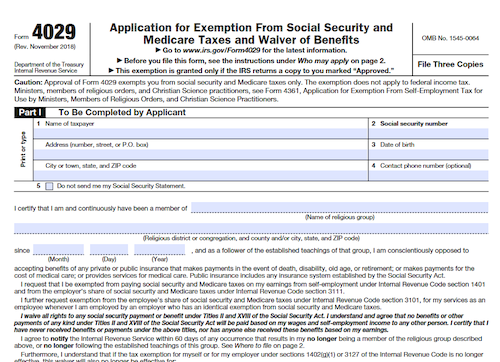

Form 4029 is an application for Social Security and Medicare tax exemption for members of recognized religious sects or divisions. The form must be completed and signed by the applicant and the religious sect provides, and must be accompanied by statements from both the applicant and the religious sect. It must be filed with the Internal Revenue Service (IRS) within 90 days to obtain the exemption.

What is Form 4029?

Form 4029 is an application used by members of recognized religious sects or divisions to apply for exemption from Social Security and Medicare taxes. In order for the exemption to be granted, it must be completed and signed by the applicant and the religious sect or division, filed with the Internal Revenue Service (IRS) within 90 days of the date of the applicant’s entry into the religious sect or division, and accompanied by both a statement from the religious sect or division certifying the applicant’s membership in good standing and a statement from the applicant certifying that they are conscientiously opposed to accepting benefits of any private or public insurance.

IRS Form 4029 – Who Needs to Fill It Out?

Form 4029 is used for applicants of recognized religious sects or divisions who wish to be exempt from Social Security and Medicare taxes. It is the responsibility of the applicant to fill out and sign the form, as well as providing statements to certify their membership in good standing and conscientious objection to benefit acceptance. This form and its accompanying statements must be filed to the IRS within 90 days of their entry into the religious sect or division. Failing to complete the form and submit it within the allotted timeframe may result in the applicant being ineligible for the exemption.

Step-by-Step: Form 4029 Instructions For Filling Out the Document

To fill out Form 4029, applicants must first complete and sign the form. The form must then be filed with the Internal Revenue Service (IRS) within 90 days of the applicant’s entry into the religious sect or division. Along with the form, applicants must also submit a statement from the religious sect or division certifying that they are a member in good standing and a statement from themselves certifying that they are conscientiously opposed to accepting benefits of any private or public insurance. Once completed, applicants can submit the form with all required documents to the IRS to obtain their exemption from Social Security and Medicare taxes.

| Instructions for Filling out Form 4029 | Details |

|---|---|

| Form Completion | Complete and sign the form. |

| Filing Deadline | File the form with the IRS within 90 days of entering the religious sect or division. |

| Required Certifications | Submit a statement from the religious sect or division certifying membership and a statement certifying opposition to accepting insurance benefits. |

| Submission | Submit the form with all required documents to the IRS to obtain exemption from Social Security and Medicare taxes. |

Do You Need to File Form 4029 Each Year?

Form 4029 must be filed with the Internal Revenue Service (IRS) each year in order to obtain exemption from Social Security and Medicare taxes for members of recognized religious sects or divisions. The form must be completed and signed by the applicant and the religious sect or division, along with a statement from the religious sect or division certifying the applicant’s good standing and a statement from the applicant certifying their membership and conscientious opposition to accepting benefits of any private or public insurance. The form must be accompanied by all of these items and must be filed within 90 days of the date of the applicant’s entry into the religious sect or division.

Download the official IRS Form 4029 PDF

On the official IRS website, you will find a link to download Form 4029. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 4029

Sources: