For recipients of Form 1097-BTC from a bond issuer or their agent, such as brokers, nominees, mutual funds, or partnerships, who are further distributing tax credits from New Clean Renewable Energy Bonds, Qualified Energy Conservation Bonds, Qualified Zone Academy Bonds, Qualified School Construction Bonds, Clean Renewable Energy Bonds, and Build America Bonds (Tax Credit), filing Form 1097-BTC is a requirement.

What is Form 1097-BTC?

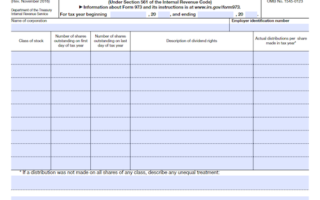

Form 1097-BTC is a form used to report interest payments on different types of tax credit bonds – new clean renewable energy bonds, qualified energy conservation bonds, qualified zone academy bonds, qualified school construction bonds, clean renewable energy bonds, and Build America bonds (Tax Credit). It must be filed by the issuer of certain tax credit bonds or their agents, as well as recipients distributing these tax credits, such as mutual funds and partnerships. Each maturity of the bond should be reported on a separate Form 1097-BTC. Recipients of Form 1097-BTC should only file one per recipient or account, aggregating credit from all applicable bonds. Form 1097-BTC should be issued to each person who holds a tax credit bond or coupon with a value of at least $10.

IRS Form 1097-BTC – Who Needs to Fill It Out?

The IRS Form 1097-BTC is a filing requirement for certain bond issuers or agents, as well as recipients of the form from the bond issuer or agent, such as mutual funds or partnerships. This includes specific tax credit bonds, such as new clean renewable energy bonds, qualified energy conservation bonds, qualified zone academy bonds, qualified school construction bonds, clean renewable energy bonds, and Build America bonds (Tax Credit). Issuers or agents must file a separate form per bond, while recipients must file one form per recipient or account, aggregating credit from all applicable bonds. Companies that opted to issue Build America bonds (Direct Pay) for refundable credits are not required to file this form. Individuals that receive at least $10 in tax credit on one or more credit allowance dates must also be issued Form 1097-BTC.

Step-by-Step: Form 1097-BTC Instructions For Filling Out the Document

Filing Form 1097-BTC is a requirement for issuers of certain tax credit bonds, their agents, and recipients of Form 1097-BTC from the bond issuer or agent. This form must be filed for each tax credit bond distributed, on a separate form per bond and separately for each maturity from bonds with multiple maturities. For recipients of the form from the bond issuer or agent, such as brokers, nominees, mutual funds, or partnerships, only one form is needed to aggregate credit from all applicable bonds. Issuers that elect to issue build America bonds or specified tax credit bonds for a refundable credit in lieu of a tax credit should not file Form 1097-BTC. Instructions on qualifying tax credit bonds under Section 54A, Special Rules on Build America Bonds and specified tax credit bonds, and who must receive Form 1097-BTC are also provided in this document.

Below, we present a table that will help you understand how to fill out Form 1097-BTC.

| Information Required for Form 1097-BTC | Details |

|---|---|

| Filing Requirement | Required for issuers, agents, and recipients of Form 1097-BTC |

| Separate Forms | One form per bond and separately for each maturity |

| Recipients | Only one form needed for aggregating credits from multiple bonds |

| Exemption | Not required for Build America Bonds or specified tax credit bonds |

Do You Need to File Form 1097-BTC Each Year?

If you are an issuer of certain tax credit bonds, or their agent, or if you are a recipient of Form 1097-BTC, such as a mutual fund or partnership, then you must file Form 1097-BTC each year for any tax credits distributed from specified bonds. For each bond, filings must be made on a separate Form 1097-BTC, and must also be reported separately for each maturity that is part of the bond. Further credit distributions must also be reported on one Form 1097-BTC per recipient or account, aggregated from all applicable bonds. Certain issuers are not required to file Form 1097-BTC.

Download the official IRS Form 1097-BTC PDF

On the official IRS website, you will find a link to download Form 1097-BTC. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1097-BTC

Sources: