Corporations that overpaid their estimated taxes by at least 10% of the expected tax liability and $500 or more may be eligible for a quick refund by filing Form 4466 with the Internal Revenue Service.

What is Form 4466?

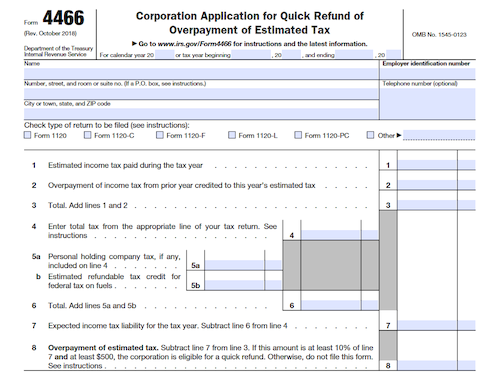

Form 4466 is a form used by any corporation who overpaid their estimated tax for a tax year to apply for a quick refund. To be eligible for the refund, the overpayment must be at least 10% of the expected tax liability AND at least $500. Form 4466 must be filed no later than the due date of the corporation’s income tax return, and prior to filing the income tax return. Only the common parent corporation of an affiliated group that paid estimated taxes on a consolidated basis may file Form 4466. An unsigned Form 4466 must also be submitted with the return, with the original, signed Form 4466 kept in the corporation’s records. Any application with material omissions or errors may be disallowed.

IRS Form 4466 – Who Needs to Fill It Out?

Corporations that overpaid their estimated taxes for the tax year by at least 10% and $500 or more may fill out IRS Form 4466. If members belong to the same affiliated group and paid estimated tax on a consolidated basis, only the common parent corporation should fill out the form. On the other hand, if any group member paid estimated taxes during the time it wasn’t part of the group, they should file the form by themselves. Form 4466 should be filed after the end of the tax year and no later than the tax return due date, before submitting the tax return. The IRS will review the form within 45 days. An original, signed copy must be filed with the applicable IRS Center, as well as an unsigned one attached to the tax return.

Step-by-Step: Form 4466 Instructions For Filling Out the Document

Filling out Form 4466 is simple when you understand the requirements. Any corporation that has overpaid its estimated tax for the tax year may apply if the overpayment is at least 10% of the expected tax liability and at least $500. If members of an affiliated group paid their estimated income tax on a consolidated basis, only the common parent corporation may file. The form must be filed after the end of the corporation’s tax year but before the due date for the tax return. The IRS will act within 45 days of filing. Additionally, a signed form must be sent in and a copy included with the tax return. Errors or omissions may result in disallowance of the application.

Below, we present a table that will help you understand how to fill out Form 4466.

| Information Required for Form 4466 | Details |

|---|---|

| Overpayment Amount | Minimum overpayment required to apply for a refund |

| Filing Deadline | When to file Form 4466 and submission requirements |

Do You Need to File Form 4466 Each Year?

Yes, Form 4466 needs to be filed after the end of the corporation’s tax year, and no later than the due date for filing the corporation’s tax return (not including extensions). Any corporation that has overpaid its estimated tax for the tax year, by at least 10% of the expected tax liability and at least $500, may apply for a quick refund by filing Form 4466 with the applicable Internal Revenue Service Center. The IRS will review and act on Form 4466 within 45 days from the date it is filed. The corporation must also attach the signed Form 4466, or an unsigned Form 4466 with the same information stated on the signed Form 4466, to its income tax return. All applications must be accurate and complete or they may be disallowed.

Download the official IRS Form 4466 PDF

On the official IRS website, you will find a link to download Form 4466. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 4466

Sources: