Form 8867 must be filed with the taxpayer’s return or amended return claiming the EIC, the CTC/ACTC/ODC, the AOTC, and/or HOH filing status. As a paid tax return preparer, you must exercise due diligence and meet the knowledge requirement by interviewing the taxpayer and reviewing applicable information. Failure to meet the due diligence requirements could result in a penalty.

What is Form 8867?

Form 8867 is a form for paid tax return preparers to submit when a taxpayer’s return or amended return includes claims for the earned income credit (EIC), the child and dependent care credit (CTC/ACTC/ODC), the American opportunity tax credit (AOTC), and/or head of household filing status. The form must include all applicable benefits that the taxpayer is eligible for, but has actually claimed on the return. All signing and nonsigning tax return preparers for these credits and filing statuses must complete Form 8867. The paid tax return preparer must accurately and truthfully complete the form and document the information used to prepare the form for 3 years. Failure to meet the due diligence requirements could result in a penalty for each failure.

IRS Form 8867 – Who Needs to Fill It Out?

Form 8867 must be completed and filed with the return by the paid tax return preparer responsible for a taxpayer’s claim of the Earned Income Credit (EIC), the Child Tax Credit/Additional Child Tax Credit/Other Dependent Credit (CTC/ACTC/ODC), the American Opportunity Tax Credit; and/or the Head of Household filing status. All preparers should adhere to specific due diligence requirements set forth in Treasury Regulations, such as interviewing the taxpayer and obtaining the appropriate information needed. All Forms 8867 must be retained for 3 years, as well as other associated documents used to complete the form. Failure to fulfill these requirements could result in a penalty for each failure.

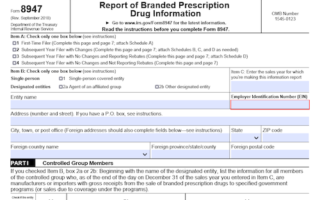

Step-by-Step: Form 8867 Instructions For Filling Out the Document

When filling out Form 8867, paid tax return preparers should meet the knowledge requirement by interviewing the taxpayer and asking adequate questions. They must also contemporaneously document the questions and the taxpayer’s responses on the return or in notes and review adequate information to determine the taxpayer’s eligibility and figure the amount of any credits claimed. Form 8867 must be filed with the taxpayer’s return or amended return and, depending on whether the preparation is electronic or not, the form must be submitted in a specific manner. Paid preparers must also retain a copy of Form 8867, the applicable worksheets, documents provided by the taxpayer, a record of information source and any additional information relied upon. In addition, they must meet the due diligence requirements for the EIC, the CTC/ACTC/ODC, the AOTC, and/or HOH filing status in order to avoid potential penalties.

Below, we present a table that will help you understand how to fill out Form 8867.

| Form Name | Form 8867 |

|---|---|

| Purpose | Ensure paid tax return preparers meet knowledge requirements, document interviews, and review information to determine taxpayer eligibility and credits claimed. |

| Filing Requirements | File with the taxpayer’s return or amended return. Follow specific submission requirements based on electronic or non-electronic filing. |

| Additional Information | Retain a copy of Form 8867, applicable worksheets, and documents provided by the taxpayer. Meet due diligence requirements to avoid potential penalties. |

Do You Need to File Form 8867 Each Year?

Yes, if you are the paid tax return preparer for a taxpayer claiming the EIC, the CTC/ACTC/ODC, the AOTC, and/or HOH filing status, Form 8867 must be completed and filed with the tax return or to the IRS. The form itself must be truthfully and accurately completed and must meet the due diligence requirements set forth in Treasury Regulations. This includes interviewing the taxpayer, asking adequate questions, and obtaining appropriate and sufficient information. Along with the form itself, you must provide the signing preparer the applicable worksheet(s) and copies of any documents on which you relied upon to determine the person’s eligibility for the credit(s). Records of all five of these items must be retained for three years from the latest date.

Download the official IRS Form 8867 PDF

On the official IRS website, you will find a link to download Form 8867. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8867

Sources: