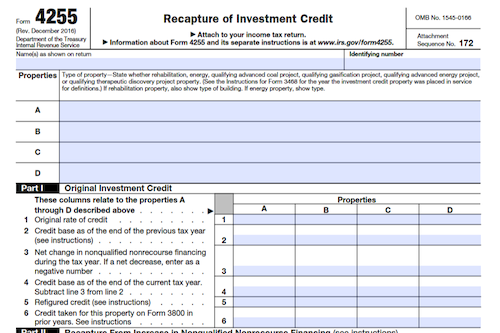

Form 4255 is used to calculate the tax increase for investment credit and a qualifying therapeutic discovery project grant when certain conditions apply. Learn about exceptions, adjustments, and regulations to understand the full details of the credit recapture process.

What is Form 4255?

Form 4255 is used by taxpayers to figure the increase in taxes for the recapture of investment credits claimed and for the recapture of a qualifying therapeutic discovery project grant. Generally, you may need to refigure the investment credit and potentially recapture it entirely or partially if you dispose of the investment credit property before the end of the 5-year recapture period, change its use, decrease its business purpose, etc. Exceptions to recapture include death, divorce, acquisition of assets, changes in form of conducting a trade or business, and certain grants under the Affordable Care Act. The form also assists you in refiguring remaining carryforwards, carrybacks, and increasing the basis of the property subject to the recapture. If you are a partner or shareholder of an S corp, you must also adjust your interest in the partnership or S corp accordingly.

IRS Form 4255 – Who Needs to Fill It Out?

Individuals who have disposed of investment credit property before the end of 5 full years after the property was placed in service, changed its use, decreased its business use, received a grant under section 1603 of the American Recovery and Reinvestment Tax Act of 2009, reduced the proportionate interest by more than one-third in a partnership, S corporation, estate, or trust, or received a grant for a qualifying therapeutic discovery project grant may need to complete Form 4255 to figue the increase in tax for the recapture of investment credit. Generally, the exceptions to credit recapture are those due to death, transfer between spouses or incident to divorce, provisions of section 381(a), change of form in conducting a trade or business, and net increase in nonqualified nonrecourse financing. See the instructions for Form 4255 for more information.

Step-by-Step: Form 4255 Instructions For Filing Out the Document

Form 4255 is used to figure the increase in tax for the recapture of investment credit or a qualifying therapeutic discovery project grant. Generally, if any of the conditions listed apply, all or part of the credit must be recaptured. Certain exceptions may apply, and in the case of a partnership, S corporation, estate or trust, the refiguring of the credit must be allocated to each shareholder or partner. When completing the form, some adjustments should be made to the basis of the property, and the instructions provided regarding the recapture of a qualifying therapeutic discovery project grant should be followed closely. When done, the Schedule K-1 should be provided to partners, shareholders, and beneficiaries.

Below, we present a table that will help you understand how to fill out Form 4255.

| Form Name | Form 4255 |

|---|---|

| Purpose | Figure the increase in tax for the recapture of investment credit or a qualifying therapeutic discovery project grant. |

| Filing Requirements | Complete the form and provide Schedule K-1 to partners, shareholders, and beneficiaries. Follow instructions for property basis adjustments. |

| Additional Information | Consider exceptions and closely follow instructions for recapturing a qualifying therapeutic discovery project grant. |

Do You Need to File Form 4255 Each Year?

Yes, Form 4255 is required each year if you have claimed an investment credit or a qualifying therapeutic discovery project grant in the past and any of the specific recapture requirements or special rules apply to you. These include disposing of property within five full years of it being placed in service, a decrease in business use of property, and a net increase in nonqualified nonrecourse financing. Exceptions to recapture do apply, such as transfers between spouses or incident to divorce. For more information, consult Notice 2009-23, 2009-16 I.R.B. 802, Notice 2011-24, 2011-14 I.R.B. 603 and Notice 2014-81, 2014-53 I.R.B. 1001. All partnerships, S corporations, estates, and trusts must provide information to their partners, shareholders, and beneficiaries in order to refigure their credits.

Download the official IRS Form 4255 PDF

On the official IRS website, you will find a link to download Form 4255. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 4255

Sources: