying for a tax credit. Common uses for Form 2441 include daycare, nannies and professional caretaking services. It’s important to be aware of the special qualifications for disabled parents, those making more than $4,050, those filing joint returns, and divorced parents. Before filing your taxes, it’s highly recommended to get help from a professional tax preparation service to ensure you’re getting the most out of your return.

Download the official IRS Form 2441 PDF

On the official IRS website, you will find a link to download Form 2441 – Child and Dependent Care Expenses. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 2441

Sources:

https://www.irs.gov/forms-pubs/about-form-2441

https://www.irs.gov/instructions/i2441